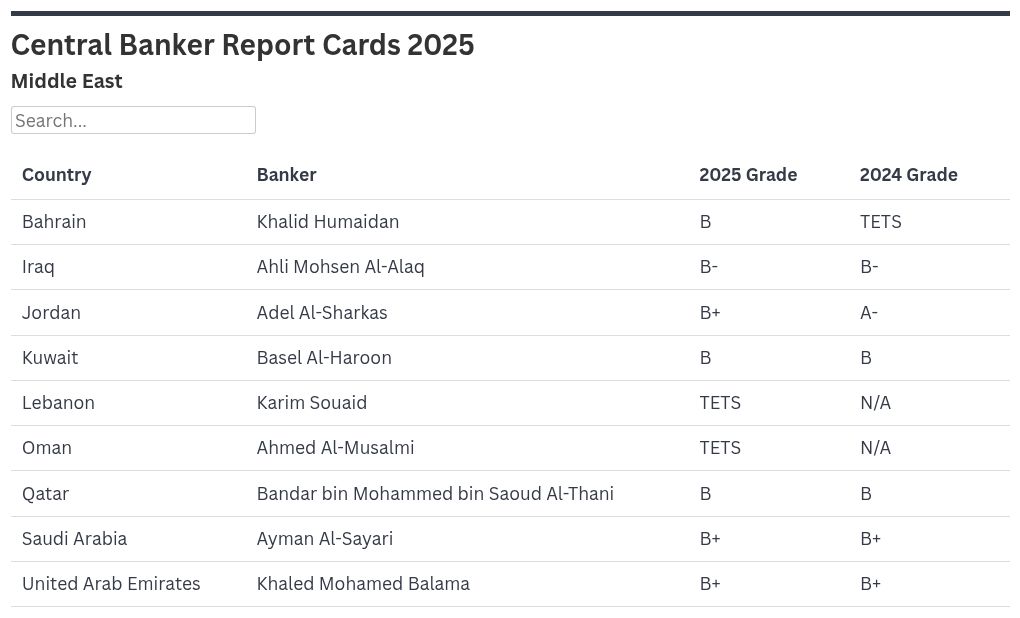

While central banks brace for 2026 inflation, consensus on tackling it is still elusive. Global Finance reveals the 2025 Central Banker Report Cards in the Middle East.

BAHRAIN | Khalid Humaidan: B

The smallest economy in the Gulf Cooperation Council (GCC), Bahrain, remains stable. GDP growth is expected to remain at 3.5% this year, while inflation is expected to remain below 1%. The dirham is pegged to the dollar, and the Central Bank of Bahrain’s (CBB) monetary policy aligns with that of the Fed.

Following the Fed’s cut in September, CBB cut the ovrnight deposit rate by 25 bps to 4.75% While the peg remains an appropriate instrument, “Bahrain could face tighter financial conditions from trade-related inflationary pressures and disrupted global supply chains,” the World Bank noted in its latest statement.

Bahrain was among the first Middle Eastern countries to diversify its economy away from oil rents decades ago. The financial sector is at the center of the non-oil economy, with some of the region’s oldest and largest banks based in Manama. Humaidan, a former head of Global Markets, Middle East and Africa at BNP Paribas and CEO of Bahrain’s Economic Development Board, encourages lenders to leverage new technologies to expand market share.

In July, the CBB became the first Gulf regulator to introduce rules for stablecoins.

Humaidan also works closely with GCC peers to facilitate cross-border transactions and interconnect payment systems. The authorities continue to implement their reform agenda, reducing subsidies, encouraging private-sector investment, and broadening public revenue sources.

This year, Bahrain rolled out a 15% corporate tax on multinationals with consolidated annual revenues exceeding €750 million in two of the last four fiscal years. The kingdom, however, faces some headwinds. Public debt is projected to reach 144% of GDP by 2028, up from 130% last year, with debt servicing consuming roughly 30% of government revenue. Bahrain also remains heavily reliant on regional support with frequent support packages from Saudi Arabia, Qatar and the UAE.

IRAQ | Ali Mohsen Al-Alaq: B-

Following two consecutive years of recession, Iraq’s GDP growth is expected to recover in 2025, primarily driven by a rebound in oil production. The economy remains heavily reliant on hydrocarbons, which account for 95% of government revenue, leaving it exposed to global oil price fluctuations.

Although diversification has long been on the agenda, real progress is limited. In response, the Central Bank of Iraq (CBI) is advancing what Governor Al-Alaq describes as “developmental central banking,” focusing on channeling credit into strategic sectors, such as agriculture and industry, to broaden the country’s economic base. Price stability is Al-Alaq’s stated priority. In 2024, inflation fell to 3.8% from a peak of 7.5% the previous year. With the consumer price index easing, the CBI cut its policy rate from 7.5% to 5.5% to stimulate credit growth and support recovery.

