June 28 (UPI) — Senate Republicans released their updated version of the massive spending bill late Friday, which still includes an extension of tax cuts mainly for wealthy people, and have scheduled the first vote to move it forward for Saturday.

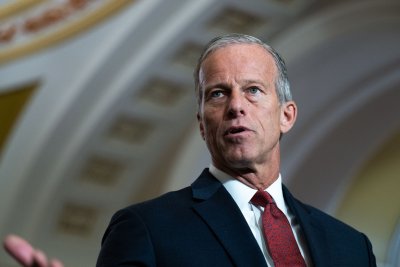

The Senate conveyed for a special session at 2 p.m. for a key procedural vote, though it’s uncertain whether Senate Majority Leader John Thune of South Dakota has the necessary 50 votes for it to move forward, ABC, CBS and NPR reported.

Republicans hold a 53-47 majority in the Senate with all Democrats planning to oppose the legislation.

House and Senate leaders are committed to sending the bill to President Donald Trump on the Fourth of July. Trump has been pressuring Senators to send the bill to his desk for signing, including conducting an event Thursday that touted the advantages.

Thune hopes the Senate bill not only draws reluctant colleagues but conforms to what parliamentarian Elizabeth MacDonough approves. On Thursday, she rejected key aspects of changes with Medicaid, which is health insurance for low-income people.

NPR and Politico analyzed Senate changes in the 940-page bill.

Reconciliation allows bills to pass with a simple majority instead of 60 votes and all changes in the Senate bill need to be sent back to the House for approval. “The house is ready to act as soon as the Senate does,” House Speaker Mike Johnson said Friday.

The legislation passed the House 215-214 on May 22. Two Republicans voted against the bill and one voted present.

In the reconciliation process, after time for up to 20 hours of debate has expired, Senators may continue to offer amendments, a process that could stretch into Sunday.

Each Senator was able to speak for 10 minutes on Saturday, freshman Sen. Bernie Moreno of Ohio as the first speaker.

“We are about to enter a historic moment in this chamber,” he said. “We’re going to take up a bill called the One Big Beautiful Bill. If you’ve been watching the media over the last maybe six months, you’ve heard all kinds of absolute misinformation about this bill. I’ve had a chance to read it. … It’s an absolute historic and transformative piece of legislation that reserves four years of an assault on American workers.”

He said “indisputable facts include interest deductibility of cars are built in the United States, no taxes on tips and overtime, income tax cuts on all payees and a government-funded savings account given to raise kids. And Medicare and Social Security is untouched with Medicaid improved with work requirements.

House Minority Leader Chuck Schumer of New York was the first Democrat to speak.

“Senate Republicans are trying to pull a fast one on the American people,” he said. “For weeks they’ve struggled with the reality that most people hate this bill. Leadership has struggled to secure votes among their own ranks who know how bad the bill is. And now they’ve scrambled to meet an entire arbitrary deadline.”

“So what did the Republicans do last night. Hard to believe, this bill is even worse than any draft we’ve seen this far. It’s worse on healthcare, it’s worse on SNAP, it’s worse on the deficit. At very last minute, Senate Republicans made their bill more extreme to cater to the radicals in the House and Senate,” he added.

He said the bill was released “without knowing how much it will cost,” including a Congressional Budget Office score. He said Republicans, who have sought to lower the deficit “have made it worse” and Americans will pay the price.

Senate bill changes

The new Senate version includes much of what the House approved, including increased funding for border security and extension of tax cuts passed in 2017 during Trump’s first term in the White House. The tax cuts reduced the corporate rate from 35% to a flat 21% and for high-income single filers of more than $400,000 to 37% from 39.6%, for example.

The tax cuts would total $4 trillion over ten years in the Senate bill compared with $3.8 trillion in the House.

Some Republican senators have joined Democrat colleagues in opposing changes to Medicaid.

“We’ve got a few things we’re waiting on, outcomes from the parliamentarian on, but if we could get some of those questions issues landed, and my expectation is at some point tomorrow, we’ll be ready to go,” Thune said Friday.

In Medicaid, a stabilization fund for rural hospitals over five years was boosted to $25 billion from $15 billion in the Senate bill. Some Republicans opposed big cuts to the health program.

Republicans Josh Hawley of Missouri and Susan Collins of Maine have warned rural hospitals could be forced to close.

Planned cuts to provider taxes that fund state obligations for Medicaid would be delayed by one year to 2028. The allowable provider tax in Medicaid expansion states would go from 6% to 3.5%. The new Senate bill increases the deduction from $10,000 to $40,000 but would revert to current levels after 2029.

Schumer said on the Senate floor that when he learned the CBO said the Medicaid cuts are worse than previous versions, he fears that “Medicaid will be fed to the sharks.”

In the Senate’s version of the bill, the debt limit would be increased by $5 trillion, instead of the $4 trillion voted for by the House. Currently, the U.S. debt stands at $36.22 trillion, according to the U.S. Treasury.

Sen. Rand Paul, a Republican from Kentucky, opposed boosting the debt limit. Republicans can spare only three oppositions.

The non-partisan Congressional Budget Office has determined the House version of the bill would add roughly $2.4 trillion to the debt over 10 years. The $5.3 trillion of tax cuts and increases to spending the House approved would be partially offset by $2.9 trillion of revenue increases and spending cuts.

The new Senate bill raises the per-child tax credit from $2,000 to $2,200. Also, the Senate would permanently expand the standard deduction instead of only through 2028 in the House version. What remains is the deduction phasing out for people earning more than $75,000.

The Supplemental Nutrition Assistance Program, referred to as SNAP and formerly known as food stamps, provides food for more than 40 million low-income U.S. residents, remains in both versions. But the Senate legislation adds work requirements for “able-bodied adults” up to age 64 with some exemptions.

Alaska and Hawaii may be temporarily exempted from paying for some costs. Alaska’s two Republican senators, Lisa Murkowski and Dan Sullivan, want an exception for their state.

GOP senators also changed the state and local tax deduction, or SALT, which has been backed by House members in states dominated by Democratic voters.