Where Will Robinhood Markets Stock Be in 1 Year?

The digital trading platform company’s value has increased fivefold in just a year.

What a difference a year makes.

Consider this: In late September 2024, investors could pick up one share of Robinhood (HOOD -0.38%) for about the price of a baseball cap — around $23.

As of this writing, that same share now trades for about $123.

So, what gives? Why have Robinhood shares increased fivefold in only 12 months? And, more importantly, where is the stock headed?

Image source: Getty Images.

Robinhood’s recent moves

As of this writing, shares of Robinhood have advanced by 233% year to date. Over the past three years, they’ve increased by a jaw-dropping 1,150%.

The engine behind this stock surge was good old-fashioned execution. Simply put, Robinhood is beating out its competitors, and that is generating investor optimism.

The company operates using a model under which it charges no commissions on trades and only passes unavoidable regulatory fees on to its customers. Instead, the company leverages its platform assets to generate revenue in other ways, including:

- Payment for order flow: It directs its customers’ buy and sell orders to vendors that pay fees for those orders, and which themselves profit on the spread between asking and bid prices.

- Net interest: This is revenue generated via the spread between the interest generated from customers’ cash balances and what Robinhood pays those customers in interest on their accounts’ cash balances.

- Subscriptions: Gold members receive access to certain tools, perks, and benefits.

As the total value of the assets on Robinhood’s platform increases, its ability to generate revenue does as well. As of the end of the second quarter, Robinhood’s total platform assets stood at $279 billion, up from $62 billion at the end of 2022.

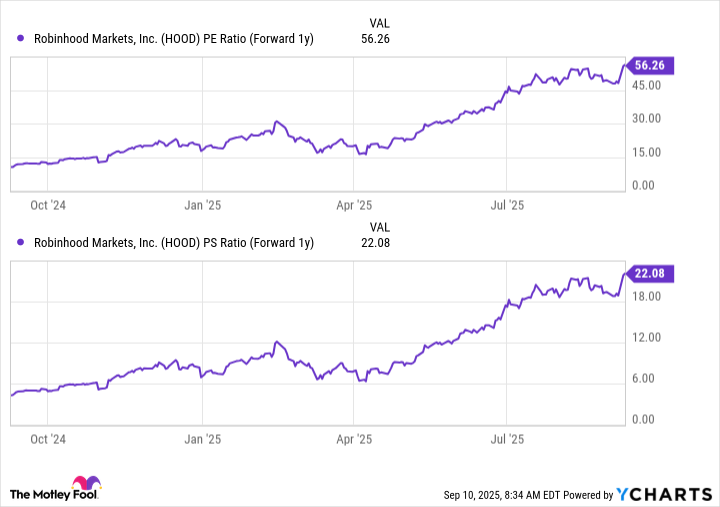

Consequently, Robinhood’s trailing 12-month revenue has increased from $1.4 billion three years ago to $3.6 billion today. Similarly, the company has swung from a significant net loss of $1.3 billion in 2022 to a net profit of $1.8 billion over the past four reported quarters.

Lastly, in addition to, and in part because of, the company’s excellent financials, Robinhood was recently added to the S&P 500, which further expands the stock’s appeal within the investment community.

What’s next for Robinhood?

While there’s no way to know for sure where the stock will be in one year, the stock looks appealing to me for several reasons.

First, its business model lends itself to natural growth. If the company can continue attracting new customers, it is likely to continue growing its top and bottom lines thanks to how it leverages customer assets.

Second, it continues to innovate, which opens up new revenue opportunities and helps drive new customer acquisition. Robinhood’s Vlad Tenev is one of my favorite CEOs because he thinks big and isn’t afraid to boldly experiment. The company has announced initiatives aimed at social media investing (Robinhood Social) and allowing retail investors access to private markets (through Robinhood Ventures Fund), among other innovative ideas.

Finally, Robinhood appeals to a younger investing demographic, one that will undoubtedly grow wealthier as the effects of the great wealth transfer begin to kick in. That will further increase its total platform assets, driving a virtuous cycle of greater revenue and profits.

In summary, Robinhood stock has surged over the past year thanks to its business model, solid execution, visionary leadership, and demographic tailwinds. In my opinion, those catalysts will continue for many years to come.

It is true, though, that there are risks to Robinhood’s stock price. Most notably, an economic downturn or a recession could dampen financial markets, resulting in decreased activity by retail investors — the traders who sit at the core of Robinhood’s business model.

However, over the long term — by which I mean five years or longer — I’m confident in Robinhood’s ability to deliver on its goals. Those seeking a long-term investment in the brokerage sector may want to consider Robinhood stock.

Jake Lerch has the following options: long January 2026 $30 calls on Robinhood Markets. The Motley Fool has no position in any of the stocks mentioned. The Motley Fool has a disclosure policy.