Nvidia’s revenue is highly dependent on just a few key customers, and if any of them pull back on spending, that could heavily impact its growth rate.

Nvidia (NVDA 3.52%) is the most valuable company in the world, with a valuation of $4.1 trillion. Its performance in recent years has been remarkable, with Nvidia still generating over 50% revenue growth in recent quarters — and that’s considered a slowdown for the tech giant.

But when a stock’s valuation reaches such significant proportions, that also means expectations are high. If the company falls short of them, the stock could be vulnerable to a serious correction, especially as investors who are up big may be looking for any signs that it may be approaching a peak, as that could be an opportunity to cash out and lock in as large of a gain as possible.

The problem with Nvidia’s stock is that if there are any notable headwinds or slowdowns in the tech sector, then it could be among the first to endure a big drop in value. And that’s because its revenue isn’t all that diversified.

Image source: Getty Images.

The vast majority of Nvidia’s revenue comes from just six customers

Nvidia has multiple segments that it generates revenue from, including automotive, gaming, professional visualization, and data centers. But its main income source right now is its data center business, which accounted for 88% of the $46.7 billion in revenue it posted in its most recent period, which ended on July 27.

What’s most concerning, however, is the customer concentration risk in that segment. Nvidia’s AI chips aren’t cheap, and it’s primarily the big tech companies that can afford to spend significantly on them. Companies disclose when customers account for a big slice of revenue, and Nvidia says that its two largest customers, which it refers to as just Customer A and Customer B, represented 23% and 16% of revenue for the past quarter, respectively.

But that’s not all. It also noted that there were four direct customers that each made up 10% or more of its quarterly sales. In total, approximately 85% of its revenue was attributable to just six customers. While specific names weren’t mentioned, my guess is that its key customers are big hyperscalers, with the majority of them potentially among the “Magnificent Seven.”

The problem is clear: if there’s a slowdown in AI-related spending, Nvidia’s growth rate could quickly unravel given its exposure to just six customers.

Nvidia’s valuation has come down, but it remains high

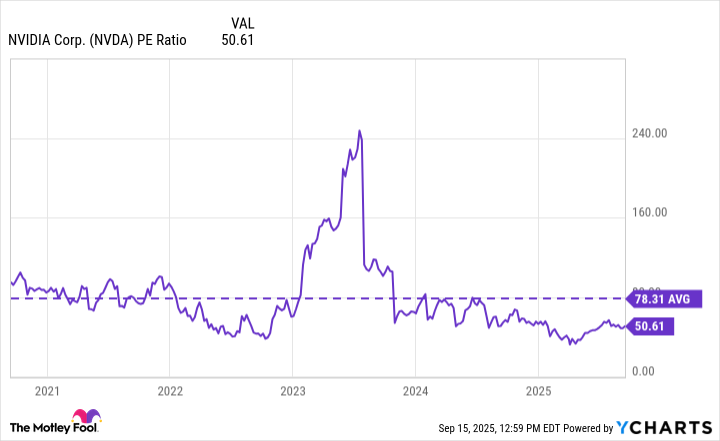

Currently, Nvidia’s stock trades at a price-to-earnings multiple of more than 50. Although that premium has come down over the past year and it’s below its five-year average, that’s still a high price to be paying for the AI stock.

Data by YCharts.

Both Nvidia’s sales and profits were up over 50% last quarter, but that hasn’t been enough to give the stock much of a boost. Over the past month, the stock has declined in value by nearly 6% (as of Sept. 17). There could be some resistance from investors to price the stock much higher than where it is right now, given the risks related to the overall economy, its fragility, and the potential for a slowdown in AI spending in the future.

Is Nvidia stock still a good buy?

In just five years, Nvidia has generated life-changing returns of nearly 1,300% for investors. But now with its market cap up around $4.3 trillion, the inevitable questions come up of how much higher it can possibly go. It’s no longer chasing any other stock — it has already become the most valuable company in the world.

I think Nvidia has a fantastic business, and it commands impressive margins, and there’s potentially much more growth out there in the long run due to AI. If you’re looking at holding onto the stock for at least the next five years, then Nvidia can still be a good investment, but I would suggest bracing for the possibility of at least a modest pullback in the near future.

David Jagielski has no position in any of the stocks mentioned. The Motley Fool has positions in and recommends Nvidia. The Motley Fool has a disclosure policy.