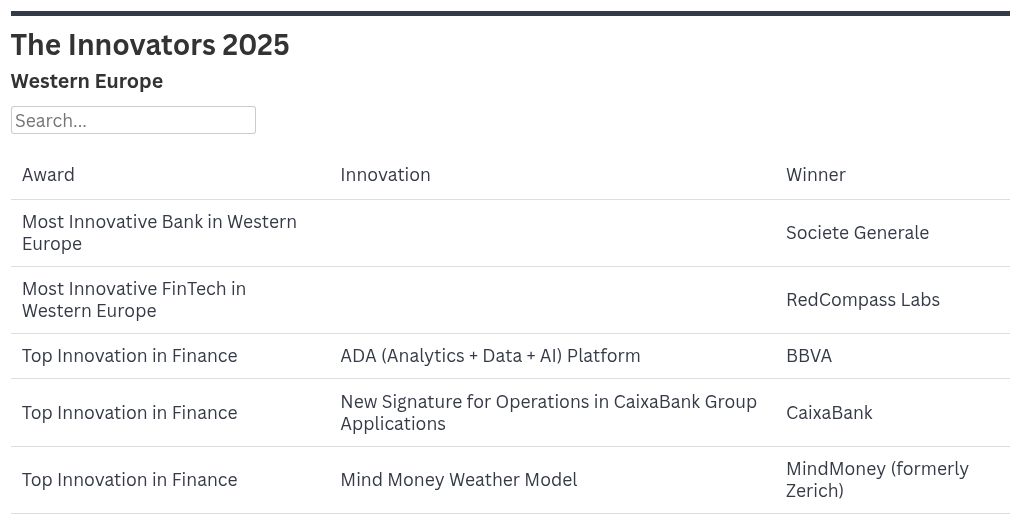

Banks accelerated digital transformation by adopting customer-focused platforms, AI-driven services, and advanced data analytics. Global Finances announces the 2025 Innovators from Western Europe.

Regional Winners

Most Innovative Bank in Western Europe | SOCIETE GENERALE

Societe Generale’s Global Transaction and Payment Services division has launched several new innovations to reduce their corporate clients’ workload. These include IKAR, a Gen AI chatbot for cash management product-documentation inquiries; and the Digitrade Tool, which uses advanced data analytics, including algorithms and pattern recognition, to personalize the document-checking process. The Digitrade Tool identifies and extracts key information from documents, adapting to the specific requirements of different transactions. By eliminating the need for paper checks and offering digital tools with multiple features, the tool provides users with a more convenient and tailored experience, aligning with their preferences for efficiency and accuracy.

Additionally, the bank’s X-Border API enables other banks to automatically send payment instructions to Societe Generale in 40 different currencies from a single account, benefiting from a guaranteed rate for 20 minutes after obtaining the quotation.

Most Innovative Financial Technology Company in Western Europe | REDCOMPASS LABS

AnalystAccelerator.ai is the world’s first multiagent AI solution engineered specifically to accelerate payments transformation. Developed by RedCompass Labs and launched in November 2024, this innovative tool leverages the extensive knowledge and experience gained from over 300 payment projects undertaken for leading global banks. It also utilizes the most comprehensive library of global payments documentation available.

Using AnalystAccelerator.ai, a business analyst can reduce manual work on a typical payment modernization project by up to 68%. Regulatory and project documentation updates that used to take weeks can be completed in under a day, saving banks millions of dollars and months of work. This leads to improved project outcomes and enhanced compliance with regulatory requirements.

In April this year, RedCompass Labs unveiled AnalystAccelerator.ai v2.5, an enhanced version fine-tuned on the largest collection of payments rulebooks in the world and outperforming leading general AI models. It delivers 13% better performance on complex payment-related tasks than GPT-4o and achieves a perplexity score 10 times lower than open-source AI models.

Innovations In Finance Globally From Western Europe

ADA (Analytics + Data + AI) Platform | BBVA

BBVA ADA, the first global data platform to fully integrate all countries in which the BBVA group has a presence, launched last November in Europe and Uruguay. The platform streamlines the end-to-end analytics process, utilizing 100% of the bank’s data and Amazon Web Services’ advanced managed services to optimize data processing, machine learning, and analytics. The combination improves the strategic capabilities and decision-making expertise of data scientists, analysts, and reporting teams throughout the organization.

New Signature for Operations in CaixaBank Group Applications | CAIXABANK

By consolidating the signing process on a single platform, CaixaBank has effectively eliminated the need for its customers to navigate multiple applications or interfaces to complete their banking tasks. The streamlined approach not only saves time but reduces the potential for error and enhances the overall user experience. The new authorization method incorporates advanced security measures to safeguard customers’ sensitive information and financial assets, ensuring they can conduct their banking activities knowing their transactions are protected by robust security protocols.

Mind Money Weather Model | MIND MONEY (FORMERLY ZERICH)

Mind Money Weather is the first quantitative model to connect operational weather forecasts and commodity prices. Typically, factoring weather data into trading strategies involves detecting significant patterns and combining these with meteorologists’ informal impact assessments, considering the economic context (demand, supply, stocks) but without a clear mathematical model. Instead of focusing on forecasting, Mind Money Weather centers on the formal, quantitative assessment of how weather affects commodity pricing.