Map of Gaza shows where Israeli forces are positioned under ceasefire deal | Israel-Palestine conflict News

EXPLAINER

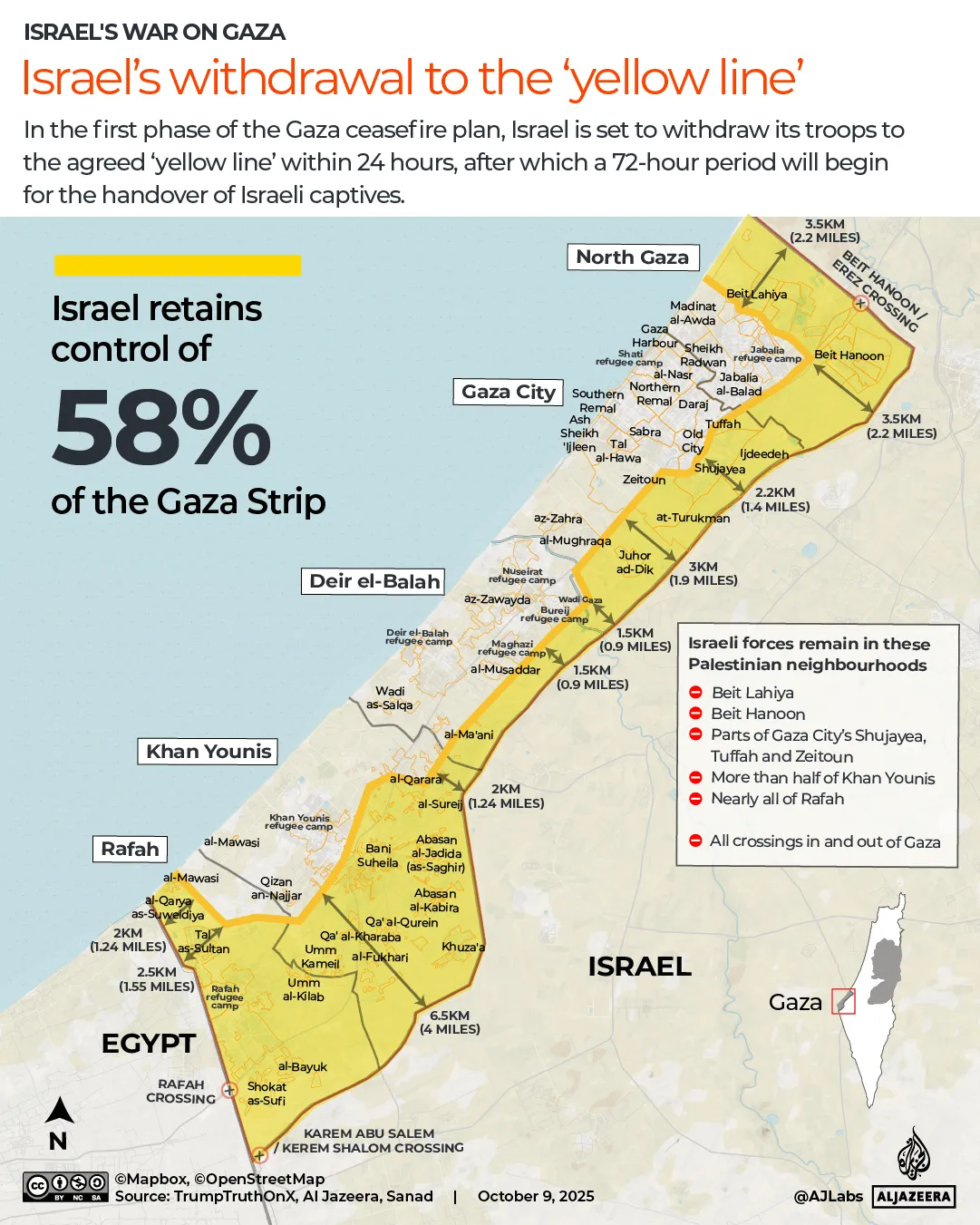

Satellite imagery shows Israel holds about 40 active military positions beyond the yellow line.

Satellite imagery analysis by Al Jazeera’s fact-checking agency Sanad shows that the Israeli army holds about 40 active military positions in the part of the Gaza Strip outside the yellow line, the invisible boundary established under the first phase of the ceasefire to which its troops had to move, according to the deal.

The images also show that Israel is upgrading several of these facilities, which help it maintain its occupation of 58 percent of Gaza even after the pullback by troops to the yellow line.

While the majority of sites are concentrated in southern Gaza, every governorate hosts at least one military position. Some sites are built on bases established during the war, while others are newly constructed. The total number of sites in each governorate is:

- North Gaza: 9

- Gaza City: 6

- Deir el-Balah: 1

- Khan Younis: 11

- Rafah: 13

One of the most prominent military points in Gaza City is located on top of al-Muntar Hill in the Shujayea neighbourhood of Gaza City. A comparison of images between September 21 and October 14 shows the base being paved and asphalted.

Where is the invisible yellow line?

Since the ceasefire took effect about two weeks ago, nearly 100 Palestinians have been killed in Israeli attacks across the Strip, with some attacks occurring near the yellow line.

On October 18, Israeli forces killed 11 members of the Abu Shaaban family in the Zeitoun neighbourhood of Gaza City, according to Gaza’s Civil Defence. Seven children and three women were among those killed when the Israeli military fired on the vehicle as the family attempted to return home to inspect it.

The Israeli military said soldiers had fired at a “suspicious vehicle” that had crossed the so-called yellow line. With no physical markers for the line, however, many Palestinians cannot determine the location of this invisible boundary. Israeli Defence Minister Israel Katz has since said the army will install visual signs to indicate the line’s location.

