A new artificial intelligence (AI) trend could boost the stock price for one of August’s losers.

August is over, and September is here. But many investors are fearful because of the so-called “September Effect.” It turns out that September is historically the worst month for the S&P 500 (^GSPC -0.32%), with stocks often going down more often than they go up.

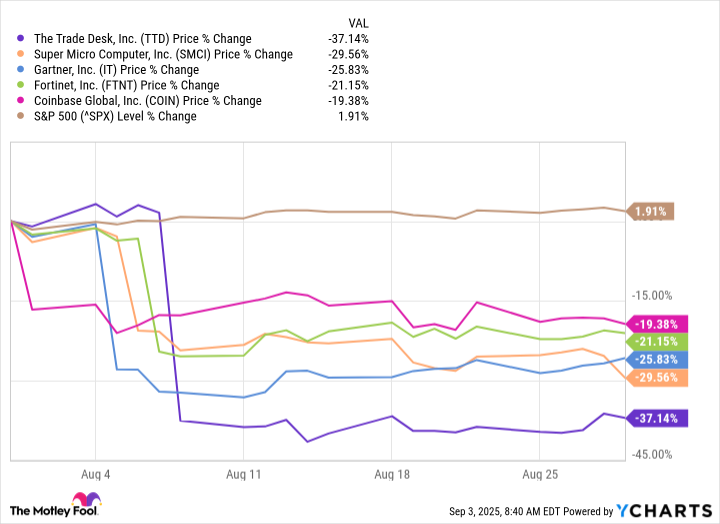

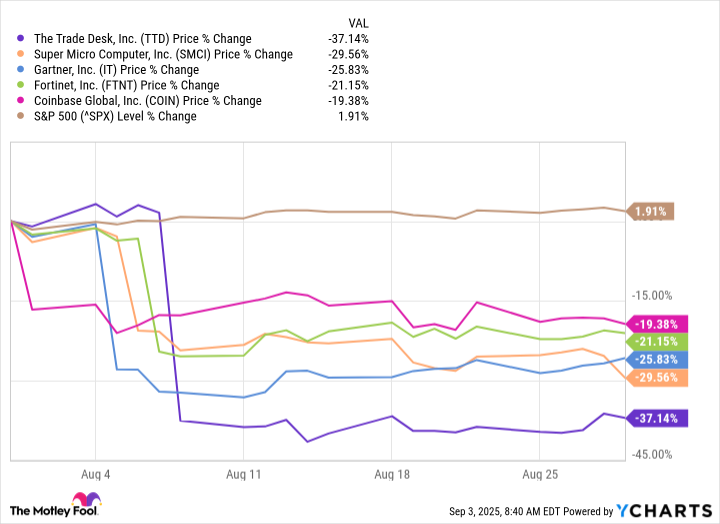

However, I’m sure that investors in The Trade Desk (TTD 0.23%), Super Micro Computer (SMCI -0.76%), Gartner (IT 3.83%), Fortinet (FTNT 3.06%), and Coinbase (COIN -2.49%) welcome September anyway. That’s because these five stocks were the five worst performers in the S&P 500 during August, dropping between 19% and 37% during the month.

Data by YCharts.

As the chart shows, all of these stocks dropped sharply early in August. But the drops happened on different days, suggesting that each stock was down for unique reasons.

Considering these businesses range from adtech to cryptocurrency to cybersecurity, it makes sense that all five are down for their own reasons. And that’s why I want to explore why each stock fell in August, as well as which of the five might be the most opportunistic buying opportunity today.

Image source: Getty Images.

Why these five stocks lost ground in August

All five of these stocks were down for unique reasons, yes. But they did all share one thing in common: The drops came right after each company reported quarterly financial results.

The Trade Desk

On Aug. 7, The Trade Desk disappointed investors with its financial guidance for the third quarter of 2025, only calling for 14% revenue growth — its slowest growth rate as a publicly traded company, outside the pandemic. And at the same time, the company abruptly changed its chief financial officer (CFO), which particularly unsettled investors in light of its lackluster outlook.

Super Micro Computer

On Aug. 5, Supermicro reported its completed fiscal 2025 financial results. Its fiscal 2025 net sales were up by 47% year over year, which was good. But its gross margin dropped to 9.5% in the fourth quarter — its lowest ever as a publicly traded company. So while its net sales are going up, profits aren’t up as much as investors would like to see.

Gartner

The business insights company reported financial results for the second quarter of 2025 on Aug. 5, beating expectations on the top and bottom lines. But the stock fell because management only expects 2% growth for the entire year, which is pretty meager and leads investors to believe that there’s little upside potential with this investment.

Fortinet

Gartner recognizes Fortinet as a leader in cybersecurity, but its stock plunged in August nevertheless. One of the company’s main products is firewalls, and when it reported second-quarter results on Aug. 6, management mentioned a refresh cycle.

In short, analysts are worried about the company’s growth, considering it’s already about halfway done with refresh for 2026, and 2027 is looking particularly slow. The refresh cycle was so heavy on investors’ minds that management even had a special call in which it tried to downplay any weakness in its refresh cycle, but it did little to relieve nervous investors.

Coinbase

On July 31, Coinbase reported financial results for the second quarter of 2025, showing that revenue was down and expenses were up. The big issue is that the company’s transaction revenue — what it makes when its users buy and sell cryptocurrency — is dropping sharply, leading management to expect a big year-over-year drop in revenue for the upcoming third quarter. This obviously isn’t what investors wanted to see, and the stock consequently fell.

With all of this now out of the way, which of these stocks is the best buy as September gets going?

Why AI might be the difference maker here

Coinbase may be the most vulnerable here. The cryptocurrency space goes into bear markets every few years on average, and it’s about due for a new one. The company’s transaction tends to suggest that a “crypto winter” may be just around the corner.

Of the remaining four stocks, I don’t think investors with a long-term view can go wrong. Gartner expects low growth, but it’s still a reliable business, and the valuation is cheap. Fortinet is experiencing a normal refresh cycle, and cybersecurity remains a big need. And The Trade Desk has been so reliable for years that it’s premature to assume that its best days are behind it.

However, Super Micro Computer stock may be the opportunity with the most upside of these five.

First, Supermicro clearly doesn’t have a growth problem. Demand for its servers and storage solutions are popular with companies building infrastructure for artificial intelligence (AI), as evidenced by its 47% top-line growth in its fiscal 2025. And management expects at least 50% additional top-line growth in fiscal 2026, showing that demand isn’t slowing.

Moreover, Supermicro stock is cheap at just 24 times its earnings. That’s cheaper than the average for the S&P 500, even though its growth is far above average. This could limit the downside of this investment.

Therefore, the investment thesis for Supermicro hinges on whether its gross margin can improve. If it can, then expect its profits to skyrocket far faster than its already torrid revenue growth. That would likely be rocket fuel for the stock.

For its part, Supermicro’s management believes this is possible. Countries are looking into building their own AI infrastructures, known as sovereign AI. The company has products to address this trend, which could boost its gross margin. Management is expecting gross margins to recover to 15%-16% long term.

It’s not a sure thing. But even modest gross-margin improvement would radically change the trajectory of Supermicro’s profits and, by extension, its stock price. This is why I believe Supermicro is one to take a look at here in September, considering it went on sale in August.