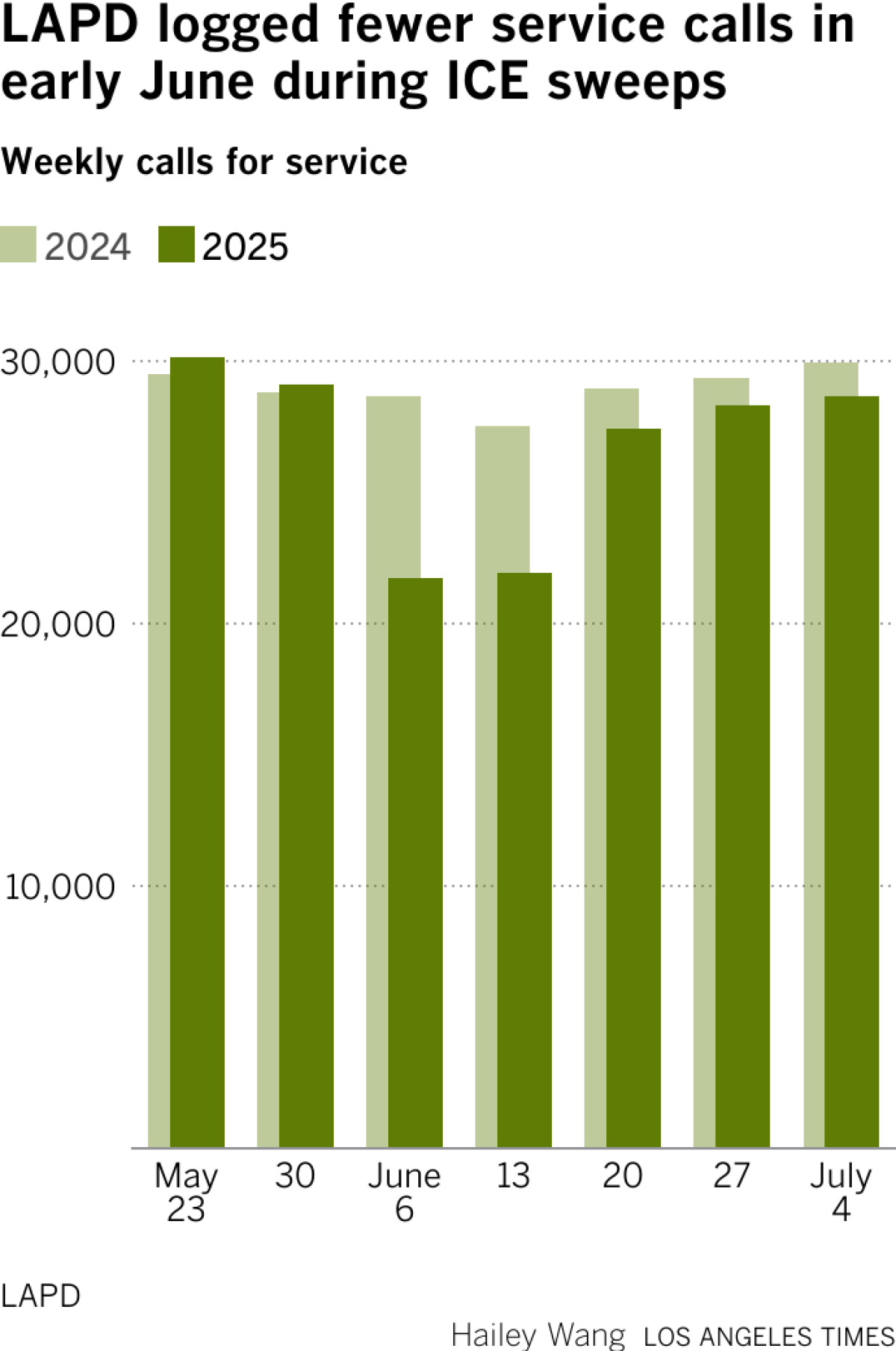

At the same time that federal immigration enforcement ramped up across the Los Angeles area this summer, calls for help to local police plummeted.

Emergency dispatch data reviewed by The Times show a major decrease in LAPD calls for service in June, during the weeks when sweeps by U.S. Immigration and Customs Enforcement and other federal agencies were met by large street protests in downtown Los Angeles.

In a city where roughly a third of the population is foreign-born, the steep decline in calls adds to long-standing concerns from advocates that aggressive immigration enforcement leads to domestic abuse and other crimes going unreported because victims fear triggering deportations.

