OpenAI has launched apps within ChatGPT in its bid to add functionality and improve monetization of the product.

In this podcast, Motley Fool contributors Travis Hoium, Lou Whiteman, and Rachel Warren discuss:

- ChatGPT gets apps.

- App opportunities.

- A trillion-dollar question for ChatGPT.

To catch full episodes of all The Motley Fool’s free podcasts, check out our podcast center. When you’re ready to invest, check out this top 10 list of stocks to buy.

A full transcript is below.

This podcast was recorded on Oct. 08, 2025.

Travis Hoium: Is artificial intelligence in need of an app store? Motley Fool Money starts now. Welcome to Motley Fool Money. I’m Travis Hoium. I’m joined by Lou Whiteman and Rachel Warren. We’ve got to get to the big news of the week. We’ve got a couple of days to process this, that is OpenAI introducing apps. They have tried some of these things before, plug-ins, custom GPTs to varying levels of success, but obviously they’re going in a different direction now. But this was I thought a really interesting announcement because the vision here is a lot bigger than just being an AI tool. It’s being the operating system of your life, if you will. There are companies involved who are willingly building apps, companies like Zillow, Expedia, Booking.com. Rachel, what are you taking away from this and what should investors know about OpenAI’s move into apps? It’s not quite an app store, but they are making apps.

Rachel Warren: Yeah, it’s interesting. I think you can see how a lot of the efforts that they have leveraged in the past maybe have led them to this point. I want to talk a little bit about how this app store works and why I also do think this could be really different from what we’ve seen in OpenAI in the past. Their app store, is this new platform, it’s integrated directly within ChatGPT, and it basically allows users to interact with third party apps using conversation natural language. For instance, you could ask ChatGPT to create a playlist with Spotify or find houses for sale with Zillow and then those apps are activated from directly within the ChatGPT conversation. Instead of having to leave the chat to use another service, those apps run directly in the thread. I think the idea is to simplify the user experience. At launch they’re partnering with some really big companies, with Spotify, Booking.com owned by Booking Holdings, Expedia, Zillow, Figma which is newly public, as well as private companies like Canva. I think it’s interesting to note, their past attempts like plugins that you alluded to. These had been limited text-based access. They were really rigid invite-only systems for developers. The chat interface was really cumbersome. Importantly, monetization wasn’t really a core feature there. Now, these new apps, I think, are very much designed to be a funnel toward monetization where OpenAI could make money from more of a revenue sharing model. It’s really interesting to see what they’re doing with this.

Travis Hoium: Lou, is this the way that we’re going to be using AI in the future? The vision here I think is, look on an iPhone or something or another smartphone. You’re going to download apps and then you’re going to actually interact with the app. You’re not really calling them from something like Siri, but this is taking that to the next level and going, hey, Zillow why don’t you just build for this AI chatbot and we’ll just call your information. Is that the way that we’re going to go in the future?

Lou Whiteman: Maybe. I will say this, if it works as good as the demo, it’s gold. But I’ve learned I think we’ve all learned not to just buy the demo. What I worry about here is there’s a garbage in garbage out problem, I think, because AI isn’t actually smart, it’s just trained on data. Just to pick on one, Zillow, their walkability score is the biggest, I shouldn’t call it garbage so I’ll just call it sub-par. [LAUGHTER] You can’t actually know whether or not a house, you can walk around it from the walkability score. In the example of give me a house that I can walk you to restaurants from, if it’s based on the Zillow walkability score, I think it’s going to be sub-human responses. I think there’s a trillion of these problems to be worked out. I think there’s all sorts of questions that we can get to later about Walled Gardens versus everybody there and how you make this work. To me, I want to get excited. It looks really good on paper, but I wonder if this is one of these things that’s always going to look better on paper than it is in real world execution.

