Impinj’s P/E ratio of 695 looks absurd at first glance. These surging metrics in a tough market environment tell a different story.

Many investors don’t give Impinj (PI 4.59%) a second look nowadays. It’s easy to gloss over this technology stock when you see a trailing price-to-earnings ratio (P/E) of 695 and a price-to-sales ratio (P/S) just below 15. The company’s RFID tagging technology may be crucial to inventory management and shipping services in this digital era, but that’s still a downright offensive valuation.

Yet analysts agree that Impinj’s stock is a solid buy, and their average price target is roughly in line with current share prices. How is that possible, when Impinj’s valuation could result in nosebleeds and acrophobia?

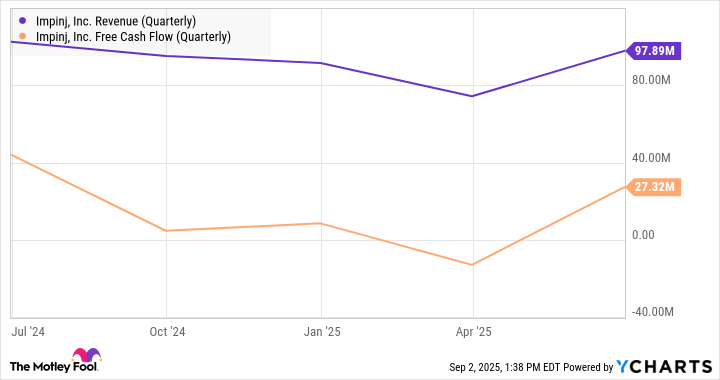

This chart can clarify the situation, and maybe even change your mind about Impinj’s lofty stock price:

PI Revenue (Quarterly) data by YCharts

Impinj’s sales and free cash flows are soaring right now — despite weak results in the company’s core target markets. Many retailers and shipping specialists are reporting soft or even negative revenue growth and sliding cash flows in this economy. Yet, Impinj is enjoying robust order growth and record-level gross margins right now.

And this looks like the start of a golden age for Impinj. Management set optimistic growth targets for the next quarter and next year, based on strong demand for RFID tags and data management systems.

Image source: Getty Images.

What’s next for Impinj?

In other words, Impinj is breaking through to a new era of consistently positive earnings, for the simple reason that its main customers absolutely require tighter operations nowadays. Accurate and flexible unit-tracking tools are more valuable than ever.

And the incredibly high valuation ratios should subside as Impinj continues to tell this thrilling growth story. P/E ratios can look weird when a bottom-line improvement is passing by the breakeven level, as Impinj’s trailing earnings are doing now. Those headline-writing ratios should look a lot less scary in 2026 and beyond.