Modernizing Iraq’s underdeveloped banking system is another priority. Reforms to state-owned banks are underway, alongside initiatives aimed at reducing the use of cash. New regulations for digital banks and electronic payment companies were issued in May 2024, prompting several new players to enter the market. Despite prolonged efforts to combat money laundering and terrorism financing, the central bank still faces severe compliance challenges. Several Iraqi banks remain restricted from dollar transactions due to concerns over illicit financial flows to sanctioned entities, and in early 2025, the authorities uncovered a new scheme involving prepaid Visa and Mastercard products used to channel money to Iran-backed militias. In response, the CBI capped monthly cross-border transfers at $300 million and limited individual cardholder transactions to $5,000.

JORDAN | Adel Al-Sharkas: B+

Bordering Israel and Syria, Jordan sits at the crossroads of regional turmoil, yet the kingdom has demonstrated commendable macroeconomic resilience over the past few months. The country recorded 2.5% GDP growth in 2024, with a similar outlook for 2025. Governor Adel Al-Sharkas prioritizes maintaining price stability and preserving purchasing power.

The Jordanian dinar is pegged to the dollar, and the Central Bank of Jordan’s (CBJ) monetary policy closely follows the Federal Reserve’s moves, with the latest cut in September bringing the main policy rate to 6.25%. Inflation declined to 1.6% last year from 2.1% in 2023 and is expected to stay around 2% in 2025. Jordan’s banking sector is robust, well-capitalized, and resilient to external shocks. In 2024, deposits grew by 6.1% and credit by 4.4% indicating positive market dynamics.

In July, the IMF highlighted that “Jordan’s banking sector remains healthy, with the central bank strengthening systemic risk analysis, financial oversight, and crisis management.” Fiscal and economic reforms are underway to improve the business environment. Last year, the CBJ launched its National Financial Inclusion Strategy for 2028, which aims to foster sustainable growth, enhance publicprivate collaboration, and modernize the banking sector. However, the country remains heavily reliant on external financial support, and given that public debt exceeds 90% of GDP, managing fiscal sustainability will be a critical concern for the future.

KUWAIT | Basel Al-Haroon: B

While most Gulf countries are stepping out of the oil rent, hydrocarbon sales still account for 90% of Kuwait’s revenues. As a result, economic performance remains closely tied to production volumes and prices. After contracting by 2.6% in 2024, GDP is expected to grow by a modest 1.9% this year.

Since his appointment in 2022, Governor Basel Al-Haroon has gradually tightened monetary policy, raising the main policy rate by a cumulative 275 basis points to 4.25% by July 2023. A modest cut followed in September 2024, bringing the actual rate to 3.75%. The Central Bank of Kuwait (CBK) describes its approach as “gradual and balanced,” aiming to manage inflation without constraining growth.

Unlike other GCC central banks, Kuwait does not peg its currency to the dollar but to an undisclosed basket of goods, a framework the IMF calls an “appropriate nominal anchor.” The Washington-based fund also noted that the policy rate is “currently in line with controlling inflation and stabilizing non-oil output while supporting the exchange rate peg.” The financial sector is the backbone of Kuwait’s non-oil economy and remains strong.

Kuwaiti banks maintain healthy capital and liquidity buffers, with low levels of non-performing loans, thanks to prudent lending and robust provisioning. In June 2025, the CBK released a draft framework for open banking regulation, aiming to foster collaboration between fintechs and traditional banks to meet the rapidly evolving needs of a young, tech-savvy population.

LEBANON | Karim Souaid: Too Early To Say

After six years of an unprecedented financial, monetary, and economic crisis that caused the local currency to lose 99% of its value and experience triple-digit inflation, Lebanon could finally see the light at the end of the tunnel. The war between Israel and Hezbollah devastated large parts of the country, but in early 2025, a long-standing political gridlock broke. A new ruling team has begun passing critical reforms that could unlock a much-needed support package from the IMF.

Karim Souaid was appointed governor of the Banque du Liban (BDL) in March 2025. It is too early for Global Finance to assess his record, but it is safe to say he faces the monumental challenge of completely restructuring the banking sector and restoring confidence in an institution many in Lebanon and abroad no longer trust.

His predecessor, Riad Salameh, who led BDL for nearly three decades, was arrested in Beirut and awaits trial for embezzlement, money laundering and tax evasion. Some crucial steps towards reform have already been taken: In April, Parliament lifted banking secrecy, and, in July, it passed a bank resolution law that should allow for restructuring.

Consolidation among lenders is expected, while others may close altogether. The next milestone is a gap-resolution law to determine who will pay for the sector’s estimated $80 billion in losses. “Work must be done to gradually return all bank deposits, starting with small savers as a priority,” Souaid promised on his first day in office. Now all eyes are on him and the new ruling team.

OMAN | Ahmed Al-Musalmi: Too Early To Say

Oman’s economic development has traditionally been less flashy than neighboring Gulf countries, but the Sultanate is nevertheless undergoing an ambitious transformation. Economic growth is expected to rise to 3% in 2025, up from 1.7% in 2024, driven by increased oil revenues as well as strong performance in the non-oil economy.

In August, Oman became the last GCC country to introduce a Golden Visa program. This initiative is expected to attract foreign investors and stimulate domestic demand in real estate and other key sectors. Meanwhile, the banking sector has more than doubled in size over the past decade, creating opportunities for innovation in financial services and increasing regulatory complexity.