Travis Hoium: According to some interviews by Sam Altman in the past couple of days, the vision here is bigger, and it will all make sense in a few months. Maybe we need to hold a little bit on what the full vision is. But I think what was interesting with these apps and one of the reasons that this is pertinent to us as investors, I think it’s from a disruption angle. If you think about the biggest disruptions are moving to a different technology paradigm, so the PC. You have opportunity and disruption, the Internet opportunity disruption, mobile devices, same thing. If ChatGPT becomes the way that we interact with technology, now you don’t have Zillow as an aggregator. You don’t have booking.com as an aggregator. You have ChatGPT in the power position. Altman even said, we could have just who had gone out and called all the information that Zillow was calling, but we wanted to work with these partners like he’s being some philanthropist with the technology. But this is, I think, a risk for a company is if you’re losing that direct customer relationship and you’re giving it to ChatGPT, is this a good thing, even if you’re partnering with the leading AI company today, Lou?

Lou Whiteman: There’s so much here, so much unpacked. For one, the big thing is, before we even get into the brands, it’s privacy. OpenAI has a ton of data. Can OpenAI just ring off my wanting to book a trip without telling every other partner they have? Hey, Lou is going to be in Toronto next week. Why don’t you sell him stuff, things like that. There’s all sorts of just on that layer. I like only Expedia knowing if I’m going to Toronto. But the bigger thing here, this whole idea of the OpenAI as the new Windows. Windows became Windows because it worked with everything. That was it, whatever you wanted to build, you could do. There’s a chicken and the egg problem here. You need customers, you need a ton of customers to attract every retailer to come on board or every website to come on board, but you need retailers to lure the customers. In theory, yes, there is a perfect world here where it’s just I go to my OpenAI, and that’s all I ever need. But how we get there is a bear.

Travis Hoium: Yeah, Rachel, this does seem like an area where it’s possible for disruption if this vision works. But it’s pretty unclear exactly how this is going to play out, given the massive size of this vision, not only from a technology standpoint but also from a financial standpoint.

Rachel Warren: Yeah, I want to stress that I think there’s room for multiple winners here. You know, I don’t think OpenAI comes in, and then that standard business model from some of these flagship players just goes out the window. As you noted, it’s very early days. We’re still waiting to see how exactly is OpenAI going to monetize this? Are consumers going to adopt this at a broad scale. But I do think it is interesting to look at the Bear thesis for a minute. Who could face disruption here if this type of platform ecosystem really takes off? Obviously the most significant disruption, which is what you alluded to, would be companies whose core business is providing a user interface for specific tasks. You could think about how Apple, Alphabet Google, Microsoft, which obviously control their respective ecosystems could face market threats. Of course, there’s other companies you think of the Adobes and sales forces of the world. They’re already experiencing some market skepticism amid the AI revolution. Then there’s the traditional search engine business, which of course is dominated by Google. Could that be disrupted? OpenAI’s approach has been to collapse the search to convert process. That could allow in this new app store, users to interact with services directly within ChatGPT. You could even think about how companies like Uber or DoorDash, who have really built their value on having users interact with their specific app to book a service could face some threats, but I don’t think the actual reality is going to be this bleak. Honestly, I think more likely than not, if this new use case for AI succeeds, we’ll probably see consumers adopt it as one other tool in their vast toolkit in the digital age. I don’t think strong companies with robust competitive advantages are going anywhere. If anything, maybe they can use this type of tool to play to their strengths if they execute it right.

Travis Hoium: We’re going to talk about that potential widening the funnel in just a moment. You’re listening to Motley Fool Money.

Widening the funnel for some of these applications. Some that were announced as apps that are coming soon, Peloton, DoorDash, Target, it is possible that ChatGPT allows more customers to interact with these applications than they had previously. If you’re not somebody who has downloaded the Peloton app and signed up for Peloton, you don’t have access to that. Same thing with Target. Maybe you don’t shop at Target, but maybe just having a conversation with ChatGPT is a good way for them to broaden out and get more customers. Is that possible that some of these applications, at least, are going to see this as a way to bring more customers to them? It’s an opportunity instead of a threat, Rachel, because I think there’s always two sides to the coin here, and one of the things we’re going to talk about in a minute is how in the world does ChatGPT make money? Well, if you have a business that makes money and your problem is customer acquisition, maybe ChatGPT answers this for you.

Rachel Warren: Yeah, I do think it could widen the funnel. I also think an important point to make is, you see all of these major companies that are onboarding in the very early launch of this app store. I don’t think these companies would be coming to the table with OpenAI if they thought this was just going to cannibalize their business. I think they see this as an opportunity.

