Investors should make sure they’re eligible for this ultra-high dividend.

Altria (MO 0.45%) is one of the world’s largest tobacco companies, with well-known brands under its umbrella that include Marlboro, Black & Mild, Parliament, Copenhagen, and Skoal. Although some investors may have reservations about investing in a tobacco company, those who do invest in the company typically do so for one reason: Its ultra-high-yield (and growing) dividend.

If you’re interested in investing in Altria, you might want to do so before Sept. 15, because that is its ex-dividend date. When it comes to stocks, a company’s ex-dividend date is the day by which an investor must own shares of the company to be eligible to receive its next dividend payout. In Altria’s case, owning the stock before Sept. 15 will ensure you receive the dividend payout scheduled for Oct. 10.

Image source: Getty Images.

One of the stock market’s top dividend stocks

When Altria recently announced that it was increasing its quarterly dividend to $1.06 per share (up from $1.02), it marked the company’s 56th consecutive year increasing its dividend, and the 60th total increase in that span. That track record of growth helped Altria earn the designation as a Dividend King.

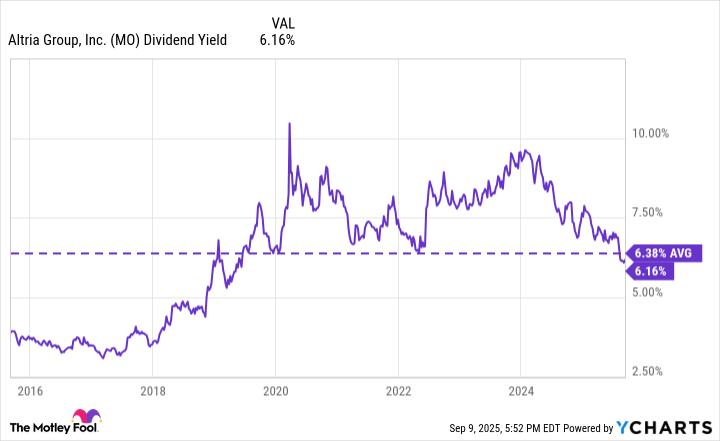

At the time of writing, Altria’s dividend yield is around 6.16%, which is slightly below its average over the past decade, but more than five times the S&P 500’s current average of 1.2%.

Data by YCharts.

While Altria’s appeal has long been its dividend, the stock has had an impressive 2025 so far, up 26%. I wouldn’t invest in the stock expecting these returns year in and year out, but if you’re looking for a company that can provide reliable dividend income, Altria is a good choice.

Stefon Walters has no position in any of the stocks mentioned. The Motley Fool has no position in any of the stocks mentioned. The Motley Fool has a disclosure policy.