Shares of the cloud software stock pulled back after an initial pop.

After skyrocketing on its opening day of trading on July 31, Figma (FIG 1.14%) gave back some of those early gains last month as the software stock searched for equilibrium following the year’s biggest initial public offering (IPO).

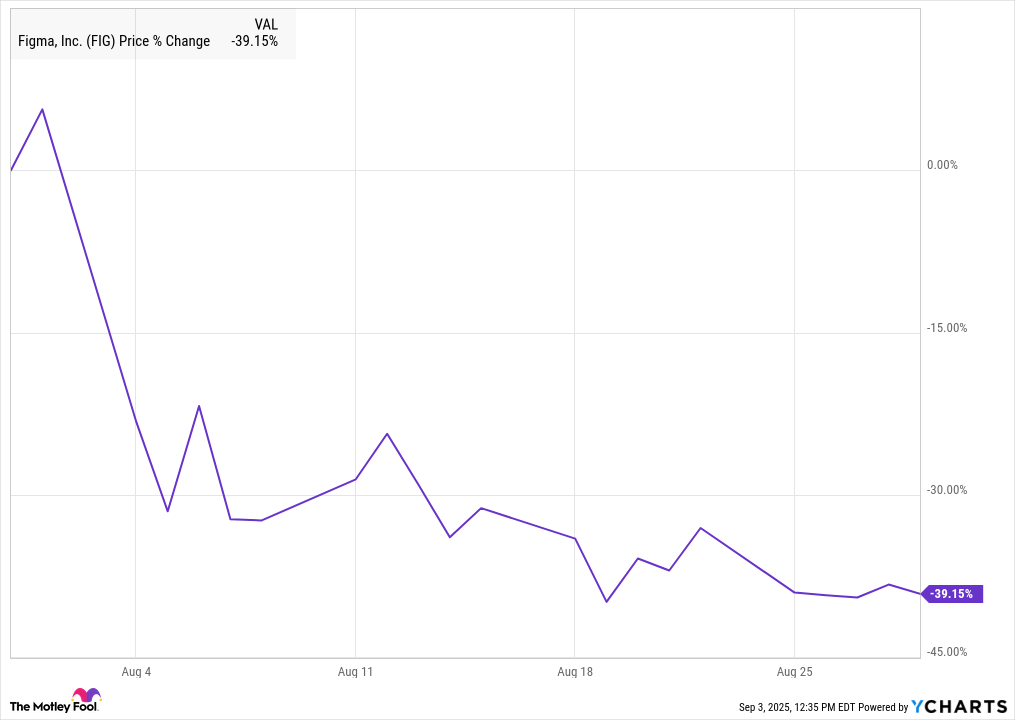

According to data from S&P Global Market Intelligence, the stock finished the month down 39%. As you can see from the chart below, it tumbled early in the month as it pulled back from the initial frenzy, and shares traded mostly flat over the duration of the month after it fell.

Figma gets its feet wet

IPO stocks tend to be volatile, so it’s no surprise to see Figma fall sharply after the stock more than tripled on its opening day, going from an IPO price of $33 to closing at $115 a share.

The stock jumped again the following day, Aug. 1, hitting a peak at $142.92, before pulling back on Aug. 4 as IPO buyers took profits.

Trading volume faded over the course of the month as the stock gradually declined, finally stabilizing in the last week of August.

There was little company-specific news on Figma last month, coming directly after its IPO, but a number of Wall Street analysts did weigh in on the stock, giving it mostly hold-equivalent ratings, though there were a couple of buy ratings in the mix.

Piper Sandler, for example, rated it overweight with a price target of $85, crediting its “differentiated” platform and “attractive” business model. Others were more skeptical of the company’s valuation, including Goldman Sachs, which said there is limited visibility into its momentum and revenue growth.

Image source: Getty Images.

What’s next for Figma

The cloud software specialist will deliver its first report as a publicly traded company after hours today, and the stock is likely to move on the news.

The Wall Street consensus calls for revenue of $248.7 million, up 40.3% from the quarter a year ago. On the bottom line, the company expects $0.08 in earnings per share.

Even after last month’s pullback, Figma stock remains expensive, trading at a price-to-sales ratio of 36, though the company is growing rapidly, delivering a profit, and has a stamp of approval from Adobe, whose earlier $20 billion acquisition of the company was blocked.

While its valuation should act as a headwind, at least in the near term, the future looks bright for Figma.

Jeremy Bowman has no position in any of the stocks mentioned. The Motley Fool has positions in and recommends Adobe and Goldman Sachs Group. The Motley Fool has a disclosure policy.