Travis Hoium: That’s usually the way that disruption works, to be fair. [LAUGHTER] As you see it, Disney sold their content to Netflix and basically armed the rebels.

Rachel Warren: To play the bull case here, I do think that a lot of these companies and others might view this integration into the OpenAI app ecosystem as an opportunity to widen their user funnel. The thing is, AI can commoditize very basic functions, but I think these companies are thinking that they can leverage OpenAI’s platform to maybe deliver more integrated, personalized, or even efficient experiences that would draw users back to their core services and data. You can actually take Zillow as an example, which Lou was talking about earlier. Say a user uses ChatGPT to find homes near a certain location. Let’s say they want to get the estimate valuations. They want to view the 3D virtual tours. They want to connect with a Zillow premier agent. They have to then go back to that app ecosystem. That could make them more of a gateway to some of that high value data. That’s just one example. I do think there could be a competitive opportunity for companies that play this right. I just think it’s too soon to know for sure what this is going to look like. I think it’s also fair to say to your point, Travis, there might be companies that are onboarding to this because they fear getting left behind. That’s also potentially a factor at play.

Lou Whiteman: Two thoughts here. For one, the idea of, so I’m not a Peloton customer. I maybe put in something in OpenAI, how can I get in shape? Then, am I going to get spammed with Peloton? [OVERLAPPING] I keep going back to this because this all just rings as something that sounds so much better on stage than it does in execution. I’ll give you another example of this. Who is the gatekeeper here? Booking and Expedia are both partners right now. If I want to fly to Minnesota, who gets that business? Who decides that? Is that a competitive auction thing? Because if it is, and it gets expensive, [OVERLAPPING].

Travis Hoium: As it works right now, you would have to specifically call booking.com. [OVERLAPPING]

Lou Whiteman: But if you do that, you’re not broadening the funnel. I’m already a relationship. If DoorDash and Instacart are both in this system, and one day, I say, I need milk. How does that work? There’s a lot of ways that, yes, in theory, if they can work all of this out, it is intriguing. But there’s all sorts of, I keep thinking of that meme where it’s like, step 1, do this. Step 2, 3, and 4 is blank, and step 5 is profit. There’s a lot of blanks in that middle right now as far as figuring out the economics here, who gets paid what and how it all works out. I get the vision, I just keep coming back to these execution things and wondering.

Travis Hoium: Well, that’s a question I think we should dive into a little bit is is this a TenX improvement? The concept for a lot of disruptions and moving people from what they’re doing today to doing something else is that it has to be 10 times better. If you go back to the advent of the PC. You’re moving from doing math, for example, on paper to doing it on a computer, way easier. The Internet, now suddenly the encyclopedias that we had at home you can just find all that information online. Mobile devices, now that all that information is just in your pocket. All these are easily TenX improvements. Is going to one app, and this is where maybe we’ll find out more about what the hardware future for OpenAI looks like over the next couple of months. But I do think that is a question, Lou is this the improvement in our lives that is going to necessitate us actually adopting OpenAI as our do everything application instead of the way that we’re doing things today.

Lou Whiteman: Yeah, and another point on this. If we get into retail in a second, we can do more. But look, most shopping is not as exciting as what these presentations would say. Most shopping is, I need a gallon of milk, I need something. It’s not I want to explore new fashion trends. I don’t know if that we need a killer app for all of this. I see the use case, I see the concept, the execution, it’s just the actual day to day implementation for us normies. I don’t know how you get there.

Travis Hoium: Let’s talk about one of those dark horses, Rachel. I thought it was interesting that Target was listed as one of their apps that’s coming soon. Every one of these other companies is a tech company. I guess all trails would be maybe not quite as much of a tech company. But there you have a retailer that’s struggling in the big box retail space. Maybe this is a way to attract some new customers. Could there be some dark horses here where you extend the long term? We’ve gone, especially in retail, I think that’s maybe the best example is that Amazon has sucked all the oxygen in the room because you choose to go to the Amazon app. Well, Amazon, guess what? They don’t want to be on ChatGPT and be disaggregated. Does that present an opportunity for companies that can, like you said earlier, go, hey, I’m not only not going to be left behind, but I’m going to take advantage of this because I don’t have the same digital footprint as a company like Amazon.