In the two weeks after June 6, when the immigration raids kicked off, LAPD calls for service fell 28% compared with the same period last year — an average of roughly 1,200 fewer calls per day.

LAPD officers responded to roughly 44,000 calls for service in that two-week span — versus nearly 61,000 calls during the same days in June 2024.

The calls include reports of serious crimes, such as home break-ins and domestic disputes, along with instances when the public has sought help with noisy neighbors, loud parties and other routine matters.

The data analyzed by The Times do not include all 911 calls — only LAPD calls for service, which are typically registered when a squad car is dispatched. Though multiple people may call 911 in connection with a single incident, in most cases only one LAPD call for service is recorded.

The decrease was especially noticeable for LAPD calls responding to suspected domestic violence and other incidents related to family disputes, which fell this year by 7% and 16%, respectively, after the ICE activity increased. Although family-related calls later began to creep back to 2024 levels, those for domestic incidents kept declining.

National experts said the findings reflect a crisis of public confidence that has followed other controversial incidents. Similar downturns in calls to local police occurred during the first Trump administration, after the 2020 murder of George Floyd in Minneapolis and following the fatal shooting six years earlier of Michael Brown, a Black 18-year-old, in Ferguson, Mo.

It’s hardly surprising that the same thing could happen even in a city where the police force is majority Latino and whose leaders have reaffirmed the city as a sanctuary for immigrants, said Vida Johnson, an associate law professor at Georgetown University.

“You’re going to see fear of law enforcement that is going to last generations,” Johnson said. “And that has the biggest impact on women, because women often are more likely to be victimized, and then more afraid to call for help than men.”

At least some of the decline during the initial two-week period can be explained in part by LAPD going on citywide tactical alert, which allowed the department to have more officers and resources at the ready to deploy to the front lines of the protests. During that time, the department prioritized responding to serious crimes such as shootings and robberies, leading to many other less urgent calls going unanswered.

But that doesn’t explain why calls for service remained down after the department returned to its normal operations. While police call levels began to rise again later in June and early July, they still remained down roughly 5% from the same period in 2024.

The decrease in calls was less pronounced in the nine police districts in South L.A., the San Fernando Valley and the Eastside where Latinos make up the majority of residents, but the data show a persistent dip in domestic violence calls in those areas that remained in the weeks after the immigration enforcement campaign began.

Police calls for service have been on a slow decline for years, a phenomenon that has coincided with a drop in overall crime. LAPD Chief Jim McDonnell and other leaders have tried to emphasize in public remarks that local cops are not allowed to enforce civil immigration laws and only work with federal agents to arrest criminal suspects or quell unrest that threatens public safety.

But Carlos Montes, a longtime organizer with the Boyle Heights-based immigrant advocacy group Centro Community Service Organization, said the sight of LAPD officers standing alongside the feds during recent operations has ensured that even more Angelenos will think twice about calling the police for help.

“In general, in the neighborhood we don’t want to call the cops because they’re not going to solve anything or they’re going to arrest someone, or beat someone or shoot someone,” he said.

LAPD Assistant Chief German Hurtado, the department’s immigration coordinator, acknowledged that it has been a struggle to reassure the public it’s safe to call the police.

“Police are also the most visible form of government, and right now people are not trusting the government,” Hurtado said in an interview last month. “People [are] scared to be deported, and that’s totally understandable. That’s something that we’re going to have to deal with and figure out a way to heal with the community.”

In response to what he called “negative publicity” around the LAPD’s actions in recent weeks, he said the department was stepping up its outreach efforts in various immigrant neighborhoods, with a series of planned listening sessions and other events aimed at educating the public.

The department recently launched a citizens academy for Spanish speakers, and senior lead officers have been out meeting with faith and community leaders trying to get them to reinforce the message that police need victims to cooperate in order to solve crimes.

Marielle Coronel, 24, co-owner of a boxing gym in Sylmar, said she worries about being profiled while being out and about, which has also made her think twice about calling police.

Even though she believes that at least some police officers are trying to help, she said the last few months have been unnerving. She recalled how her parents recently gave her a version of “the talk” that many parents of color have with their children about how to deal with police. Their fears have grown to include unidentified masked men posing as ICE agents, Coronel said.

Her parents insisted that she start carrying her passport with her everywhere she goes and that she not lower her window to anyone unless they clearly identify themselves. Tending to her gym’s front desk one recent afternoon, she said she has taken the advice to heart.

“Even if I am a U.S. citizen, you just don’t know,” she said. “We don’t feel like we have backup from the government.”