In the first ceasefire phase, Israel retains control of more than half of the Gaza Strip, with areas beyond the yellow line still under its military presence. This has blocked residents of Beit Lahiya, Beit Hanoon, the neighbourhoods of Shujayea, Tuffah, Zeitoun, most of Khan Younis, and all of Rafah City from returning home.

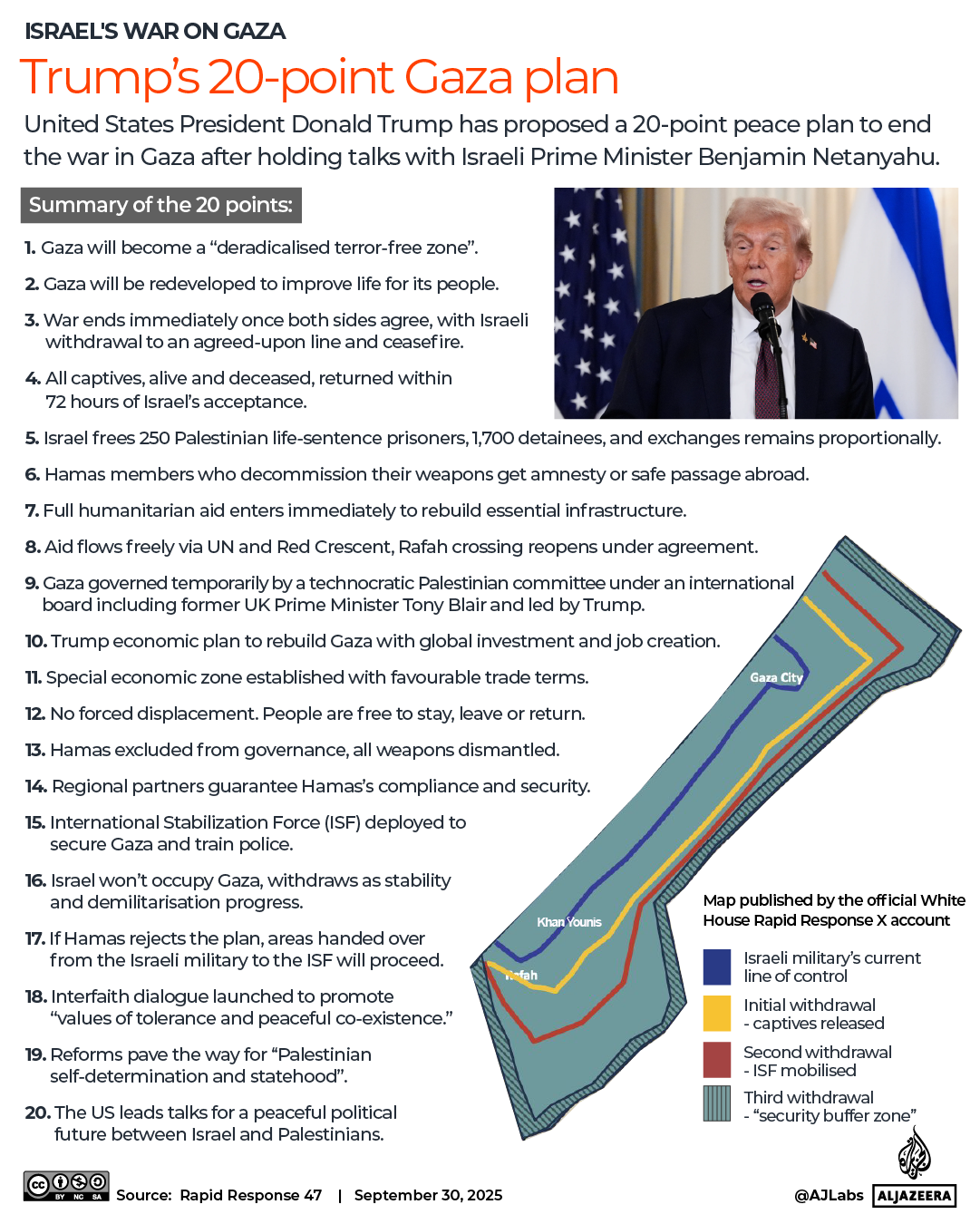

What are the next phases of Trump’s 20-point Gaza plan?

According to the 20-point plan announced by United States President Donald Trump and Israeli Prime Minister Benjamin Netanyahu on September 29 – developed without any Palestinian input – Israel is to withdraw its forces in three phases, as shown on an accompanying crude map, with each phase marked in a different colour:

- Initial withdrawal (yellow line): In the first phase, Israeli forces pulled back to the line designated in yellow on the map. Hamas has released all living Israeli captives that were in Gaza, and most of the dead bodies of captives who passed away in the enclave.

- Second withdrawal (red line): During the second phase, an International Stabilisation Force (ISF) will be mobilised to oversee security and support Palestinian policing, while Israeli forces are to retreat further to the line marked in red, reducing their direct presence in Gaza.

- Third withdrawal (security buffer zone): In the final phase, Israeli forces are to pull back to a designated “security buffer zone”, leaving a limited portion of Gaza under Israeli military control, while an international administrative body supervises governance and a transitional period.

Even after the third withdrawal phase, Palestinians will be confined to an area which is smaller than before the war, continuing a pattern of Israel’s control over Gaza and its people.

Many questions remain about how the plan will be implemented, the exact boundaries of Palestinian territory, the timing and scope of Israeli withdrawals, the role of the ISF, and the long-term implications for Palestinians across Gaza and the occupied West Bank.

The plan is also silent on whether Israel gets to continue its aerial and sea blockade of Gaza, which has been in place for the past 18 years.