DKM Loads Up on QQQ With 7,900 Shares Worth $4.8 Million

On October 10, 2025, DKM Wealth Management, Inc. disclosed a new position in Invesco QQQ Trust, Series 1, acquiring 7,935 shares for an estimated $4.76 million in Q3 2025.

What happened

According to a filing with the U.S. Securities and Exchange Commission dated October 10, 2025, DKM Wealth Management, Inc. initiated a position in Invesco QQQ Trust, Series 1 (QQQ -3.46%), purchasing approximately 7,935 shares in Q3 2025. The estimated transaction value is $4,763,936 in Q3 2025. This brings the fund’s total QQQ position to $4.76 million, with no prior holding reported last quarter.

What else to know

This is a new position for the fund, now accounting for 3.8% of DKM Wealth Management, Inc.’s $124.58 million in reportable U.S. equity assets in Q3 2025.

Top holdings after the filing:

- (NASDAQ:TBLD): $18.72 million (15.0% of AUM) in Q3 2025

- (NYSEMKT:TCAF): $14,341,015 (11.5113% of AUM) as of September 30, 2025

- (NYSE:SOR): $12.86 million (10.3% of AUM) in Q3 2025

- (NYSEMKT:GRNY): $9.22 million (7.4% of AUM) in Q3 2025

- (NYSEMKT:ITOT): $7,186,455 (5.7685% of AUM) as of September 30, 2025

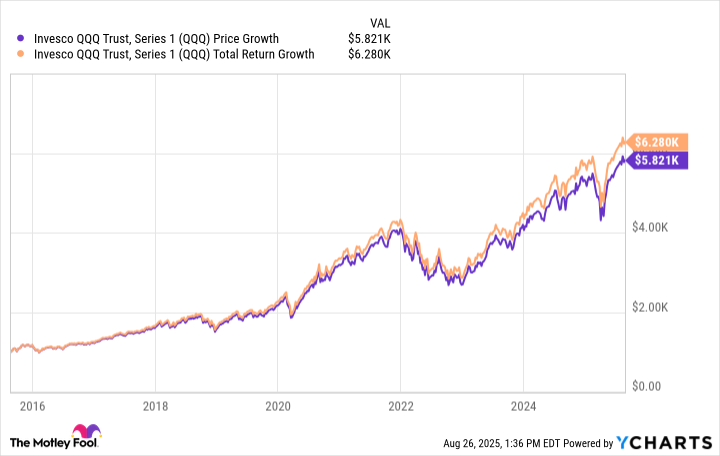

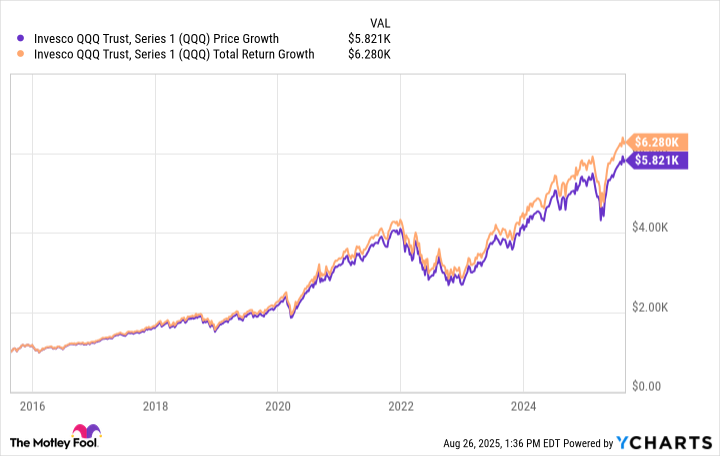

As of October 9, 2025, shares of Invesco QQQ Trust, Series 1 were priced at $610.70, up 23.84% for the year through October 9, 2025, outperforming the S&P 500 by 8.38 percentage points

Company overview

| Metric | Value |

|---|---|

| AUM | $385.76 Billion |

| Price (as of market close 2025-10-09) | $610.70 |

| Dividend yield | 0.48% |

| 1-year total return | 23.84% |

Company snapshot

The investment strategy seeks to track the performance of the NASDAQ-100 Index®.

The portfolio is periodically rebalanced to maintain alignment with the index.

The fund is structured as a trust.

Invesco QQQ Trust offers investors targeted exposure to the NASDAQ-100 Index. The fund’s strategy uses periodic rebalancing to closely mirror index composition and weights.

Foolish take

DKM Wealth Management opened a new position in Invesco’s popular QQQ Trust in Q3 2025, to the tune of $4.8 million and over 7,900 shares. Because QQQ tracks the NASDAQ-100, it gives DKM Wealth Management and other investors a more balanced exposure to tech stocks without nearly as much risk as would be present in investing in individual technology companies.

This has pros and cons, since any individual tech holding can suddenly become a hot commodity and its value balloon dramatically in the current market environment. However, by selecting a basket of tech giants, investors can largely avoid the dramatic ups and downs involved with this sector, and are protected from the more serious losses that can also be present here.

QQQ is an ETF that’s frequently and sometimes aggressively traded, more preferred by active traders than its very similar cousin, QQQM. QQQ also has higher liquidity, which may be preferred by DKM if the fund feels that this is a shorter term investment, rather than a permanent portfolio balancing move. It can certainly be held long term like QQQM typically is, but it has a higher expense ratio and a higher per share price. Don’t expect this to be a long-term move.

Glossary

13F reportable assets: Assets that U.S. institutional investment managers must disclose quarterly to the SEC on Form 13F.

Assets under management (AUM): The total market value of investments managed on behalf of clients by a fund or firm.

Position: The amount of a particular security or investment held by an investor or fund.

Trust (fund structure): An investment fund organized as a legal trust, often holding assets on behalf of investors.

Periodic rebalancing: Adjusting a portfolio’s holdings at set intervals to maintain target asset allocations or index alignment.

Dividend yield: The annual dividend income from an investment, expressed as a percentage of its current price.

Total return: The investment’s price change plus all dividends and distributions, assuming those payouts are reinvested.

NASDAQ-100 Index®: A stock market index comprising 100 of the largest non-financial companies listed on the NASDAQ exchange.

Outperforming: Achieving a higher return than a benchmark index or comparable investment over a given period.

Market value: The current total value of a holding, calculated as the share price multiplied by the number of shares owned.