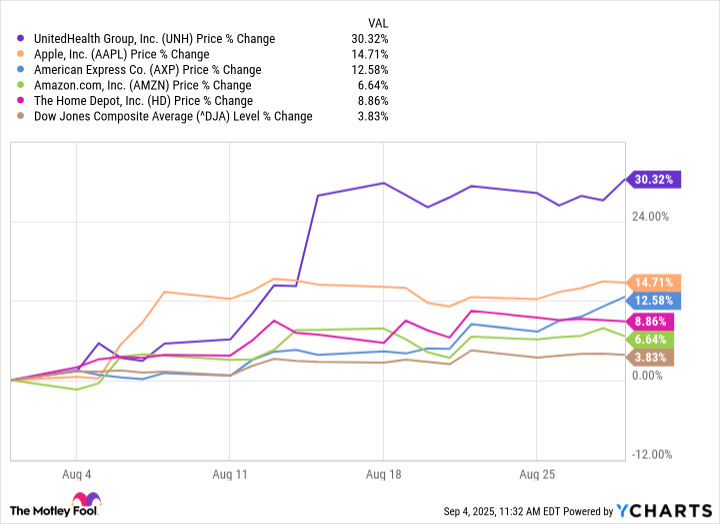

These Were the 3 Top-Performing Stocks in the S&P 500 in August 2025

Which S&P 500 stocks soared while the broader market barely budged in August 2025? The surprising winners had almost nothing in common.

The stock market trended higher in August. The popular S&P 500 (^GSPC -0.05%) index gained 1.9% last month. As of September 10, it has seen a total return of 20.6% in 52 weeks.

The top three performers among the 503 S&P 500 components took very different routes to the top. Let’s take a quick look.

1. UnitedHealth, up 24.2%

Health insurance giant UnitedHealth Group (UNH -0.31%) had three things working in its favor last month:

- The stock dropped after reporting weak Q2 results near the end of July. It’s mathematically easier to post big gains after a dip like that.

- The long-suffering acquisition of home healthcare specialist Amedisys finally closed. The $3.3 billion deal was proposed in the summer of 2023, following a process that included lawsuits and substantial concessions to secure the final approval.

- Above all else, Warren Buffett’s Berkshire Hathaway (BRK.A -0.55%) (BRK.B -0.59%) disclosed owning 5 million UnitedHealth shares. It’s an entirely new position and investors celebrated Berkshire’s cash-powered seal of approval.

2. Intel, up 23%

Intel (INTC -2.09%) followed a similar stock-chart trajectory but for strange reasons. The Trump administration will buy $8.9 billion of Intel stock.

The U.S. government will hold a 9.9% ownership interest in Intel, with a warrants-based option to purchase another 5% of the stock under certain circumstances.

3. Newmont, up 19.8%

Gold miner Newmont (NEM -0.50%) rounds out this trio. Gold prices have been rising all year long, currently soaring near all-time highs. The average gold price rose 4.8% in August.

Newmont wasn’t alone in this surge. Fellow gold miners Coeur Mining (CDE 1.04%), Gold Fields (GFI -0.06%), and Iamgold (IAG 1.27%) outperformed Newmont in August, gaining 37.4% (Gold Fields) to 51.3% (Coeur).

Image source: Getty Images.

Shaky macroeconomics often result in rising gold prices, as investors flock to safer asset classes. That’s what’s going on in 2025, too.

However, Newmont is the only gold stock in the S&P 500, so its rivals don’t qualify for this particular list. Otherwise, all the names mentioned above would have ranked lower — including Newmont.

Anders Bylund has positions in Intel and UnitedHealth Group. The Motley Fool has positions in and recommends Berkshire Hathaway and Intel. The Motley Fool recommends UnitedHealth Group and recommends the following options: short August 2025 $24 calls on Intel and short November 2025 $21 puts on Intel. The Motley Fool has a disclosure policy.