Why Sezzle Stock Fell 16% in September

Weakness in the fintech sector hit Sezzle last month.

Shares of Sezzle (SEZL 0.77%), the high-flying BNPL (buy now, pay later) stock, were pulling back in September as part of a broader retreat among fintech stocks.

Investors sensed a weakening in the credit market as downbeat employment data and a pair of bankruptcies in the auto sector sent Sezzle and a number of its peers lower last month, even as the broad market gained. Sezzle is a recent IPO, and investors have yet to see it go through a full credit cycle. Therefore, it’s not surprising for it to show some sensitivity to rising credit risk.

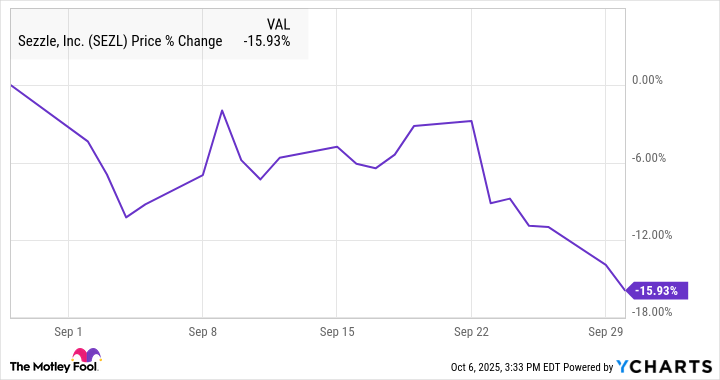

According to data from S&P Global Market Intelligence, Sezzle stock finished the month down 16%. As you can see from the chart below, the stock was volatile but steady through the first few weeks of the month before sinking toward the end, following the Federal Reserve’s rate cut.

Sezzle pulls back again

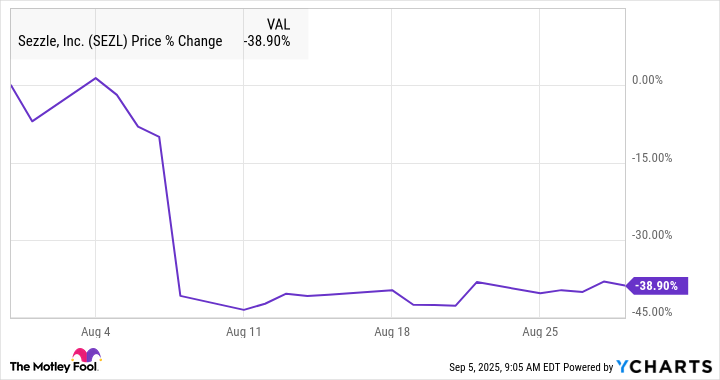

Sezzle has been a standout performer in the BNPL sector, though the stock is now down more than 50% since its peak in July, as concerns about its ability to maintain its growth rate seem to have taken over.

In addition to worries about rising credit risk on the macro level, one Wall Street analyst weighed in on the stock last month.

TD Cowen initiated coverage of the stock with a hold rating and a price target of $82. Cowen noted the company’s rapid growth, but credited that to the strength of the BNPL sector, and said that the sector is trading in a narrow valuation range. Based on the price target, the analyst expected a pullback in the stock, and Sezzle stock fell 1.6% on Sept. 11, the day the report came out.

Additionally, Shopify asked a judge to dismiss a lawsuit filed against it by Sezzle which alleges that Shopify’s BNPL product is anticompetitive and violates antitrust laws.

That news seemed to contribute to the sell-off at the end of the month as the Fed rate cut and other macro-level news added to worries about rising credit risk.

Image source: Getty Images.

What’s next for Sezzle?

Sezzle continues to grow at breakneck speed, with the company forecasting 60%-65% revenue growth for 2025. However, growth in charge-offs outpaced revenue growth in the second quarter, rising from $8.2 million to $20.3 million. That could be a sign that its customers are having more challenges in paying Sezzle back, but it still seems too early to tell.

While its revenue growth and profitability are impressive, rising delinquency rates would spoil the bull case for the stock.