Rachel Warren: I do think there’s an opportunity there for companies like Target that are worth the classic brick and mortar that also have a strong online presence and others. But I think a lot of the utility of this goes back to how useful it is to the consumer. I think the core idea here is that if you are, say, shopping, you’re on ChatGPT rather than having to go and open up a series of different apps to find the things you want. You can tell ChatGPT to open up a specific app and search for the thing that you want within that user interface. I do think that’s something that is compelling to a consumer, particularly those of us who are on our phones, on our devices a lot. For Target’s part, as you mentioned, they’ve had a very rough few years, particularly coming out of the pandemic, as well as a host of other issues that have been very specific to them and they have also been, I think, very much adopting a lot of different AI tools into their overall business. They already use generative AI, for example, to improve a lot of their product display pages on their website. They had last year introduced a proprietary generative AI chatbot for store employees called Store Companion. I do think they could use some of that standoff attitude that Amazon has leveraged in the past and instead really focus on key areas where they can build competitive differentiation. I do think that could provide a seamless, more personalized experience. Does this save a company like Target from some of its current woes? No, but does it provide perhaps a more unified ecosystem that gets more eyeballs to its platform from users? I think that’s possible.

Lou Whiteman: I don’t want to pick on Target here because I enjoy Target, but Target is a destination for pragmatists, not for dreamers. I don’t know, back to my other point, Target is where you go when you need dog food or toilet paper or something. I don’t know if I need an AI customized experience for that. I’m not sure I’m ever going to be like, I’m hunting for some nice gift from my wife.

Rachel Warren: Some of us ladies are at Target dreaming as we walk through the aisles, Lou. You have no idea [LAUGHTER].

Lou Whiteman: Maybe so, but I don’t know. I like their curbside drop off and delivery. I think they’ve done good things. I keep going back to this, and I hate to be such a wet blanket, but it feels like a solution in search of a problem for Target here.

Travis Hoium: We’ll see out to see how this plays out and as this vision rolls out, especially with potentially new devices, maybe that will change the game. Next, we’re going to ask the trillion dollar question, and that is how in the world does OpenAI and all of their partners pay for this? You’re listening to Motley Fool Money.

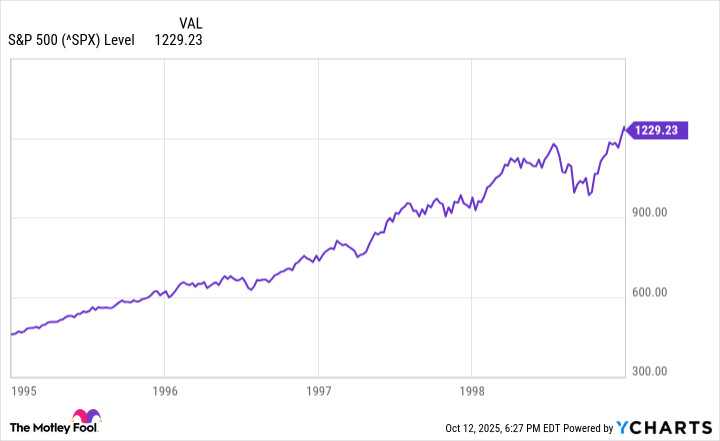

Welcome back to Motley Fool Money. Look, here’s the trillion dollar question for OpenAI. We are through all their partners, spending somewhere around $1 trillion, probably more than that at this point. How are they going to pay for all this, are these apps going to be part of that solution? If you squint, you can see a monetization strategy, but it’s not really clear yet, Lou. Is this going to be the key to the future of OpenAI becoming that company that can pay for tens of billions of dollars of compute each year.

