- Bitcoin ETFs have attracted over $40 billion in lifetime inflows, setting a historic record as institutional investors continue pouring money into regulated crypto exposure.

- Standard Chartered’s head of digital assets apologized that their forecast of $120K for Q2 was considerably lower than it should have been.

- Bitcoin Pepe’s presale is gaining serious momentum with its end-of-month launch fast approaching, positioning it as potentially the best crypto to buy now before it brings lightning-fast trading to the Bitcoin ecosystem.

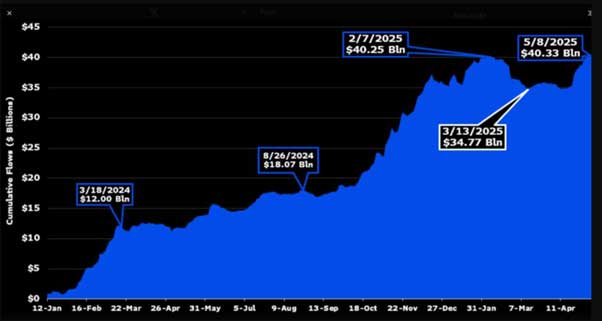

The institutional money flooding into Bitcoin right now is absolutely staggering. ETF inflows have just smashed through $40.33 billion, according to Bloomberg data shared by analyst James Seyffart, with May 8th alone setting records for single-day buying.

After yesterdays inflows, the spot Bitcoin ETFs are now at a new high water market for lifetime flows. Currently at $40.33 billion according to Bloomberg data h/t @EricBalchunas pic.twitter.com/0GKPNlmprs

— James Seyffart (@JSeyff) May 9, 2025

Above: Bitcoin ETF inflows are accelerating. Source: James Seyffart from Bloomberg.

Analysts are raising their price targets dramatically. Standard Chartered’s head of digital assets recently admitted to CNBC, “I apologize that my $120k Q2 target may be too low,” adding, “The dominant story for Bitcoin has changed again… It is now all about flows. And flows are coming in many forms.”

What’s most telling about ETF flows is their acceleration. It took nearly a year to reach $35 billion by March, but just two more months to add another $5 billion. That represents serious institutional capital positioning for what many believe will be a historic Bitcoin run.

Asset managers and hedge funds are finally embracing Bitcoin ETFs as their preferred vehicle for gaining exposure, which could lead to a domino effect.

We all know what FOMO is in the retail trading sector, but consider what would happen to crypto if some of the world’s leading financial institutions and sovereign wealth funds start to feel that they’re the ones missing out.

ETF Supercycle creates perfect conditions for Bitcoin infrastructure growth

Adoption of ETFs is not only driving up the price of Bitcoin, but it is also bringing about a significant transformation for the entire ecosystem. As institutional holdings grow, we’re seeing some key ripple effects that traders should keep their eyes on.

For example, look at what’s happening to Bitcoin’s circulating supply. With ETF providers now holding billions worth of BTC in cold storage, the amount of Bitcoin actually moving around the network is shrinking dramatically. This supply squeeze helps push prices higher, but it also intensifies the network’s existing bottlenecks. Fewer available coins mean even more congestion on an already cramped base layer.

Second, during the period when retail traders dominated, simply holding Bitcoin was sufficient, and there was little necessity for super-fast trading. Now, Bitcoin may reveal its limitations with transaction speeds of just seven TPS, thousands of times slower than Ethereum and Solana.

This dynamic creates a golden opportunity for layer 2 solutions built on Bitcoin. We saw exactly how the scenario played out with Ethereum—layer 2 networks rocketed in value by extending the chain’s functionality.

Bitcoin Pepe: Breaking Bitcoin’s Speed Barrier When It Matters Most

As Bitcoin investment rockets across the retail and institutional sectors, any solution that improves and extends its functionality will attract immense interest. Bitcoin Pepe is hitting the market at exactly the right moment, shattering BTC’s speed limitations.

Bitcoin Pepe works by creating a layer 2 solution on top of Bitcoin—an express lane built above the main highway. When you trade on Bitcoin Pepe, transactions are considerably quicker than on Bitcoin’s congested base layer.

The PEP-20 token standard is central, allowing people to create and trade tokens that are ultimately secured by Bitcoin but don’t suffer from its slow speeds. Transactions are bundled together and processed in batches; the final results are recorded on the main Bitcoin blockchain

Bitcoin Pepe is first focusing on meme trading—fun, viral trending crypto projects. It’s the perfect gateway to adoption for what is fundamentally a strong infrastructural add-on for Bitcoin.

The dev team recently opened up a generous staking program divided across three tiers: a 90-day quick option that still pays 75% APY, a stronger 120-day commitment delivering 250% APY, or the whale-sized 180-day package with its massive 10,000% APY (limited to just 1M tokens—about 0.05% of the total supply). These astronomical yields are designed to build strong community backing during the early stages.

$BPEP STAKING IS STILL LIVE!

Get ready to earn big with $BPEP staking! Whether you’re going for the Long Pool with 10,000% APY or the Medium and Small Pools, there are huge rewards waiting for you.

Long Pool: 10,000% APY

Medium Pool: 250% APY

Small Pool: 75%… pic.twitter.com/2cgdrBRyle

— Bitcoin Pepe (@BitcoinPepe_) May 11, 2025

Multiple tier-1 platforms are reportedly fast-tracking BPEP for immediate post-launch trading, creating the potential for explosive price discovery once the token goes live. With less than a month until launch, the current presale prices could soon look like a distant memory—making this final presale phase potentially the last chance to secure tokens before they hit the open market and face unlimited upside.

Among the best cryptos to buy now by a huge margin, Bitcoin Pepe is positioned to capitalize on the growing recognition that Bitcoin needs performance upgrades to match its soaring valuation.

Bitcoin’s ETF Momentum Creates Ideal Backdrop for Layer 2 Breakout

The Bitcoin ETF tsunami keeps smashing records daily. For those attempting to capitalize on Bitcoin’s probable ascent to $200K, the challenge lies not in deciding whether to invest but in identifying the optimal cryptocurrency to purchase at present, one that can yield substantial returns to surpass the potential returns of a basic ETF exposure.

Bitcoin Pepe offers something way more intriguing than vanilla Bitcoin funds. While institutional investors pile into ETFs for conservative gains, BPEP is targeting the massive potential that comes from fixing Bitcoin’s biggest flaw.

Bitcoin Pepe stands out due to its clear pitch and strict deadline. No endless fundraising, no moving goalposts—just “here’s what we’re building, here’s when it launches, get in now or miss it forever.”

As one of the most trending crypto projects in the Layer 2 space, it’s perfectly positioned to capitalize on Bitcoin’s success while solving its critical limitations. When this trending crypto hits exchanges with the full weight of a $2 trillion Bitcoin ecosystem behind it, today’s entry prices could look like prehistoric artifacts from a bygone era.

To learn more and to buy Bitcoin Pepe before the launch, check out the official website.

This article is for informational purposes only and does not provide financial advice. Cryptocurrencies are highly volatile, and the market can be unpredictable. Always perform thorough research before making any cryptocurrency-related decisions.