Ken Griffin of Citadel just made a bold proclamation about Alphabet’s size in the artificial intelligence (AI) realm.

Ken Griffin, the billionaire hedge fund manager and CEO of Citadel, recently turned heads after making a striking observation about Alphabet (GOOG 0.21%) (GOOGL 0.28%). During an interview at Stanford Business School, Griffin proclaimed that Alphabet wields comparable levels of computational power as the fifth-largest country in the world.

This is not mere hyperbole. Griffin’s remark underscores the vast scale of Alphabet’s technological infrastructure and its dominance in shaping the artificial intelligence (AI) revolution.

For investors, this comment is more significant than a memorable sound bite. It highlights Alphabet’s role at the center of AI’s growth, where demand for compute power and data processing is only accelerating.

Ken Griffin just made a bold statement about Google

When most people think of Alphabet, Google Search and YouTube are usually the first properties that come to mind. But the company’s influence stretches far beyond the internet.

Today, Alphabet operates across a diverse set of industries — ranging from cybersecurity through its investment in Wiz, to cloud computing with Google Cloud Platform, consumer electronics with Android, autonomous driving via Waymo, and even custom AI hardware with its tensor processing units (TPUs). In effect, Alphabet has quietly engineered one of the most powerful computing backbones in the world.

By comparing Alphabet’s resources to those of a nation, Griffin underscores the staggering scale of its capabilities in processing, storage, and advanced data workloads. For perspective, the world’s fifth-largest country in terms of electricity consumption falls between Japan and Russia — industrialized economies that power hundreds of millions of people.

If a single company like Alphabet commands that level of computational power, it signals just how central the company has become to the global digital economy.

Image source: Getty Images.

Alphabet is purpose-built for the AI infrastructure era

At the heart of Alphabet’s AI strategy is TensorFlow, its open-source framework for machine learning. TensorFlow is more than a toolkit — it’s an ecosystem powering advanced applications in natural language processing (NLP), robotics, computer vision, and more.

Griffin’s observation ties directly to this computational muscle: Alphabet’s vast infrastructure is the foundation for training and deploying AI models, at a scale few rivals can match. This isn’t simply about producing isolated AI-powered products — it’s about providing the tools, frameworks, and cloud infrastructure that enable developers, enterprises, and entire global communities to innovate.

That network effect is what strengthens Alphabet’s competitive moat. Just as Google Search became the default gateway to the internet two decades ago, Alphabet’s AI backbone is positioning the company as an enduring platform on which the next era of computing is built.

The impact on investors

Griffin’s comment underscores why Alphabet should no longer be seen merely as a cyclical play on digital advertising. Viewed through the lens of AI, Alphabet emerges as a long-term compounder — an essential force powering the AI economy. For investors, the takeaway is clear. Griffin’s perspective shines light on Alphabet’s deeply entrenched position across various corners of the AI landscape.

The company’s ability to marshal computational power on par with a nation highlights not only the durability of its entire business, but stresses the importance of its competitive advantages across both hardware and software — domains with enormous capital requirements and high barriers to entry.

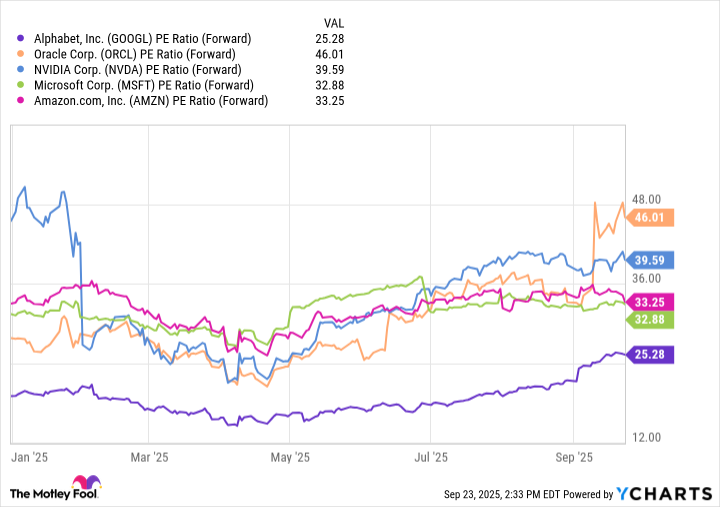

GOOGL PE Ratio (Forward) data by YCharts

Yet despite its technological leadership, the stock continues to trade at a steep discount relative to other megacap tech peers based on forward earnings multiples.

This disconnect suggests that the broader market has yet to fully price in Griffin’s astute insight — leaving long-term investors with meaningful upside potential as Alphabet’s position in the high ground becomes even more pronounced, while rivals scramble to keep pace.

Adam Spatacco has positions in Alphabet, Amazon, Microsoft, and Nvidia. The Motley Fool has positions in and recommends Alphabet, Amazon, Microsoft, Nvidia, and Oracle. The Motley Fool recommends the following options: long January 2026 $395 calls on Microsoft and short January 2026 $405 calls on Microsoft. The Motley Fool has a disclosure policy.