The S&P 500 has produced historically strong returns over the past decade.

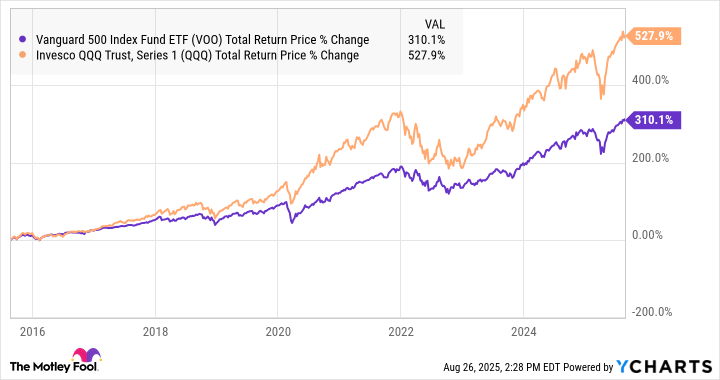

It has been a remarkably strong decade for the S&P 500. In fact, a $1,000 investment in the low-cost Vanguard S&P 500 ETF (VOO -0.35%) a decade ago would be worth about $4,100 today, assuming you reinvested all of your dividends. That is an annualized return of about 15%.

Why has the S&P 500 had such a strong decade?

It’s worth noting that a decade ago, the S&P 500 had already more than tripled from the 2009 financial crisis lows. So, adding a 310% total return on top of that is no small feat.

VOO Total Return Price data by YCharts

The short explanation is that while most sectors have performed quite well, the bulk of the stellar performance has been largely fueled by large-cap technology stocks. After all, the trillion-dollar megacap tech stock wasn’t a thing back then, and now there are eight of them. To illustrate this, consider the five largest holdings of the Vanguard S&P 500 ETF and how each one has performed over the past decade:

|

Company (Symbol) |

% of S&P 500 |

10-Year Total Return |

|---|---|---|

|

Nvidia |

8.1% |

32,230% |

|

Microsoft |

7.4% |

1,270% |

|

Apple |

5.8% |

843% |

|

Amazon |

4.1% |

802% |

|

Alphabet |

3.7% |

566% |

|

S&P 500 |

100% |

310% |

Data source: yCharts, Vanguard. Percentages of assets as of 7/31/2025.

Think about this. The worst performer of the five largest megacap tech stocks in the S&P 500 outperformed the overall index by more than 250 percentage points over the past decade.

Image source: Getty Images.

Historically, the S&P 500 has delivered annualized returns in the 9% to 10% range over long periods, so it’s fair to say that this has been an incredibly strong decade for S&P 500 investors. And while there’s no way to predict what might happen over the next 10 years, it wouldn’t be realistic to expect 15% annualized returns over the long run forever.

Matt Frankel has positions in Amazon and Vanguard S&P 500 ETF. The Motley Fool has positions in and recommends Alphabet, Amazon, Apple, Microsoft, Nvidia, and Vanguard S&P 500 ETF. The Motley Fool recommends the following options: long January 2026 $395 calls on Microsoft and short January 2026 $405 calls on Microsoft. The Motley Fool has a disclosure policy.