Sezzle delivered strong Q2 results, but investors were disappointed with its guidance.

Sezzle (SEZL -1.34%) saw its monster surge hit a wall last month as the breakout BNPL (buy now, pay later) company posted strong results in its second-quarter earnings report, but its guidance wasn’t quite enough to keep up the stock’s momentum. Management still expects a substantial deceleration in the second half of the year.

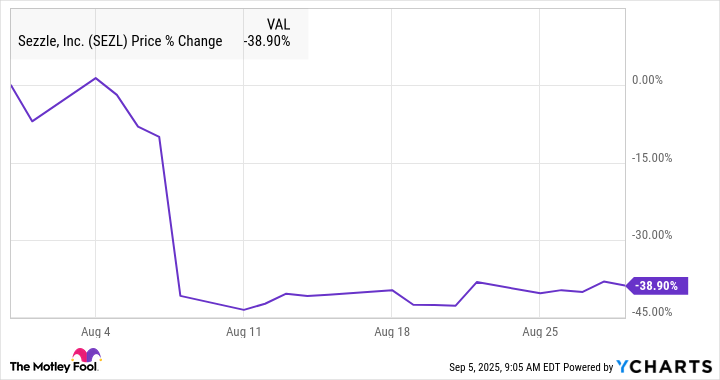

There was little else in the way of company-specific news last month, and the stock traded flat after the earnings plunge, finishing the month down 39%, according to S&P Global Market Intelligence.

You can see the stock’s performance over the course of the month below.

Is the Sezzle breakout over?

Sezzle continued to deliver blistering growth in the second quarter with revenue up 76.4% to $98.7 million, which topped estimates at $94.9 million. That was driven by strong on-demand growth, meaning consumers who use the BNPL product without a subscription, as well as its partnership with WebBank, which agreed to be its exclusive banking partner last year.

User growth was strong as well with monthly on-demand and subscribers (MODS) reaching 748,000, up from 658,000 in the first quarter, and it delivered impressive margin expansion as operating income jumped 116.1% to $36.1 million, and adjusted earnings per share was up 97% to $0.69, which beat the consensus at $0.58.

Sezzle’s growth seems to be driven by a combination of new products, its focus on subscribers, and broader adoption of BNPL, which has seen strong growth as consumer confidence has fallen over fears around tariffs and now a weakening job market.

Image source: Getty Images.

What’s next for Sezzle

Sezzle sees strong growth for the full year, but it may have been below investor expectations given the strong Q2 results. It also did not update its guidance from the first quarter, which was likely a disappointment to investors.

For the full year, the company sees revenue growth of 60% to 65%, though that implies a sharp slowdown after revenue essentially doubled in the first half of the year. It also called for adjusted earnings per share of $3.25, which is slightly below the consensus at $3.27.

Sezzle has delivered a remarkable performance over the past couple of years. The stock was trading at under $2 a share (split-adjusted) at the end of 2023.

While the company’s differentiated model has helped it build momentum, it’s understandable for the stock to cool off in response to slowing growth. Still, the valuation looks attractive now at a forward P/E under 30.

Jeremy Bowman has no position in any of the stocks mentioned. The Motley Fool has positions in and recommends Sezzle. The Motley Fool has a disclosure policy.