ASEAN kicks off summits with China, Gulf states amid US tariff threat | News

Southeast Asian leaders are set to hold their first ever summit with China and the six-member Gulf Cooperation Council (GCC), as they seek to insulate their trade-dependent economies from the effect of steep tariffs from the United States.

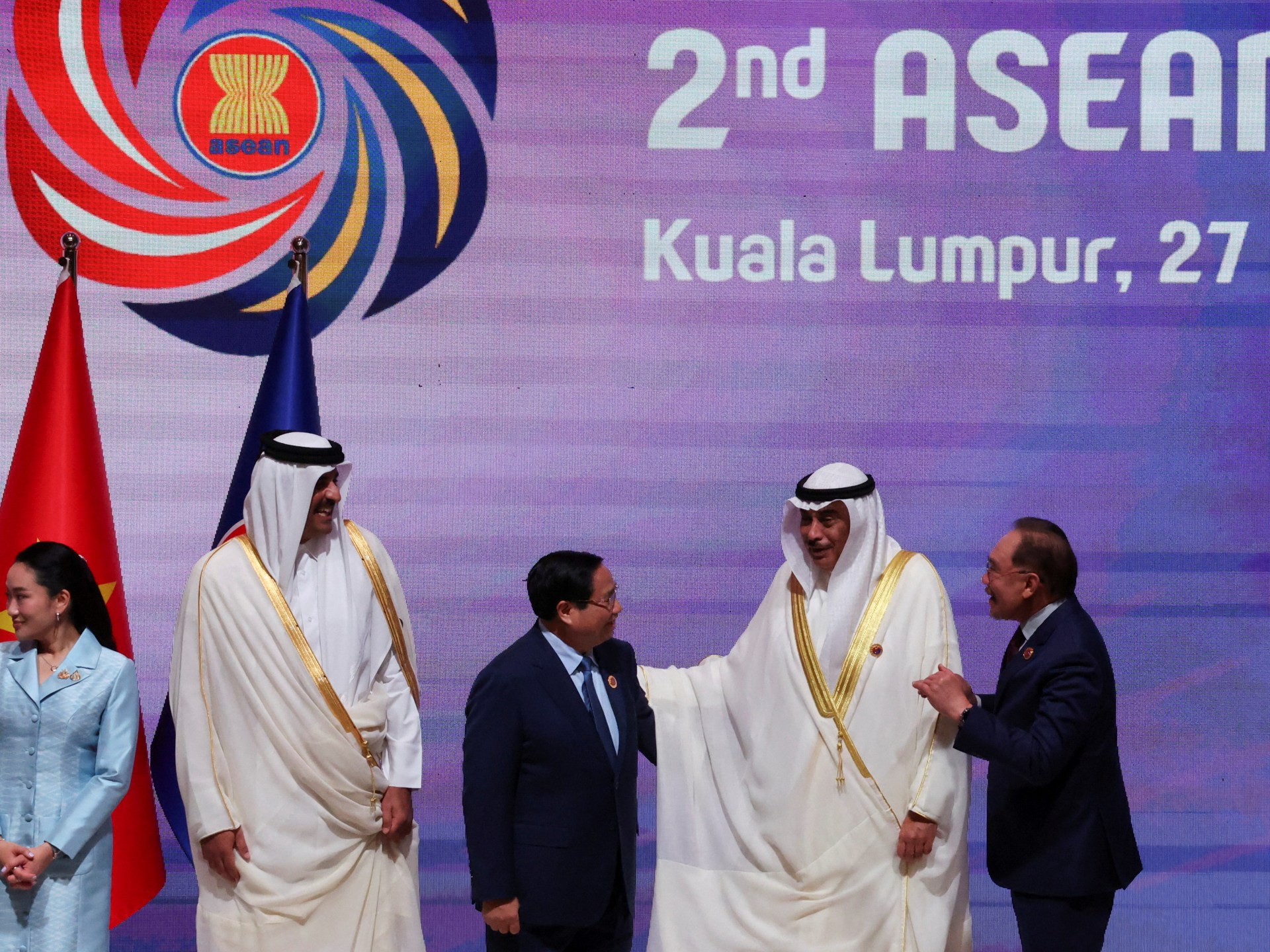

The meeting, in the Malaysian capital, Kuala Lumpur, is taking place on Tuesday, on the second day of the annual summit of the 10-member Association of Southeast Asian Nations (ASEAN).

