The tech company is projecting huge cloud computing growth in the coming years.

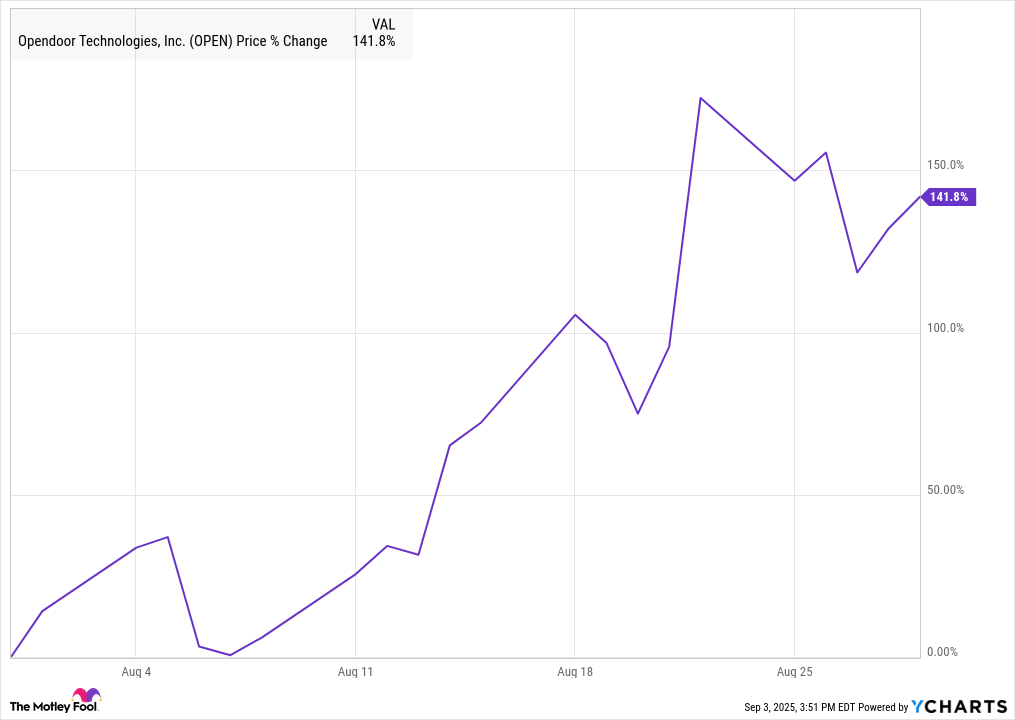

It’s not often that a stock absolutely skyrockets right after it misses analysts’ expectations for both revenue and profits, but that was what Oracle (ORCL -4.50%) did following its recent fiscal 2026 first-quarter report. The market’s excitement about the stock appeared to stem from the company’s growing cloud computing business. The stock has now more than doubled so far in 2025.

Let’s take a closer look at Oracle’s earnings report and prospects to see whether or not it’s too late to buy the stock.

Cloud excitement

Sometimes there is a last-mover’s advantage, and in the cloud computing space, Oracle appears to have one. Before the artificial intelligence (AI) boom, the company’s cloud computing unit was new and pretty small. However, it’s now building it out quickly with all the latest technology. As a result, top AI model companies are flocking to its services, and even the big three cloud computing infrastructure providers — Amazon, Alphabet, and Microsoft — are partnering with it.

Oracle is particularly excited about its opportunity in the inference space. It said it has a big edge because its customers can connect all of their Oracle databases and cloud storage to “vectorize” their data. They can then apply the large language model (LLM) of their choice to answer questions using a combination of private enterprise data and publicly available information. It expects the AI inference market to become much bigger than the AI training market over time.

Image source: Getty Images.

Oracle’s cloud computing strength could be seen in its latest quarterly results. Its cloud infrastructure revenue surged 55% year over year to $3.3 billion. Meanwhile, within the segment, it said its multicloud database revenue from the big three cloud providers soared by 1,529% in the quarter. Meanwhile, it plans to build 37 new data centers for them in the coming years. What got investors really excited was the company’s forecast that its cloud infrastructure revenue would hit $144 billion by fiscal 2030, up from just $10.3 billion in fiscal 2025. It’s looking for cloud infrastructure revenue to increase by 77% to $18 billion this year, and then just continue to surge.

Below is a table of Oracle’s cloud infrastructure revenue projections.

| Metric |

Fiscal 2026 |

Fiscal 2027 |

Fiscal 2028 |

Fiscal 2029 |

Fiscal 2030 |

| Cloud infrastructure revenue forecast |

$18 billion |

$32 billion |

$73 billion |

$114 billion |

$144 billion |

Note: Oracle’s fiscal years end on May 31 of the calendar year.

Management said much of this revenue is already locked in: The company has $455 billion in remaining performance obligations (RPOs), with most of these contracts generally non-cancelable. That was a whopping 359% increase from a year ago when its RPOs were $99 billion, and up from just $138 billion a quarter ago. The huge increase was the result of Oracle signing four major contracts with three different customers in the quarter.

Oracle’s overall revenue increased 12% to $14.93 billion, which missed the $15.04 billion analyst consensus by less than 1%. Cloud revenue jumped 28% to $7.2 billion. Within the cloud segment, cloud infrastructure revenue soared by 55% to $3.3 billion while cloud application revenue rose 11% to $3.8 billion.

Adjusted earnings per share (EPS), meanwhile, rose 6% to $1.47. That came up just short of the $1.48 analyst consensus.

Looking ahead, Oracle maintained its forecast that its fiscal 2026 revenue will increase by 16% on a constant-currency basis. However, it upped its budget for capital expenditures to $35 billion from an earlier plan to spend just $25 billion. Management said most of those outlays will go toward things like graphics processing units (GPUs).

For its fiscal Q2, it guided for revenue to climb by between 14% and 16% year over year and for cloud revenue to soar by between 32% and 36%. It projected its adjusted EPS will rise by between 10% and 12% to a range of $1.61 to $1.65.

Is it too late to buy the stock?

Oracle’s projected cloud infrastructure growth over the next five years is nothing short of spectacular, and with contracts locked in, it has a clear line of sight into its future finances. However, it is worth noting that it will have to spend a lot of money to increase capacity so that it can meet these commitments, and it isn’t in as good financial shape as the big three cloud infrastructure providers.

Oracle currently has more than $80 billion in debt on its books, and it didn’t generate any free cash flow in the past year or in Q1, as it has been pouring all of its operating cash flow into expanding its data center capacity. Its cash flow from operations was $20.8 billion last year and $8.1 billion in Q1, so it likely will have to go further into debt over the next five years to build more data centers. That’s a sharp contrast to the financial situations of the big three cloud computing providers.

From a valuation perspective, Oracle now trades at a forward P/E of about 50 based on analysts’ estimates for its fiscal 2026, so it’s not cheap.

Given Oracle’s valuation, the state of its balance sheet, and the volume of capital expenditures in its future, I wouldn’t chase the stock after its huge surge.