The Ellison era of Paramount was barely a month old when another major potential Hollywood merger appeared on the horizon.

Last week the share prices of Paramount and Warner Bros. Discovery surged following reports that the former was preparing a bid to take over the latter with a mostly cash offer backed by the Larry Ellison family. This would come a remarkably short time after Skydance Media, the production company founded by Larry’s movie producer son David, combined with Paramount in an $8-billion deal.

A merger of Paramount and Warner Bros. Discovery would have profound ramifications for the media and entertainment industry.

It would consolidate two of Hollywood’s oldest studios, Paramount and Warner Bros., in the most significant movie business merger since Walt Disney Co. devoured the entertainment assets of 21st Century Fox in 2019. The film industry has still not recovered from having the 20th Century Fox studio effectively taken off the board.

Additionally, a merger would put two mass-market streaming services, Paramount+ and HBO Max, under the same roof, probably leading to the eventual melding of the two. The Ellison clan’s move would also bring Warner Bros. Discovery’s linear TV networks, including CNN, HGTV, Food Network and TNT, together with Paramount’s Comedy Central, MTV and BET.

All of this would lead to substantial “synergies,” meaning cuts and layoffs, at a time when the job market in entertainment and corporate media is already fraught as the industry reconfigures itself. Paramount is currently bracing for thousands of layoffs as the new owners seek $2 billion in cost savings.

That’s not to mention the changes that would likely come if CNN came under the control of Ellison.

Larry Ellison, the Oracle Corp. billionaire who, depending on the day, is one of the world’s two wealthiest people alongside Elon Musk, is known to be Trump-friendly. The effects of the Ellison reign are already being felt at Paramount’s CBS News, where a former conservative think tank leader was recently appointed as ombudsman and where center-right and staunchly pro-Israel journalist Bari Weiss is expected to have an influential role after Ellison buys her digital media startup the Free Press.

So why is all this happening now, and why so quickly?

After all, the Wall Street Journal first reported Ellison’s interest in Warner Bros. Discovery on Sept. 11, just weeks after the Paramount-Skydance combo closed on Aug. 7.

In a sense, this scenario is unsurprising. Wall Street has been practically begging for another wave of consolidation in the media business, as the audience for theatrical movies shrinks, cord-cutting guts TV profits and more of viewers’ attention turns to YouTube, Netflix and TikTok. Most of the legacy entertainment companies don’t have the streaming firepower to compete. They need to combine to measure up.

But the timing is unexpected, and the unavoidable political considerations are particularly interesting.

With Trump in the White House, the political winds are clearly blowing in the Ellisons’ direction, after the Skydance and RedBird Capital team that bid for Paramount placated federal regulators with promises to eliminate diversity, equity and inclusion initiatives and to make CBS News more balanced, at least in eyes of Trump-appointed FCC Chairman Brendan Carr.

Paramount paid $16 million to settle Trump’s lawsuit over a “60 Minutes” Kamala Harris interview. Ellison and his team want to make a Warner Bros. deal happen when a friendly administration is in power.

Paramount has lately upped its spending, acquiring the rights to UFC (run by Trump friend Dana White), locking down “South Park” for Paramount+ and announcing a deal with Activision to make a “Call of Duty” movie.

Also of note is that Ellison’s group is coming in with an offer for the whole company even as Warner Bros. Discovery Chief Executive David Zaslav prepares to split the media giant into two firms: one with the studios, HBO and streaming businesses, and the other with the TV networks. Putting in a bid now could dissuade other potential buyers that might be interested in just one part.

Apple and Amazon have long been seen as potential bidders for Warner Bros. (Amazon already owns MGM), but it’s unlikely they would want a bunch of TV channels that are on the brink of being orphaned. Analysts have speculated that one reason for the proposed split was to make the studio and streaming assets more attractive to buyers by uncoupling them from the challenged pay-TV business. That split is expected to take place sometime in mid-2026.

Paramount’s bid could also preempt those that may want to do a deal, but are firmly on the Trump administration’s bad side. NBCUniversal owner Comcast Corp.’s CEO Brian Roberts has been the subject of disparaging Trump missives. Comcast is liberal network MSNBC’s parent company (for now). A regulatory review involving a perceived Trump enemy would likely not go well.

Of course, competitive bids could emerge anyway, for example, if a private equity player such as Apollo Global decided to get into the mix after previously expressing interest in Paramount through an unsuccessful team-up with Sony.

Big mergers in media and entertainment often fail, and they’re always disruptive.

Warner Bros. itself was involved in some of the most disastrous deals ever: AT&T’s purchase of Time Warner, and before that, the media company’s ill-fated marriage with AOL. Warner Bros. is now on a box-office hot streak, but that has come after years of Zaslav taking heat for killing projects such as “Batgirl.”

Such deals result in mass layoffs. Movie theater owners will most likely see darker days ahead as they’ll be minus yet another big supplier of blockbusters. Journalist Richard Rushfield, of the Ankler newsletter, demanded that somebody do something to stop it. We’ll see.

An Oracle scion buying two studios one after the other probably wasn’t the tech takeover of Hollywood that many people envisioned. Analysts long assumed that Apple would be the one to buy an entertainment powerhouse — maybe even Disney — despite having not shown any particular inclination for doing so. But though it’s not the Silicon Valley roll-up people anticipated, it may be the one they’re going to get.

