Artificial intelligence (AI) continues to advance at an astonishing rate.

The frenzy over artificial intelligence (AI) stocks kicked off in late 2022 with the arrival of OpenAI’s ChatGPT. While this watershed moment occurred years ago, the AI market shows no sign of slowing down.

In fact, Google parent Alphabet (GOOGL -0.16%) (GOOG -0.04%) achieved a recent breakthrough with Gemini, a large language model (LLM) comparable to ChatGPT in many ways. The innovation suggests the AI industry could enjoy prosperity for decades.

If so, now may be the time to invest in AI giants like Alphabet. Here’s a dive into the company’s artificial intelligence accomplishment, as well as the implications for Alphabet’s stock and the broader AI market.

Alphabet’s AI achievement

In September, Alphabet’s Gemini achieved a groundbreaking outcome, becoming the first AI model to win a gold medal in an international computer programming competition. It successfully solved complex, real-world calculations that stymied human participants.

Google DeepMind, Alphabet’s AI research division, was responsible for Gemini. The DeepMind team highlighted the significance of the landmark achievement by stating, “Solving complex tasks at these competitions requires deep abstract reasoning, creativity, the ability to synthesize novel solutions to problems never seen before, and a genuine spark of ingenuity.”

Gemini demonstrated these traits in the competition, including successfully coming up with a creative solution to one challenge that no human participant was able to solve. This result marked a crucial step on the path toward artificial general intelligence (AGI). AGI is a theoretical level of AI proficiency considered equivalent to human thinking.

Gemini’s milestone is a memorable bellwether, akin to the moment when the world was stunned by IBM’s Deep Blue computer beating the reigning human chess champion in 1997.

How Alphabet’s milestone impacts the AI industry

A quarter-century after Deep Blue’s achievement, OpenAI’s introduction of ChatGPT opened the floodgates for the current AI boom. Now, Gemini’s breakthrough signals the start of a new era in the evolution of artificial intelligence, as the tech edges closer to the capacity for original thought.

AI is evolving from simply completing specific tasks toward solving more complex problems that require leaps in thinking — for example, designing innovative microchips or coming up with new medicines. The possibilities to upend markets in the years to come could be akin to how today’s AI is delivering unprecedented transformation across industries.

One example is Nvidia, the semiconductor chip leader. AI systems require increasingly potent computing capabilities. This need led to the company’s impressive 56% year-over-year sales growth to $46.7 billion in its fiscal second quarter, ended July 27, and drove its stock to a $4 trillion market cap.

Alphabet was among the first to power its AI with Nvidia’s new Blackwell chips. When the chip debuted in 2024, Nvidia stated, “Blackwell has powerful implications for AI workloads” and that the tech would help “drive the world’s next big breakthroughs.” Following Gemini’s AI milestone, it appears that Nvidia’s words were something more than empty marketing boasts.

The computing power needed to produce the Gemini breakthrough must have been substantial. Alphabet declined to specify how much, but admitted it was more than what’s available to customers subscribing to its top-tier Google AI Ultra service for $250 per month. With that kind of computing capability required for AI to perform advanced reasoning, Nvidia and other hardware providers can continue to benefit from AI advances.

What the Gemini breakthrough means for Alphabet stock

While building toward artificial general intelligence will increase computing costs for Alphabet, the company can afford it. Thanks to its search engine dominance, Alphabet generates substantial free cash flow (FCF) to invest in its AI systems. The company produced $66.7 billion in FCF over the trailing 12 months through Q2.

In addition, AI is already delivering business growth for the company. Its second-quarter sales were up 14% year over year to $96.4 billion as customers adopted AI features Alphabet released onto its search engine, cloud computing services, and advertising platforms.

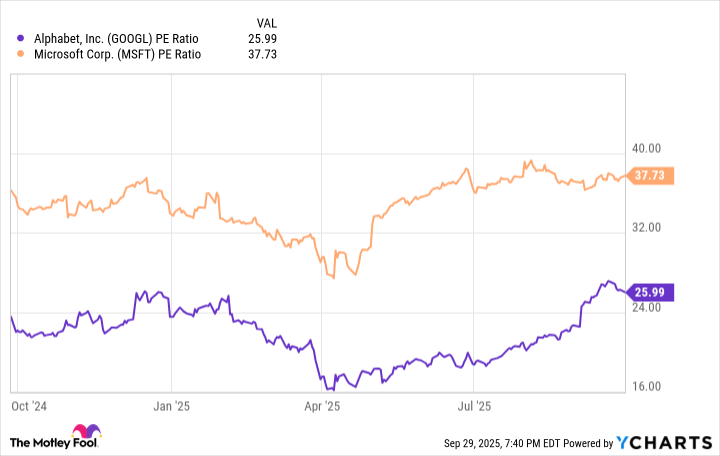

Despite these strengths and Gemini notching a significant AI victory, Alphabet shares remain reasonably valued compared to rivals such as Microsoft. This can be seen in the stock’s price-to-earnings (P/E) ratio, which reflects how much investors are willing to pay for each dollar of a company’s earnings, based on the trailing 12 months.

Data by YCharts.

The chart shows Alphabet’s P/E ratio is lower than Microsoft’s, suggesting it’s a better value. In other words, now could be a good time to pick up Alphabet shares at a reasonable price.

Since the Google parent isn’t the only beneficiary of ongoing AI progress, it’s worth considering the growth potential in other AI players, such as Nvidia, IBM, and Microsoft. As the tech industry moves closer to achieving AGI, the AI space is poised for innovations that are likely to fuel the sector’s growth for decades to come.

Robert Izquierdo has positions in Alphabet, International Business Machines, Microsoft, and Nvidia. The Motley Fool has positions in and recommends Alphabet, International Business Machines, Microsoft, and Nvidia. The Motley Fool recommends the following options: long January 2026 $395 calls on Microsoft and short January 2026 $405 calls on Microsoft. The Motley Fool has a disclosure policy.