It follows separate talks between leaders of the ASEAN and the GCC, which comprises of Bahrain, Kuwait, Oman, Qatar, Saudi Arabia and the United Arab Emirates.

Malaysian Prime Minister Anwar Ibrahim, opening the ASEAN-GCC summit, said stronger ties between the two blocs would be key to enhancing interregional collaboration, building resilience and securing sustainable prosperity.

“I believe the ASEAN-GCC partnership has never been more important than it is today, as we navigate an increasingly complex global landscape marked by economic uncertainty and geopolitical challenges,” Anwar said.

Malaysia is the current chair of ASEAN, which also includes Brunei, Cambodia, Laos, Myanmar, the Philippines, Singapore, Thailand and Vietnam.

In written remarks before the meetings, Anwar said “a transition in the geopolitical order is underway” and that “the global trading system is under further strain, with the recent imposition of US unilateral tariffs.”

With protectionism surging, the world is also bearing witness to “multilateralism breaking apart at the seams”, he added.

China calls for stronger ties

China’s Premier Li Qiang, who arrived in Kuala Lumpur on Monday, will join ASEAN and the GCC in their first such meeting on Tuesday. He met with Anwar on Monday and called for expanded trade and investment ties between Beijing, ASEAN and the GCC.

“At a time when unilateralism and protectionism are on the rise and world economic growth is sluggish,” Li said, China, ASEAN and GCC countries “should strengthen coordination and cooperation and jointly uphold open regionalism and true multilateralism”.

China is willing to work with Malaysia to “promote closer economic cooperation among the three parties” and respond to global challenges, Li told Anwar.

ASEAN has maintained a policy of neutrality, engaging both Beijing and Washington, but US President Donald Trump’s threats of sweeping tariffs came as a blow.

Six of the bloc’s members were among the worst hit, with tariffs between 32 percent and 49 percent.

Trump announced a 90-day pause on tariffs in April for most of the world, and this month struck a similar deal with key rival China, easing trade war tensions.

Al Jazeera’s Rob McBride, reporting from Kuala Lumpur, said ASEAN members are “very much looking at building ties with other parts of the world, in particular China, but also the Middle East” to strengthen their economic resilience.

“A measure of the importance that the GCC is also placing on this meeting is the delegation that has been sent here and the seniority of its members,” he added. “The Emir of Qatar, Sheikh Tamim bin Hamad Al Thani, is here, and we have crown princes from Kuwait and also Bahrain. We also have a deputy prime minister from Oman.”

Anwar said Monday he had also written to Trump to request an ASEAN-US summit this year, showing “we observe seriously the spirit of centrality.” However, his Foreign Minister Mohamad Hasan said Washington had not yet responded.

‘Timely, calculated’

ASEAN has traditionally served as “a middleman of sorts” between developed economies like the US and China, said Chong Ja Ian from the National University of Singapore (NUS).

“Given the uncertainty and unpredictability associated with economic relations with the United States, ASEAN member states are looking to diversify,” he told the AFP news agency.

“Facilitating exchanges between the Gulf and People’s Republic of China is one aspect of this diversification.”

Malaysia, which opened the bloc’s 46th summit on Monday, is the main force behind the initiative, he said.

China, which has suffered the brunt of Trump’s tariffs, is also looking to shore up its other markets.

Premier Li’s participation is “both timely and calculated”, Khoo Ying Hooi from the University of Malaya told AFP.

“China sees an opportunity here to reinforce its image as a reliable economic partner, especially in the face of Western decoupling efforts.”

Beijing and Washington engaged in an escalating flurry of tit-for-tat levies until a meeting in Switzerland saw an agreement to slash them for 90 days.

Chinese goods still face higher tariffs than most, though.