Governor Ahmed Al-Musalmi was named at the head of the Central Bank of Oman (CBO) last December. Prior to his appointment, he served as CEO of the National Bank of Oman and later as CEO of Bank Sohar. In 2023, he oversaw the merger of Bank Sohar and HSBC Bank Oman, resulting in the creation of Sohar International, now the second-largest lender in the country. As more bank M&As are expected in Muscat, Al-Musalmi’s expertise might be rapidly put to the test. It is, however, too early for Global Finance to evaluate his performance.

QATAR | Bandar bin Mohammed bin Saoud Al-Thani: B

Already one of the world’s wealthiest countries in terms of GDP per capita, Qatar is projected to grow by 2.4% this year before increasing to over 6% in 2026, when the North Field Expansion is expected to more than double liquefied natural gas production.

At the same time, inflation remains well-contained at around 1%, with strong purchasing power pushing domestic demand. The Qatari riyal is pegged to the dollar, and the Qatar Central Bank (QCB)’s monetary policy mirrors that of the US. Doha cut key rates in September, outpacing the Fed’s move. The deposit rate now stands at 4.35%, the lending rate at 4.85%, and the repo rate at 4.6%. Governor Bandar bin Mohammed bin Saoud Al-Thani—who also chairs the Qatar Investment Authority, the country’s $450 billion sovereign wealth fund—supervises eleven local banks and several international lenders as they accompany the country’s economic transformation.

“Qatari banks are profitable and benefit from strong capitalization and adequate liquidity,” S&P noted in a recent assessment, though external debt and potential capital outflows remain points of caution. As major infrastructure projects near completion, external funding needs are easing. Looking ahead, Qatar aims to attract $100 billion in foreign direct investment by 2030. A new package of pro-business legislation was introduced in January, covering bankruptcy, public-private partnerships, and commercial registry reform. The QCB is also looking to promote Qatar as a destination for financial innovation with initiatives like the Qatar Fintech Hub, in partnership with the Qatar Development Bank and the Qatar Financial Centre.

SAUDI ARABIA | Ayman Al-Sayari: B+

The largest economy in the Middle East, Saudi Arabia, has remained relatively shielded from the shockwaves of the war in Gaza, tensions with Iran and even disruptions to global trade. This year, growth is projected at 3.5%, and inflation is expected to remain at a low 2%. Like many of its GCC neighbors, Saudi Arabia pegs its currency to the dollar, a policy the IMF deems “appropriate” in its latest Article IV review.

In line with the Fed’s decisions, Governor Ayman Al-Sayari cut the main policy rates by 25 bps in September, lowering the repo rate to 4.75% and the reverse repo to 4.25%. Easing borrowing costs is expected to spur investment across sectors.

Saudi banks delivered record profits in 2024, with average return on assets at 2.2% and non-performing loans (NPLs) hit their lowest level since 2016. However, robust double-digit credit growth, driven by corporate lending and mortgages, is outpacing deposit growth and creating some level of funding pressure. To bridge the gap, banks have increasingly turned to external borrowing, pushing Net Foreign Assets (NFA) into negative territory for the first time since 1993.

Despite these pressures, Riyadh maintains one of the lowest public debt levels globally thanks to high oil revenues, large foreign reserves and a conservative fiscal policy. “SAMA’s continued efforts to enhance regulatory and supervisory frameworks are commendable,” comments the IMF. The kingdom continues to be a magnet for international banks looking to set foot in the region and to keep up with the best global practices. A new Banking Law is expected soon.

UNITED ARAB EMIRATES | Khaled Mohamed Balama: B+

The United Arab Emirates (UAE) continues to post a solid economic performance with GDP growth expected at 4.4% this year and inflation contained at 2%. The dirham is pegged to the dollar, and the Central Bank of the UAE (CBUAE) essentially follows US monetary policy. After three rate cuts in 2024, the CBUAE lowered its overnight deposit facility rate to 4.15% in mid-September.

Concentrated in Dubai and Abu Dhabi, the UAE’s banking sector is a regional heavyweight. In 2024, banking assets increased by 12% to $1.24 trillion, accompanied by record profits, while the return on average equity reached 19.1%, according to Fitch. The loan-to-deposit ratio held steady at 76%, signaling robust liquidity and strong credit capacity.

Emirati banks continue to expand their footprint at home and abroad, especially in Asia and Africa. In March, Emirates NBD, Dubai’s largest bank, secured regulatory approval to acquire a stake in Banque du Caire, Egypt’s sixth-largest lender.

Governor Khaled Mohamed Balama, who has been with the CBUAE since 2008, oversees a growing and diversified financial ecosystem that includes traditional banks as well as hundreds of fintech and non-bank institutions.

For over a decade, the UAE has been a regional driving force in digital finance and continues to pioneer new sectors, including blockchain, cryptocurrencies, and artificial intelligence (AI). In July, CBUAE announced the launch of a joint venture with Presight, an AI company, to improve financial services in the country. Governor Balama is also a strong promoter of green finance, aligning innovation with long-term sustainability goals set out by the country’s leadership.