The tech-heavy ETF has been a lucrative investment over the past decade.

One of the most popular exchange-traded funds (ETFs) on the stock market is the Invesco QQQ Trust (QQQ 0.70%). It mirrors the Nasdaq-100, an index that tracks the 100 largest companies on the Nasdaq stock exchange (excluding financial names such as banks and insurance companies). It is the second-most traded ETF in the U.S. based on average daily volume.

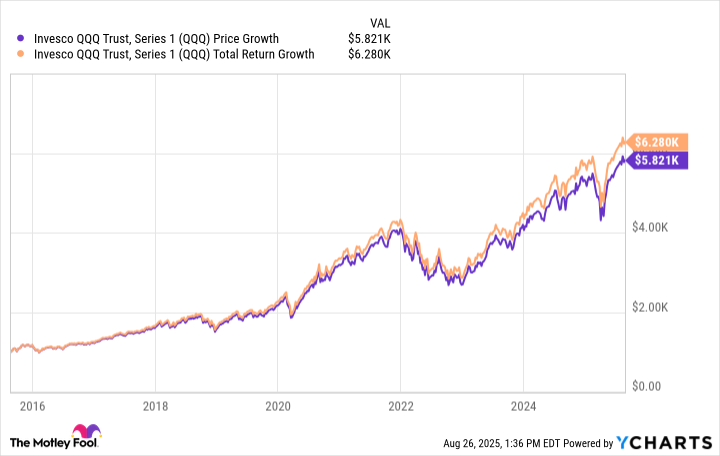

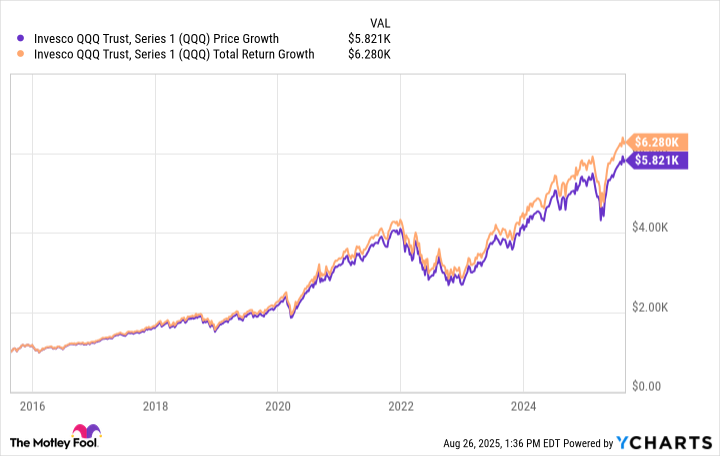

Over the past decade, QQQ has also been one of the best ETFs for investors to hold. Had you put $1,000 in the ETF 10 years ago (using Aug. 25, 2015, as the starting point), it would be worth over $5,800 today. And if you include dividends paid out during that time, the investment would be worth over $6,200.

Data by YCharts.

What could the next 10 years look like for QQQ?

The QQQ is a tech-heavy ETF (the sector makes up over 60% of the fund), so as the industry goes, so does the fund. This has worked in its favor so far, but will that be the case going forward? I believe so as the technology sector still has some of the most compelling growth opportunities across the entire economy.

The one making the most headlines right now is artificial intelligence (AI) and its potential to help companies across every industry increase their efficiency. Other opportunities that will drive tech sector growth over the next decade include cloud computing, cybersecurity, and digital advertising.

With companies like Nvidia, Apple, Microsoft, Alphabet, Amazon, and Meta Platforms leading the way, the QQQ is in good hands for the foreseeable future.

Stefon Walters has positions in Apple and Microsoft. The Motley Fool has positions in and recommends Alphabet, Amazon, Apple, Meta Platforms, Microsoft, and Nvidia. The Motley Fool recommends the following options: long January 2026 $395 calls on Microsoft and short January 2026 $405 calls on Microsoft. The Motley Fool has a disclosure policy.