Newsletter

You’re reading the Wide Shot

Ryan Faughnder delivers the latest news, analysis and insights on everything from streaming wars to production — and what it all means for the future.

You may occasionally receive promotional content from the Los Angeles Times.

Stuff we wrote

Numbers of the week

An anime film slayed its Hollywood competition at the box office over the weekend.

“Demon Slayer: Kimetsu no Yaiba Infinity Castle,” already a big hit in Japan, was the highest-grossing movie domestically, beating new films “Downton Abbey: The Grand Finale,” “The Long Walk” and “Spinal Tap II: The End Continues.”

The film, distributed by Sony Pictures and Crunchyroll, opened with a better-than-expected $70 million in ticket sales from the U.S. and Canada, according to studio estimates, making it the biggest anime opening ever. It’s also the highest-grossing domestic debut of the year so far for an animated film.

Its global weekend for Sony, which owns the Crunchyroll anime brand and streaming service, totaled $132.1 million, which includes 49 international markets.

Including grosses from Japan, the movie’s worldwide tally has surpassed $450 million, according to Comscore.

The success of “Demon Slayer,” part of a long-running popular franchise and not to be confused with Netflix’s hit “KPop Demon Hunters,” is a relief to theater owners at a time when other genres are struggling, including superheroes, comedies and original animation. It’s the latest evidence of anime’s growing global clout.

Comedian Nate Bargatze didn’t shortchange the Boys & Girls Clubs of America, nor did he kill the Emmys telecast’s ratings on Sunday night.

The 77th Emmy Awards ceremony from the Peacock Theater in Los Angeles delivered an average of 7.42 million viewers on CBS, up 8% from last year’s audience for ABC.

Once among the most-watched live awards shows on television, the Emmy Awards audience declined dramatically over the last decade as most of the series celebrated no longer have the broad reach they did when traditional TV still dominated the culture, reports Stephen Battaglio.

But the audience level appears to have stabilized. Nielsen data shows that ratings for the Emmy Awards grew for the second consecutive year. The figure is the highest since 2021, when the telecast also aired on CBS.

HBO Max’s “The Pitt,” Apple TV+’s “The Studio” and Netflix’s “Adolescence” were big winners.

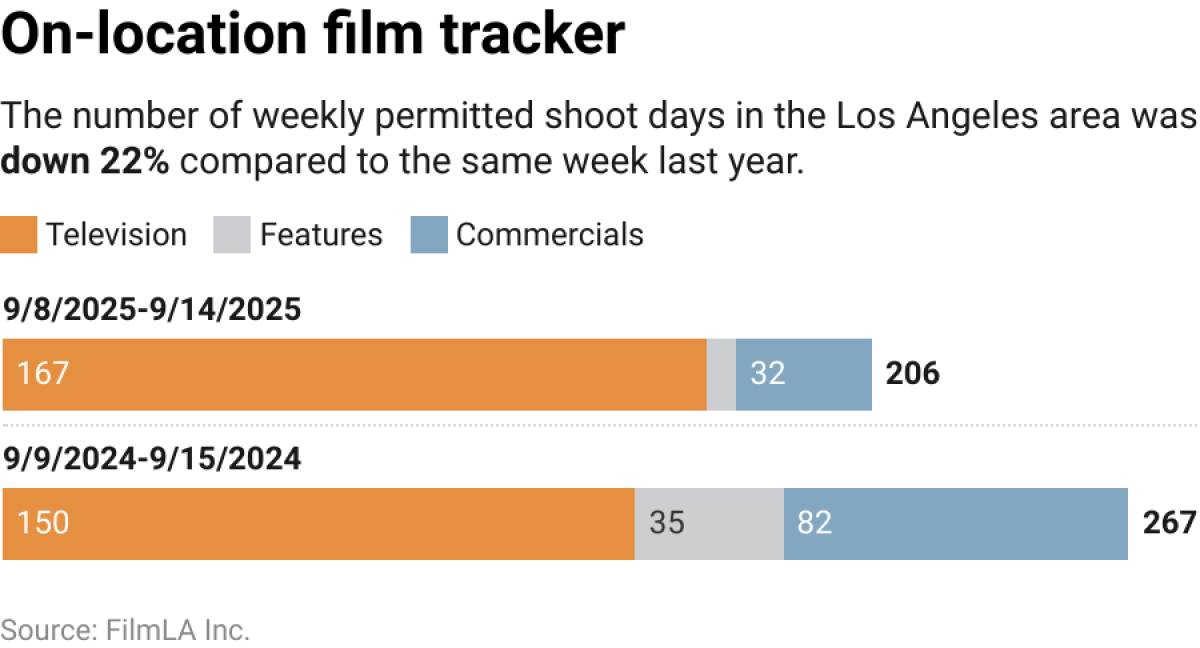

Film shoots

Finally …

Listen: The music of Le Tigre, just because it rocks. I just started the audiobook of Le Tigre and Bikini Kill frontwoman Kathleen Hanna’s memoir, “Rebel Girl.” Essential for punk rock fans.