A new partnership with Waymo revved up Lyft stock last month.

Shares of Lyft (LYFT -2.21%) were moving higher last month after the No. 2 ride-hailing company took some significant steps in offering an autonomous vehicle service with two key partnerships.

Additionally, earlier momentum in the stock seemed to carry over to September as Wall Street’s perception of the business’s prospects has improved. Lyft earned a number of bullish notes and price target hikes last month in response to things like its acquisition of Freenow, improving financials, and innovative products like Lyft Silver.

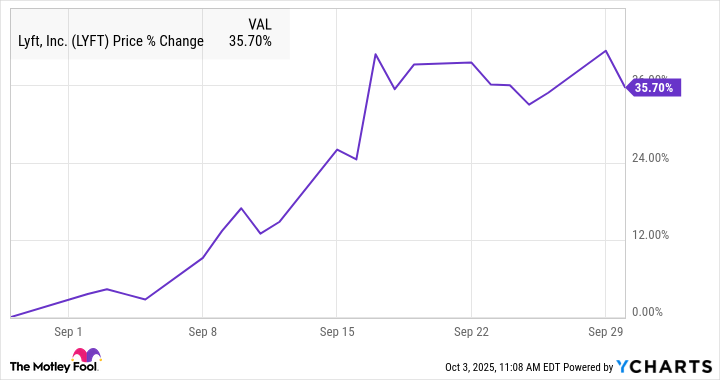

According to data from S&P Global Market Intelligence, the stock finished the month up 36%. As you can see from the chart below, shares surged in the first half of the month before levelling off later.

Lyft is going autonomous

The biggest piece of news on Lyft last month was a new partnership with Alphabet‘s Waymo, the leading autonomous vehicle platform, to launch an autonomous vehicle service in Nashville.

As part of the deal, Waymo will use Lyft’s fleet management service, Flexdrive, to handle vehicle maintenance, infrastructure, depot operations, and related services in Nashville. The service will launch exclusively on the Waymo app in 2026, but is expected to become available through the Lyft app later next year.

Lyft stock jumped 13% on the news on Sept. 17 as partnering with Waymo in Nashville could pave the way to a larger partnership. Shares of rival Uber, which has also teamed up with Waymo, fell on the news, as it shows Waymo is interested in working with both companies.

Earlier in the month, The Wall Street Journal reported that Lyft was teaming up with May Mobility to launch an autonomous vehicle service in Atlanta. May Mobility, a start-up based in Michigan, plans to start its minivan-based autonomous vehicle services with a small number of vehicles in a limited part of the city.

Image source: Lyft.

Can Lyft stock keep gaining?

The gains in September added to what’s already been a banner year for the ridesharing stock, which is up 73% so far this year as I write this.

Lyft is delivering solid growth and improved profitability, and initiatives like Flexdrive seem to have been overlooked by investors thus far. In Nashville, Lyft is building out a custom AV fleet management facility with charging and service capabilities. If it can do that successfully, there could be a long runway of growth in that business, especially if its partnership with Waymo expands.

The company still has a lot of ways it can grow and disrupt the broader transportation market. At a market cap of just $9 billion, there’s still a lot of upside potential for the stock.

Jeremy Bowman has no position in any of the stocks mentioned. The Motley Fool has positions in and recommends Alphabet and Uber Technologies. The Motley Fool recommends Lyft. The Motley Fool has a disclosure policy.