BlackRock’s IBIT ETF has crossed the $70 billion in assets under management threshold following a 31-day inflow streak.

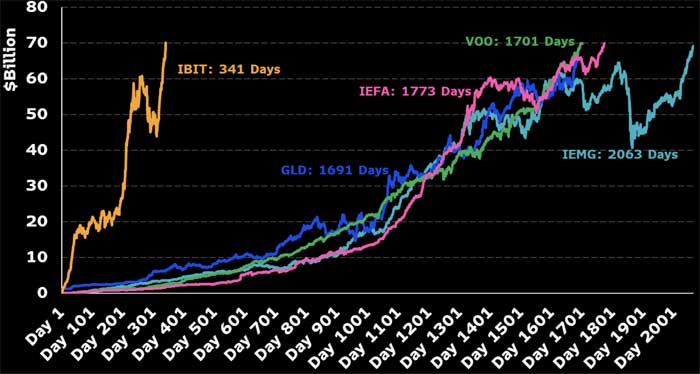

“$IBIT just blew through $70b and is now the fastest ETF to ever hit that mark in only 341 days,” wrote Bloomberg’s ETF analyst Eric Balchunas on X. He also highlighted that it did this 5 times faster than the previous fastest ETF to hit $70 billion, GLD which took 1,691 days.

BlackRock’s appetite for Bitcoin reflects a broader institutional interest in digital assets. Crypto-related US stocks are on a roll this week, as firms including Circle, Core Scientific Inc., and MARA Holdings Inc. all saw major gains on Monday.

Institutional money is flooding the crypto space, creating a butterfly effect as liquidity cycles from major assets like Bitcoin and Ethereum into smaller alternatives, which can provide more substantial gains with less liquidity.

So, what is the best crypto to buy to capitalize on this institutional crypto frenzy?

Bitcoin Hyper

Bitcoin is the most secure blockchain, but it has a speed problem. Capable of just seven transactions per second, it’s a far cry from facilitating payments on a global scale.

Bitcoin Hyper is a Bitcoin layer 2 that transforms Bitcoin from a store of value to the world’s secure transactional layer.

It’s built the Solana Virtual Machine, which means it integrates the network’s blistering speeds and smart contract functionality. This unlocks a world of new possibilities. Meme coins, DeFi, real-world assets (RWAs), and gaming – it’ll soon all be possible on Bitcoin thanks to Bitcoin Hyper.

Transactions on Bitcoin Hyper will settle on the Bitcoin layer 2 blockchain, yet it is also interoperable with Solana apps and tokens. It’s the best of both worlds, and it’s brand new to market.

The project launched a presale less than one week ago and has already raised a staggering $1 million.

This doesn’t just confirm product-market fit; it reflects investors’ deep conviction. And that signifies that $HYPER is primed for huge gains. Visit Bitcoin Hyper

Dogecoin

As institutional interest in digital assets grows, one sector will undoubtedly draw attention: meme coins. It’s crypto’s least serious, but often most profitable niche.

Dogecoin is the leading meme coin by market cap, and it’s also the oldest and most trusted.

There are currently four spot Dogecoin ETF applications pending. If approved, they could inject substantial institutional capital into the Dogecoin market.

The fact that Dogecoin holds no utility could prove interesting for Wall Street investors, as it reduces the variables and may make forecasting price moves more predictable, as opposed to a project with a lengthy roadmap filled with unprecedented technical implementations, such as Ethereum.

Eric Balchunas also predicted that an active meme coin ETF will launch by 2026. Dogecoin has a near-50% market share in the meme coin space, so it’ll likely command a sizable allocation if the meme coin ETF does launch.

Solaxy

While Solana is lightning-fast, it still faces its own version of scalability problems. Solana can compute 6,500 transactions per second, but this limit can sometimes be met in periods of peak network activity.

That’s where Solaxy comes in. It’s building the first-ever Solana layer 2 blockchain. It’ll use off-chain computation and transaction bundling technology to make the network even more scalable. Its goal is to achieve 10,000 transactions per second.

If it achieves its goal, it’ll enable more adoption and could even unlock new use cases.

Right now, the project is undergoing a presale. It has raised $46 million so far, making it the largest Solana presale ever.

With such early success and a robust use case, it certainly appears that $SOLX could prove the best crypto to buy now. However, the presale will end in six days, so potential investors should act quickly. Visit Solaxy.

Ondo

When it comes to institutional crypto interest, Ondo is certainly a project worth considering for your portfolio. It’s a RWA protocol built on the Ethereum network and interoperable with nine other blockchains.

It offers multiple innovative products, ranging from tokenized short-term US Treasuries to tokenized stocks, all of which are available for purchase on-chain.

The project also features a yield-bearing stablecoin backed by US Treasuries, and it reportedly boasts an 80% market share in the yield coin market.

It has a whopping $1 billion total value locked in its ecosystem, reflecting a strong user base and immense credibility.

Put differently, Ondo is a market leader in the RWA sector.

Blockchain technology offers numerous benefits over traditional finance. These include 24/7 operation, borderlessness, and lower fees. As institutional capital moves on-chain to capitalize on these benefits, Ondo’s adoption will grow.

Best Wallet Token

Best Wallet Token is the new cryptocurrency that powers Best Wallet, a promising new crypto wallet.

The project is all about making on-chain transacting simple, and also ensuring its users get the most out of their on-chain activity. It supports over 90 blockchains, meaning users can access virtually any cryptocurrency on any network from a single app.

It also boasts a fleet of integrated features, including a cross-chain DEX, a crypto debit card, fiat on-ramping, derivatives trading, a presale aggregator, and more. Users can access all these features without needing to manage multiple apps. This doesn’t just save time; it also protects against phishing scams, a significant problem in the crypto industry.

The $BEST token provides benefits like trading fee discounts, higher staking yields, governance rights, and access to promotions on partner projects. It’s currently undergoing a presale and has raised over $13 million to date.

With innate utility, a market-leading use case, and its current early-stage status, it appears everything is in place for $BEST to explode. Visit Best Wallet.

This article is for informational purposes only and does not provide financial advice. Cryptocurrencies are highly volatile, and the market can be unpredictable. Always perform thorough research before making any cryptocurrency-related decisions.