There are a number of reasons for investors to consider cashing in some or all of their chips on quantum computing stocks.

For the better part of the last three years, seemingly nothing has sparked investor interest quite like the evolution of artificial intelligence (AI). Empowering software and systems with the tools to make split-second decisions without human intervention, as well as to become more proficient at their tasks over time, is viewed as a game-changing technology for most industries around the globe.

Over the last three decades, there’s pretty much always been a next-big-thing trend or technology to captivate the attention and capital of Wall Street and investors. Prior to AI, there was the advent of the internet, genome decoding, nanotechnology, 3D printing, blockchain technology, and the metaverse, to a name a few key trends.

But in rare instances of outsize optimism on Wall Street, two or more game-changing trends can coexist, as we’re witnessing now with the dual rise of AI and quantum computing.

Image source: Getty Images.

The four biggest pure-play quantum computing stocks — IonQ (IONQ 0.46%), Rigetti Computing (RGTI 5.30%), D-Wave Quantum (QBTS 2.00%), and Quantum Computing (QUBT -0.81%) — have rallied between 700% to 5,130%, respectively, over the trailing year (as of Oct. 3). Though optimism is readily apparent, there’s no denying that the time to be fearful when others are greedy has arrived for these four stocks.

What is quantum computing, and why are investors so excited about it?

Quantum computing relies on quantum mechanics to solve complex problems that traditional computers can’t do. What makes quantum computing so exciting is its many real-world possibilities.

For example, quantum computers can be used to run simulations to determine how molecules would behave. These interactions can be quantified to narrow best courses of actions when developing drugs and targeting hard-to-treat diseases. Think of it as genome decoding that’s been ramped up to improve the likelihood of success when developing novel therapies.

Quantum computers can also be deployed to vastly improve cybersecurity solutions. This technology can potentially break existing encryption methods and lead to the development of quantum-resistant solutions that create lock-tight protections for cloud-based systems and end users.

But perhaps the most exciting aspect of quantum computing is what it might be able to do for the AI revolution. Quantum computers can speed up the process by which AI algorithms help software and systems “learn” and become more proficient at their tasks. Training large language models could occur significantly faster with quantum-capable solutions.

Based on one of Wall Street’s lofty estimates, which comes courtesy of Boston Consulting Group, quantum computing can create between $450 billion and $850 billion in global economic value 15 years from now. This high-ceiling estimate corresponds with substantial forward-year sales growth forecasts for the aforementioned pure-play quantum computing stocks:

- IonQ: projected sales growth of 87% in 2026

- Rigetti Computing: projected sales growth of 161% in 2026

- D-Wave Quantum: projected sales growth of 56% in 2026

- Quantum Computing: projected sales growth of 412% in 2026

Though optimism is through the roof, billionaire Warren Buffett’s famous investing advice rings loud: “Be greedy when others are fearful, and be fearful when others are greedy.”

Image source: Getty Images.

The time to be fearful with quantum computing stocks is here

Berkshire Hathaway‘s billionaire boss Warren Buffett has absolutely crushed the benchmark S&P 500 over six decades by sticking to this ethos. He pounces when fear creates advantageous price dislocations and sits on his proverbial hands (or sells shares of existing holdings) when valuations no longer make sense. This latter scenario encompasses the need to be fearful when others are being greedy.

There’s no denying that, on paper, quantum computing offers a compelling long-term growth story. The possibility of improving drug development, cybersecurity, supply chains, financial modeling, and AI algorithms, among other use cases, offers intrigue.

But there’s also a long list of reasons why, if you own shares of IonQ, Rigetti Computing, D-Wave Quantum, and/or Quantum Computing, cashing in some or all of your chips right now makes complete sense.

To begin with, history hasn’t exactly been kind to game-changing technologies in their early expansion phase. Looking back more than 30 years, there hasn’t been a next-big-thing trend that’s avoided an eventual bubble-bursting event. Put in another context, investors and businesses have repeatedly overestimated the early stage adoption rate and/or utility of these newer technologies, leading to eventual disappointment.

While I’ve made this same argument with AI, it rings 100 times truer when it comes to quantum computing. Whereas AI hardware is flying off the proverbial shelf, and Wall Street’s most-influential businesses are eagerly deploying AI solutions, quantum computing utility is still very minimal. All the hallmarks of a bubble are firmly in place.

Secondly, these four pure-play stocks are all losing money hand over fist on an operating basis and aren’t particularly close to demonstrating their operating models are viable. Through the first-half of 2025, IonQ’s operating loss more than doubled to $236.3 million from the prior-year period, while Rigetti Computing’s operating loss jumped 27%.

