Is This New York-Based Company a Solid Long-Term Buy?

Investors looking for a low-risk stock with a great dividend have a good opportunity here.

Just across Long Island Sound from Long Island itself sits Purchase, NY, home of consumer-packaged goods giant PepsiCo (PEP 0.80%). The business began with a single beverage — Pepsi-Cola — in the small coastal town of New Bern, NC. But a bankruptcy saw the brand change hands, ultimately landing it with a business in New York, the state it’s still headquartered in today.

Since relocating to its current headquarters in Purchase, NY in 1970, PepsiCo has undergone a radical transformation. It’s an international powerhouse in the consumer-packaged goods space with dozens of beverage brands as well as food brands. And recent financial results underscore why this is still a solid stock to buy for the long term.

Image source: PepsiCo.

Pepsi’s rock-solid business

Pepsi stock is down about 23% from the all-time high it reached two years ago. Investors have soured on this stock because sales volume is under pressure. Investors consequently speculate that perhaps consumers are trading down to cheaper brands, that consumers are choosing healthier options, or that weight-loss drugs are suppressing appetites.

However, Pepsi is more resilient than investors give it credit for. On Oct. 9, the company reported financial results for its fiscal third quarter of 2025. Sales volume did decline by 1% for both beverages and convenient foods. And the decline was even more pronounced in North America. But the headline numbers didn’t tell the whole story.

Pepsi is actively reshaping its portfolio of beverage brands. One example is selling Rockstar Energy to Celsius. But another example is transitioning its case pack water business to a third-party partner. Changes such as these impact quarterly sales volume.

By simply adjusting results for the change to the water business, Pepsi’s beverage volumes in North America grew in Q3 — that’s a big deal. It suggest that the company is getting some positive traction in a core market with core products.

Sales in North America have been challenged for a while now. But Pepsi’s business was never in dire straights. This is because sales volume for food and beverages has continued rising in both Latin America and Asia.

This is the benefit of being a large, diversified business. Even if one part of Pepsi’s business is facing headwinds, chances are that other parts of the business are able to pick up the slack.

Is Pepsi stock a good long-term buy?

I believe that Pepsi stock is a good long-term buy, but I should clarify what I mean by that. I don’t believe that this will be among the top-10 stocks over the next decade or anywhere close to that. Those stocks will probably be up-and-coming businesses experiencing a lot of growth. And with over $90 billion in trailing-12-month revenue, it’s unrealistic to expect Pepsi’s business to be high growth.

But I believe Pepsi stock will make investors money over the long term with relatively little risk. Even if consumer tastes and preferences are shifting, the company operates a portfolio that it can adjust. As one example, Pepsi acquired prebiotic soda brand Poppi for nearly $2 billion, and it can use this new business to build more products that are aligned with trending preferences.

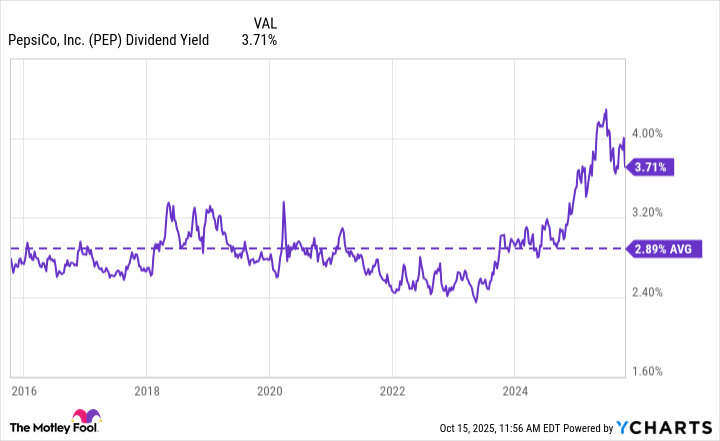

Moreover, Pepsi is a Dividend King, having paid and increased its dividend for 53 consecutive years now. This is a streak that it’s not going to give up on easily. And thanks to the pullback in the stock price, dividend investors can lock in at nearly an all-time high dividend yield, boosting returns from here.

PEP Dividend Yield data by YCharts.

Yes, Pepsi may be headquartered in New York. But this company is much more than the Pepsi brand, and it’s much bigger than the Empire State. It’s a profitable global business with a diversified portfolio that can adapt to changes in the consumer landscape.

Therefore, Pepsi stock is a solid long-term buy in my view and a good addition to a diversified portfolio of stocks.

Jon Quast has positions in Celsius. The Motley Fool has positions in and recommends Celsius. The Motley Fool has a disclosure policy.