When in doubt, go with the one with fewer obvious risks.

In the tech and business world, no topic has been harder to avoid than artificial intelligence (AI). Over the past couple of years, it has been the topic. With this surge in interest has come a rise in the valuations of many tech stocks as investors rush to capitalize on new growth opportunities.

No two companies have benefited more from the AI hype than Nvidia (NVDA -3.38%) and Palantir (PLTR -0.89%). It has propelled Nvidia to the world’s most valuable public company and pushed Palantir’s stock price up over 810% since the beginning of 2024.

Both companies have produced generational returns, but if you had to choose one of the growth stocks to invest in, which is the better choice?

Image source: Getty Images.

What Nvidia has going for it

Nvidia is undoubtedly one of the most important companies in the AI world. It produces graphics processing units (GPUs) that power data centers, making it possible to train, deploy, and scale AI as we know it today. In its latest quarter, Nvidia’s data center revenue increased 56% from a year ago to $41.1 billion (88% of its total revenue).

Nvidia makes GPUs for gaming consoles, automotive applications, and networking, but data centers are its bread and butter. The company plans to go all in on becoming an AI infrastructure company.

This pivot has worked out in Nvidia’s favor and is expected to continue doing so, as the company anticipates AI infrastructure spending to increase between $3 trillion and $4 trillion over the next five years from some of AI’s largest spenders, including the “Magnificent Seven” stocks. Nvidia expects it can capture up to 70% of this spending.

What Palantir has going for it

Palantir is a software company that uses AI to turn vast amounts of data into actionable insights. It’s not as important to the AI ecosystem as Nvidia, but its use cases are continuously growing, which has fueled its growth over the past couple of years. Palantir’s initial focus was on government entities, such as the Department of Defense, CIA, and FBI, but it has expanded and shown it can be successful in the commercial sector, too.

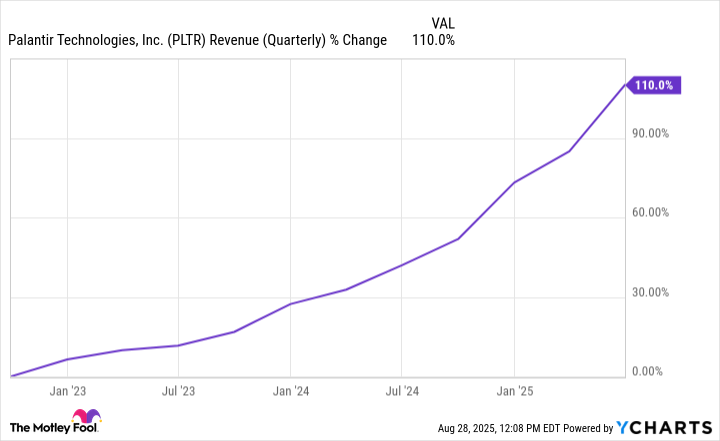

Its U.S. government segment is still the bulk of its revenue (42% of total revenue), but its U.S. commercial segment is its fastest-growing segment. In the second quarter, U.S. commercial revenue grew 93% year over year to $306 million. The growth of both segments helped Palantir achieve its first billion-dollar quarter, more than doubling its revenue from just three years ago.

PLTR Revenue (Quarterly) data by YCharts

Palantir’s AI Platform (AIP) is responsible for its recent commercial success. As it continues to gain adoption across various industries, Palantir should see its revenue base diversify, enhancing its long-term appeal.

What downsides does each company have?

Nvidia’s largest “roadblock” is that it’s in the middle of a volatile relationship between the U.S. and China. The Trump administration imposed a ban on sales of the H20 chip (Nvidia’s China-compliant AI chip) to China in April, but reversed the decision in July after Nvidia agreed to pay the government a 15% tax on AI chip revenue generated in China (the deal is in place, but has not yet been finalized). It’s worth keeping an eye on how this plays out.

Palantir’s downside is its reliance on U.S. government contracts. These contracts can provide lucrative opportunities, but they can also be subject to changing government budgets and political priorities. As volatile as the current political environment is, it wouldn’t be far-fetched for some of these contracts to be restructured or canceled completely. Palantir’s commercial business is growing, but it still relies on U.S. government contracts to keep the lights on.

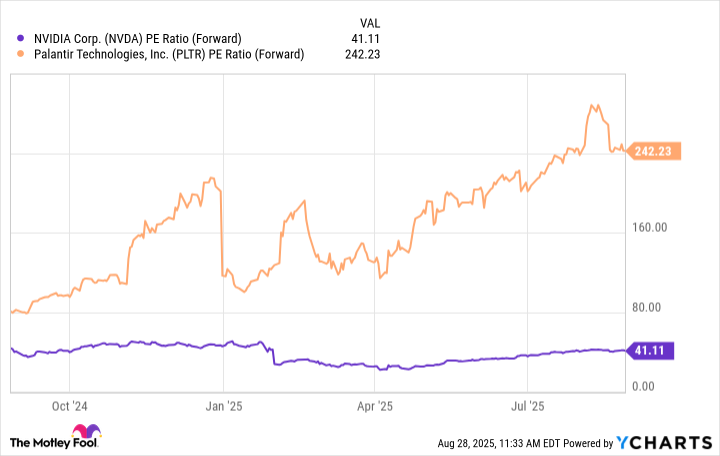

You can’t ignore how each company is valued

Although both companies have great growth prospects, you can’t decide on which is the better one to own without looking at their valuations. As of Aug. 28, Nvidia is trading at 41 times its forward earnings, while Palantir is trading at 242 times its forward earnings.

NVDA PE Ratio (Forward) data by YCharts

Nvidia’s 41 forward P/E ratio is expensive by most standards, but Palantir’s valuation is one of the highest in history. It has gotten to the point where an Economist article mentioned that Palantir “might be the most overvalued firm of all time.”

When I think of which is the better stock to own, I think about which one has more margin for error because growth stocks are known for being volatile — especially ones propped up by AI hype. Nvidia has little room for error with its valuation, but Palantir has virtually no room for error at its current valuation.

In my opinion, that makes Nvidia the better choice between the two.

Stefon Walters has no position in any of the stocks mentioned. The Motley Fool has positions in and recommends Nvidia and Palantir Technologies. The Motley Fool has a disclosure policy.