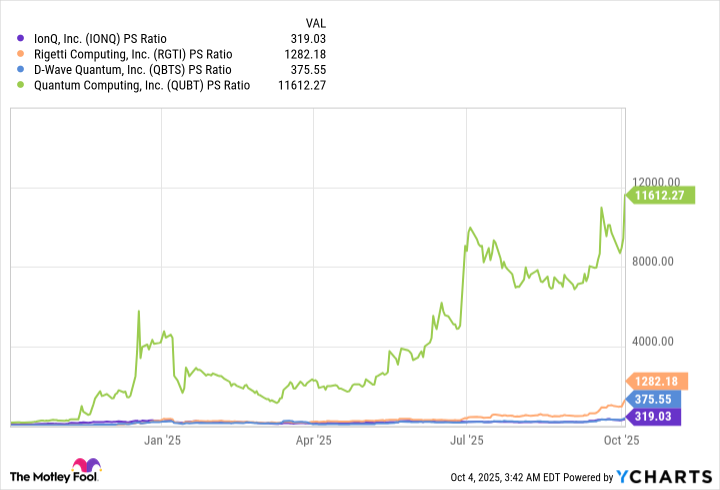

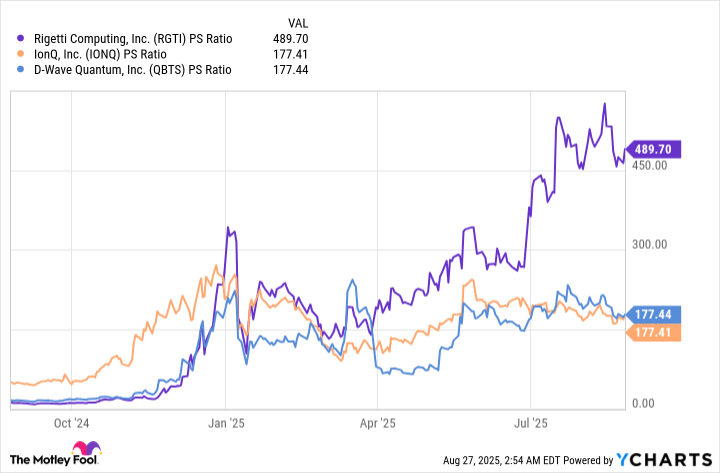

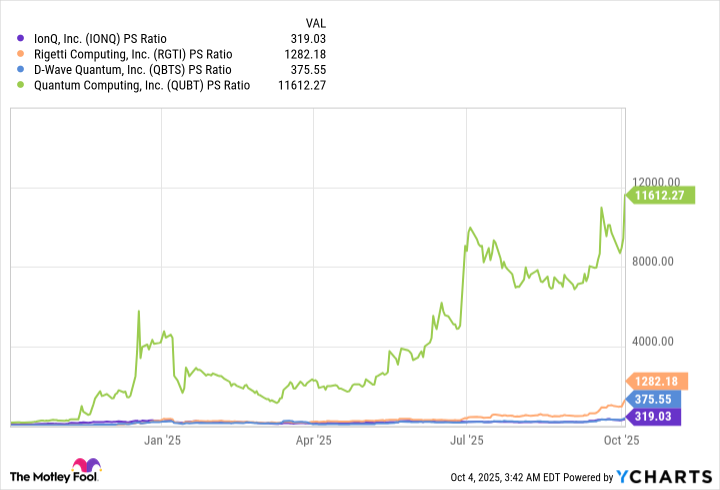

IONQ PS Ratio data by YCharts.

To expand on this point, all four pure-play stocks are valued at price-to-sales (P/S) ratios that absolutely scream “bubble!” Companies on the leading edge of prior next-big-thing trends peaked at P/S ratios ranging from 30 to 40, with a little wiggle room in each direction. The trailing-12-month P/S ratios of Wall Street’s four quantum computing superstars are:

- IonQ: 319

- Rigetti Computing: 1,282.2

- D-Wave Quantum: 375.6

- Quantum Computing: 11,612.3

In no universe do the multibillion-dollar valuations currently assigned to these four stocks justify the relative pittance in continuous sales they’re generating. It’s another sign of a seemingly imminent bubble-bursting event.

The final reason investors should be fearful with these pure-play quantum computing stocks is because the “Magnificent Seven” have deeper pockets and an inside edge to the infrastructure that can fuel an eventual quantum computing revolution. Although companies like IonQ have landed meaningful partnerships, Mag-7 companies have the ability to aggressively spend on quantum computing solutions that may eventually lessen the need for hardware and software solutions from companies like IonQ, Rigetti, D-Wave, and Quantum Computing.