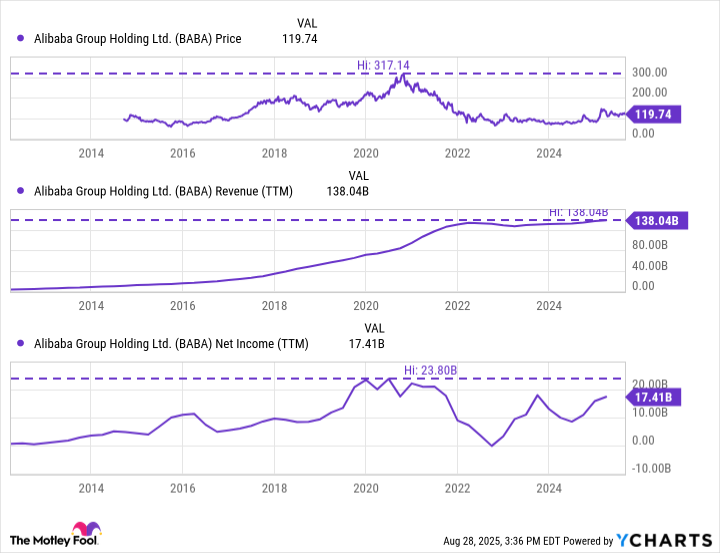

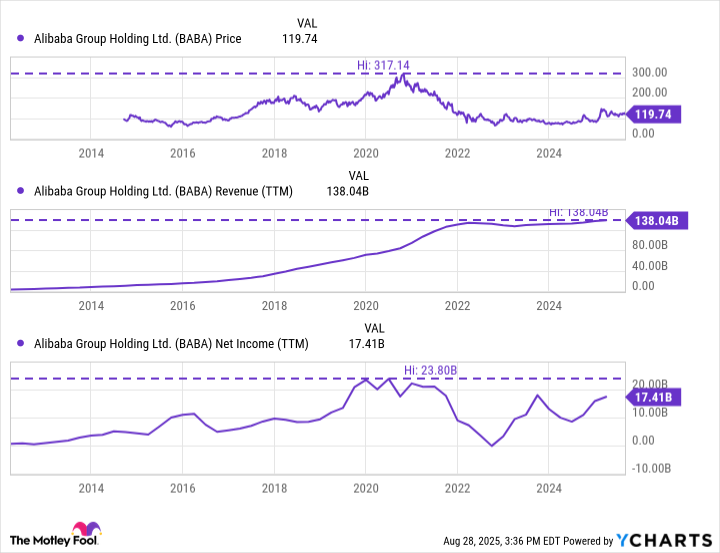

Alibaba’s stock price has suffered even as sales growth continues.

It’s been a tough few years for Alibaba Group (BABA 0.54%) investors. Shares have heavily underperformed the market since 2020. Yet sales have continued to rise. Looking back at the company’s financial history reveals a peculiar picture. It’s not hard to see why some investors think this former growth darling is now a value stock.

Not everything peaked in 2020 for Alibaba

During the COVID-19 pandemic’s height, e-commerce sales spiked, directly benefiting the sales and net income for major retailers like Alibaba. That year, for example, the company generated a staggering $74 billion in sales during its Singles Day event — nearly double the $38 billion brought in the year before.

In the years that followed, however, the company faced antitrust investigations, leading to a $2.8 billion fine. Meanwhile, outspoken founder Jack Ma garnered increased scrutiny from regulators and Chinese party officials.

While growth since 2020 has undoubtedly been tepid, Alibaba’s sales have continued to grow. Its net income is only 26% below its 2020 highs. The stock price, meanwhile, is more than 60% below its pandemic highs. That has brought the company’s price-to-earnings ratio down to just 15.6 — roughly half what the S&P 500 trades at overall.

Image source: Getty Images.

What’s the future for Alibaba? Sales are expected to grow by 6% this year, with another 8% growth expected the following year. Earnings per share, meanwhile, are expected to hit $62.47 this year, growing to $75.19 next year. Clearly, analysts remain fairly optimistic about the company’s financial situation.

After Alibaba’s stock price peaked in 2020, the company’s growth prospects reset sharply. But with shares trading at just 15.6 times earnings despite expectations for rising sales and earnings, shares seem appealing for contrarian investors looking to add beaten-down stocks to their portfolio.

Ryan Vanzo has no position in any of the stocks mentioned. The Motley Fool recommends Alibaba Group. The Motley Fool has a disclosure policy.