Dividend investors need to think carefully before buying this mREIT.

There’s one very big reason some income-focused investors might want to buy mortgage real estate investment trust (mREIT) AGNC Investment (AGNC 0.79%). That would be its astonishingly high 14% dividend yield. But a yield that high is highly unusual, given that the S&P 500 index (^GSPC -0.10%) yields only 1.2%, and the average REIT yields only 3.8%. If you’re looking for an investment that will set you up for a lifetime of reliable dividends, you’ll need to tread with caution here.

AGNC Investment is a decent mREIT

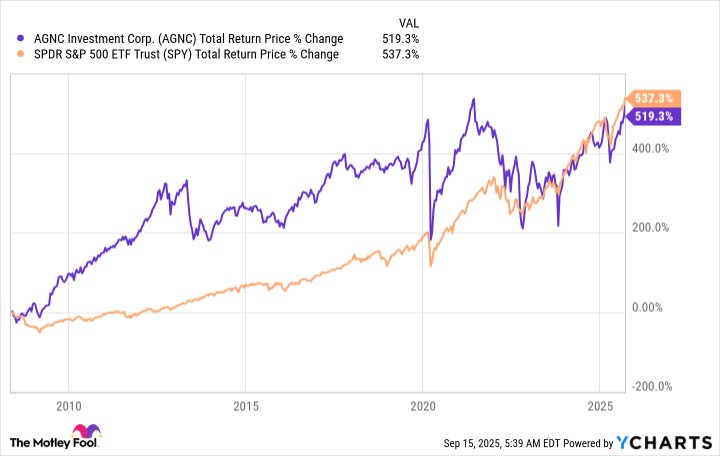

A double-digit dividend yield isn’t particularly abnormal in the mortgage niche of the broader REIT sector. For the most part, AGNC Investment is a fairly well-run mREIT. Notably, the stock’s total return since its initial public offering (IPO) is very compelling, as the chart below highlights. In fact, the total return is very close to that of the S&P 500 index. However, the return doesn’t track along with the S&P 500, so AGNC Investment looks like an attractive diversification tool.

AGNC Total Return Price data by YCharts.

If you’re looking for a total return type of investment, however, AGNC Investment could be attractive for your portfolio. There’s just one small problem. Total return requires the reinvestment of dividends. That makes sense, given the nature of the mortgage-backed securities that AGNC Investment buys.

When you make a mortgage payment, part of the payment goes to the principal and part goes to the interest. That doesn’t change just because AGNC Investment owns mortgages that have been pooled into bond-like securities. Thus, every time AGNC Investment collects a payment on a security it owns, part is interest and part is principal. The huge dividends the mREIT pays are, similarly, made up partly of interest and partly of principal. That principal is effectively a return of investor capital.

Image source: Getty Images.

AGNC Investment’s big dividend problem

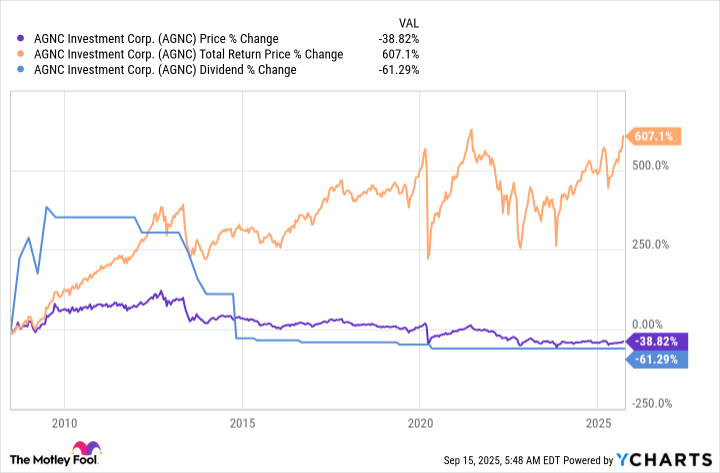

The issue for dividend investors is that AGNC Investment’s dividend hasn’t been stable over time. In the table below, the blue line is dividends, and it has been highly volatile. After the IPO, the dividend rose sharply. Then it started to fall, and it’s been heading lower for roughly a decade, as have the shares. Paying out principal, or returning capital to investors, means that the value of the portfolio inherently shrinks over time. That means that there’s less capital to earn interest.

If you spend the dividends AGNC Investment pays you, you are, effectively, spending some of your own capital. To be fair, AGNC Investment has paid out more in dividends than it has lost in value since its IPO. So dividend investors have made out OK with this arrangement. But you still can’t buy AGNC Investment and expect a reliable dividend to support your spending needs in retirement. That’s just not on the table here, and the company’s dividend history proves it. To be fair, the company itself highlights that its ultimate goal is total return, not dividend income.

AGNC is an acquired taste

AGNC Investment is not an easy REIT to wrap your head around. It’s not a bad investment, but it is highly complicated to understand. More specifically for dividend investors, the dividend is not, and probably never will be, reliable.

Most dividend investors are looking for a stock that pays a dividend that’s sustainable, if not growing, over time. If that’s what you want, this 14% yield is very likely to let you down, no matter how attractive it looks relative to other high-yield dividend stock options you have.