In the past five years, Walmart’s stock has surged by around 120%.

Walmart (WMT -0.63%) is a stock that most investors probably consider to be a safe investment. Its stores are go-to locations for consumers, whether they’re buying groceries, day-to-day essentials, or discretionary items. The business has been resilient over the years and has shown strength while other retailers have struggled.

That safety has lured in investors at a time of uncertainty in the markets. But has that bullishness pushed its value up too much, too quickly? Currently, Walmart’s stock is trading at not just a 52-week high, but also at an all-time high. Is it still a good buy at these levels, or could it be due for a pullback?

Image source: Getty Images.

Walmart’s stock is trading at elevated levels

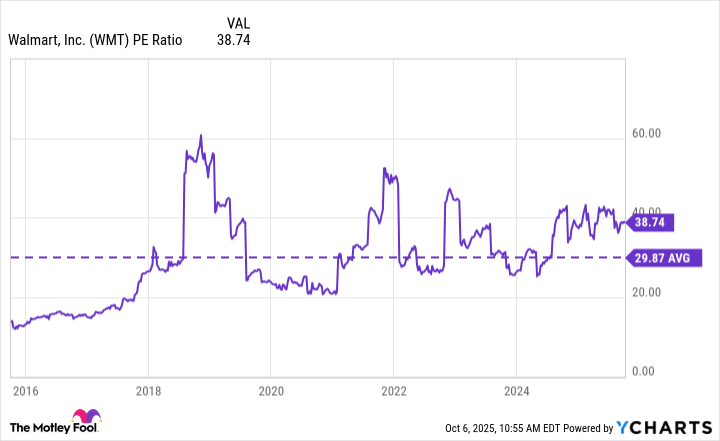

Investors have been paying a premium for Walmart’s stock due to the safety it offers and the solid, resilient earnings numbers it has been posting in recent quarters. But there’s no denying that the premium is high right now, with Walmart trading at a price-to-earnings multiple of nearly 40, which is far higher than its 10-year average.

WMT PE Ratio data by YCharts

Usually, for retail stocks such as Walmart, whose businesses are growing in the single digits, investors aren’t willing pay more than 30 times their trailing earnings, unless they are expecting significantly more growth ahead. However, that doesn’t look to be the case with Walmart; it’s forecasting between 3.75% and 4.75% full-year growth for its net sales for the current fiscal year (which ends in January).

Meanwhile, the company admits that it is facing rising costs due to tariffs and it may have to absorb some of the increases. Not only might the business’ margins suffer, but consumer demand may also diminish in future quarters if prices increase. This could lead to some underwhelming quarterly results in the months ahead.

Walmart could have even more problems to worry about

Another reason Walmart may encounter challenges is due to rising competition from Amazon, arguably its archrival at this point. Amazon recently announced that it is offering same-day grocery delivery in over 1,000 U.S. cities and its goal is to double that number by the end of the year. While Amazon’s grocery business hasn’t been a huge concern for Walmart in recent years, the tech giant is by no means giving up.

By offering same-day delivery options for groceries, that could be the move that puts Amazon head to head with Walmart in a key market, which could make it more challenging for the big-box retailer to not only grow its sales, but also its bottom line. And without strong earnings growth, Walmart’s already rich valuation could look much more expensive in the future.

Should you buy Walmart stock right now?

Walmart has a solid business that has generated nearly $700 billion in sales over the past 12 months. It’s a beast in retail and it isn’t going anywhere in the foreseeable future. Based on its strong fundamentals, it can remain a solid long-term investment.

That being said, investors should never ignore valuation because buying a stock at a high price can limit your gains from owning an investment, and it leaves little to no margin of safety. If you’re paying close to 40 times earnings for Walmart’s stock at a time when there’s growing economic uncertainty and when competition is also intensifying, that can result in a lot of pain, at least in the short term.

Given the high share price and downside risk that Walmart possesses right now, I think investors may be better off looking at cheaper growth stocks to buy.

David Jagielski has no position in any of the stocks mentioned. The Motley Fool has positions in and recommends Amazon and Walmart. The Motley Fool has a disclosure policy.