Lou Whiteman: Travis, let’s be clear here. Sam Altman says he’s focused on the customer experience and not monetization. Obviously, yeah, but come on. I do think back to a point you made about, is this a leap step forward or incremental? How do you turn this into a big moneymaker, if it is incremental? I come back to the chicken and the egg question. If you want to make money off of the consumer signing up for premium OpenAI, you darn well better have a lot of retailers, a lot of partners. But how do you get those retailers of partners if you don’t have a lot of people signed up. There is experimentation, maybe there’s losses. That’s why you focus on the customer experience now. Are we headed to Walled Gardens? Am I really going to want to use this if I can get Target but not?

Travis Hoium: It seems like that’s what OpenAI wants to build, even though they’re saying that’s not what they want to build.

Lou Whiteman: Right, well, by default. I think OpenAI would like to be so present everywhere that every retailer just has to be on it the way every retailer is. But right now I can get a Google search and see the world. Until maybe there is just a specialized thing like, I want to use Booking, and I know Booking is on here, and I like the interaction, so I will opt in that way, but that’s not the way to riches. I think there’s again, if this becomes an open field where everything’s involved like Google, I don’t know if OpenAI has the advantage there. I don’t know if commoditization is their friend and if it becomes harder to charge on the back end, so that’s, I think, why they would like just partners opting in. But I think that just makes it harder to get consumer adoption. I think it’s really, really hard to make this pay off in a big way. It could be a side feature, but this is not a core business here for the way they’re spending.

Travis Hoium: What do you think, Rachel? Is this the preview of how is the going to make money? Is it big enough?

Rachel Warren: I think it’s way too early to say. I think, honestly, OpenAI is trying to figure out their monetization strategy at this point. I think that’s fairly obvious. If you think about some of their most advanced models, like Sora. The huge challenge there, training and running those models, that requires enormous investment in computing, power, data centers, and now you have the new app store and the goal seeming is to take a commission on sales from commerce queries, rather than maybe relying on that traditional ad system. I saw one report that suggested there could be something like a 2% affiliate fee in the works, and then you’ve got, of course, this very high investment Sora product, and they’re reportedly moving toward a tiered subscription model.

Travis Hoium: Now, a 2% affiliate fee sounds like a lot. But if you look at how much companies spend [OVERLAPPING] on things like Meta ads. It’s significantly more than that. The customer acquistion cost can be 20, 30% of a purchase price.

Rachel Warren: That’s where you look at all this and you dig beneath the surface a bit, and it’s still really unclear how much of a revenue producing venture are these new initiatives going to be, much less driving the company toward profitability. Obviously, the most significant and immediate source of revenue is likely to be enterprise partnerships, and they do continue to raise massive funding rounds. I think they’re working on their monetization strategy, and they’re seeing what sticks. I think that’s really important to take away from all these recent announcements that we’ve been seeing.

Lou Whiteman: I think one filter to just as you look at all this, remember, OpenAI needs this more than their rivals. Meta has that fire hose of revenue coming in to fund this. Alphabet has Google funding this. OpenAI is the one here as an official nonprofit that, A, they aren’t subject to the same SEC rules, so they can do more of the Silicon Valley fake until you make it. I don’t mean that as against them, I think, as they should.

Travis Hoium: But it worked.

Lou Whiteman: Right, and that should be their strategy, but also they need to be saying, look at us, look at what we’re doing. It’s a neat vision of the future. I don’t think it’s a slam dunk they get there, as I look at this, it looks like a company that is wish casting as much as they are implementing. Part of wish casting is, like you said, Travis, see what happens and stick with what works.

Travis Hoium: I have heard you said that they have to keep spending because if they fall behind, they’re done. They have to keep up with the Alphabets, the Metas, everybody that’s investing tens of billions of dollars, so that’s why this vision keeps getting bigger. Maybe there is a pot of gold at the end of the rainbow, but we will see. As always, people on the program may have interest in the stocks they talk about, and the Motley Fool may have formal recommendations for or against, so don’t buy or sell stocks based solely on what you hear. All personal finance content follows the Motley Fool’s editorial standards and is not approved by advertisers. Advertisements are sponsored content provided for informational purposes only. To see our full advertising disclosure, please check out our show notes. For Lou Whiteman, Rachel Warren, Dan Boyd, behind the glass, and our entire Motley Fool team, I’m Travis Hoium. Thanks for listening to Motley Fool Money. We’ll see you here tomorrow.