Despite a long history of returning value to shareholders, these two industry giants have traded lower over the past year — but it’s an opportunity for investors.

“Do you know the only thing that gives me pleasure? It’s to see my dividends coming in.”

– John D. Rockefeller

Rockefeller was onto something there: Receiving quarterly dividend payments is one of the most satisfying things for anyone looking to reinvest for the power of compounding.

These two dividend stocks offer investors not only a long history of consistent dividends (and increases), they also both have strong economic moats to help ensure financial growth over the long haul. Here’s why these two deserve income investors’ consideration.

Getting back to its higher-margin roots

The Canadian National Railway (CNI 1.99%) is a powerful company, driving the economy by transporting more than 300 million tons of natural resources, manufactured products, and finished goods throughout North America annually. It has nearly 20,000 miles of rail lines and related transportation services, connecting Canada’s East and West Coasts, and the Midwest, including a valuable route through Chicago and all the way to New Orleans.

What makes CN (as it’s known for short) a great dividend stock is an economic moat that’s based not only on its geographic reach but also on its extensive railroad infrastructure that’s nearly impossible to replicate. And it’s the primary and most significant rail operator for the Port of Prince Rupert in British Columbia, which contributes to its intermodal growth potential.

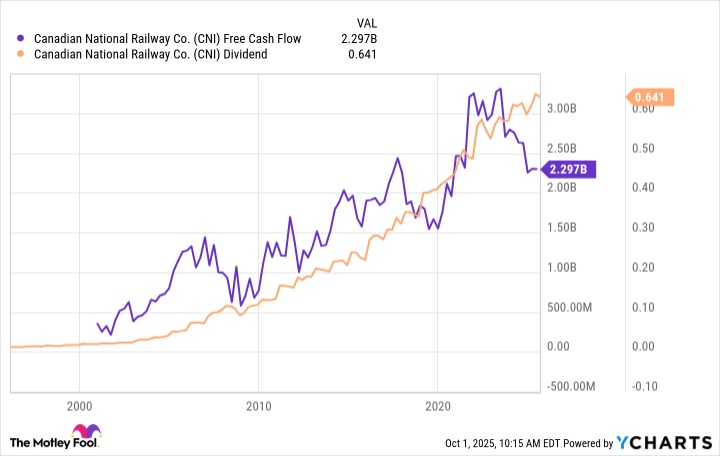

Those competitive advantages and its moat help the company continue to print cash, and in turn increase its dividend. The growth of both is obvious in the graph below.

CNI Free Cash Flow data by YCharts.

CN has closed the margin gap with competitors in recent years, after having led the industry in the early 2000s thanks to pioneering the practice of precision scheduled railroading (PSR). However, the father of PSR, Hunter Harrison, took his talents to competitors in 2009, and while his innovations still have their imprint on the business, the company needs to refocus on margins.

While that process develops, investors have a respectable dividend yield of 2.7% and a history of consistent increases.

A snack and beverage juggernaut

PepsiCo (PEP -0.24%) is a household name and global leader in snacks and beverages with brands including its namesake Pepsi, as well as Gatorade, Lay’s, Cheetos, and Doritos, among many others. The company dominates the global market for savory snacks and is the second-largest beverage provider, behind only Coca-Cola.

One factor in investors’ favor is the company’s diversification with exposure to carbonated soft drinks, water, sports and energy drinks, and convenience foods that generate roughly 55% of revenue. PepsiCo is truly global: International markets made up roughly 40% of both total sales and operating profits in 2024.

Image source: Getty Images.

This could prove to be a good time to pour a small investment into the company. The past few years of less than desirable growth — due to self-inflicted wounds and underinvesting in its marketing and brands — has left the stock trading lower over the past year. Management is working to reverse that and has steadied the top and bottom lines, so there should be room for improvement and a return to growth.

Not only does the demand for PepsiCo’s snacks and beverages remain resilient through economic cycles, but it also attracts investors with a healthy 4% dividend yield.

Are the stocks buys?

Over the past year, PepsiCo and CN have traded 17% and 19% lower, respectively. But a couple of missteps and headwinds won’t stop these two juggernauts for long because their competitive advantages are durable. PepsiCo is benefiting from the growth in its snack business and international expansion, while the Canadian National Railway is getting back to its roots and closing the margin gap with competitors, fueling its dividend in the future. Both warrant consideration for a small position for long-term investors looking for dividend income.

Daniel Miller has no position in any of the stocks mentioned. The Motley Fool recommends Canadian National Railway. The Motley Fool has a disclosure policy.