A strategic reallocation away from U.S. assets is playing a major role in Bitcoin’s optimistic outlook, according to Geoffrey Kendrick, head of digital assets research at Standard Chartered.

The analyst forecasts that the Bitcoin price may exceed $120,000 by the end of June. This also sets an optimistic tone for new Bitcoin-themed meme coin BTC Bull Token, which will be the first-ever cryptocurrency to pay real Bitcoin rewards.

Bitcoin Could Surpass $120,000 in June

Multiple bullish signals suggest that Bitcoin is on its way to new highs next month.

Notably, Kendrick highlighted that US Treasuries trade at a 12-year premium, making them less-attractive and driving investors to seek alternative safe-haven assets, like Bitcoin. Regulatory shifts and rising acceptance on the global stage positions Bitcoin in its strongest-ever position to attract capital from sophisticated investors seeking alternatives to US debt securities.

Kendrick also highlights that whale activity has been surging lately. Holders who control over 1,000 $BTC have been aggressively increasing their Bitcoin exposure, suggesting that they anticipate strong gains in the weeks ahead.

A prime example of this is BlackRock, with its IBIT ETF buying $400 million of Bitcoin on 27 May alone. This reflects a broader trend, with the asset manager accumulating $48.39 billion worth of $BTC in total, per Farside Investors data.

Bitcoin has also shown signs of decoupling from tech stocks in recent months, which is another indication of its strengthening proposition as a safe-haven asset, according to Kendrick.

However, Kendrick recently wrote an email to clients in which he said that the $120,000 target looks “very achievable,” and may even be “too low.” While he didn’t say how far it could go in Q2, Kendrick pointed to an end-of-2025 target of $200,000.

The Bitcoin Lottery? Options Traders Bet on $300K $BTC in June

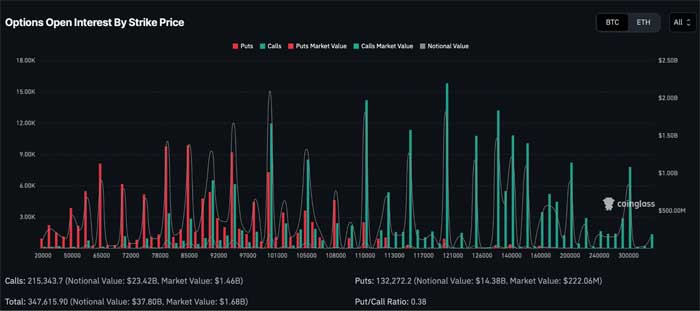

In a far-flung move, traders on options platform Deribit are increasingly eyeing a Bitcoin price of $300,000 by the end of June.

And here’s where it gets interesting: the options $300K strike price was the platform’s most popular product yesterday.

According to CoinGlass data, bulls have wagered over $500,000 on Bitcoin calls with a strike price of $300,000 so far.

While it may seem like a distant dream for Bitcoin’s price to almost triple in the next month, the fact that traders have risked hundreds of thousands of dollars on that outcome reflects the asset’s highly bullish sentiment right now.

However, as Bitcoin optimism increases, some savvy traders are betting on a new Bitcoin beta play to yield far bigger gains.

BTC Bull Token Predicted 100X as Presale Nears $7M

BTC Bull Token is a Bitcoin-themed meme coin on the Ethereum blockchain. But it’s not just here to make people laugh; it’ll pay them real Bitcoin.

The project will release Bitcoin airdrops at key price milestones, with the first occurring when it reaches $150K and the second at $200K. The airdrops will be available to presale investors, creating a unique opportunity for meme coin fans and Bitcoin enthusiasts to deepen their $BTC positions without having to buy it directly.

The project also has staking and burning mechanisms, which will strengthen its supply and demand dynamics.

Currently, $BTCBULL is undergoing a presale where it’s quickly approaching the $7 million raised mark. Its presale success reflects deep investor support, which isn’t surprising given its meme coin allure and Bitcoin rewards.

Top analysts are also paying attention to the project. For example, Umar Khan from 99Bitcoins says the project could give 100x gains.

With the Bitcoin price expected to surpass $120,000 next month, and some traders betting on it going as high as $300,000, there’s a real opportunity for liquidity inflows into related tokens.

As the only crypto that pays holders Bitcoin rewards, $BTCBULL appears well-positioned to ride this bullish wave.

This article is for informational purposes only and does not provide financial advice. Cryptocurrencies are highly volatile, and the market can be unpredictable. Always perform thorough research before making any cryptocurrency-related decisions.