AI spending is approaching $1 trillion per year, but will there be a return from that spending?

In this podcast, Motley Fool analyst Tim Beyers and contributors Travis Hoium and Lou Whiteman discuss:

- AI capex trends.

- Housing price declines.

- KPop Demon Hunters and other Netflix content.

To catch full episodes of all The Motley Fool’s free podcasts, check out our podcast center. When you’re ready to invest, check out this top 10 list of stocks to buy.

A full transcript is below.

This podcast was recorded on August 29, 2025.

Travis Hoium: Could AI spending reach $1 trillion by 2030? Motley Fool Money starts now. Welcome to Motley Fool Money. I’m Travis Hoium, joined by Lou Whiteman and Tim Beyers. We’re going to talk today about housing. We’re going to have Lou and Tim cut some of their favorite stocks from a mini portfolio. But let’s start with artificial intelligence. Morgan Stanley recently said that they expect global Data Center spending to increase from $307 billion in 2024 to 920 billion in 2030. Data Center CapEx is driving companies like NVIDIA, Amazon, Alphabet. But they’re not making enough cash to make that investment themselves. Tim, when you see these huge projections, what do you hear, and do we actually have enough cash flow from these companies to spend almost $1 trillion per year on CapEx?

Tim Beyers: We do, and we don’t. Let’s start with the we do. They are committing quarter over quarter, Travis, and these are multiple companies, somewhere between $50 and $100 million every single quarter. That’s extraordinary. I’m sorry. I said million. I meant billion. This is just a few orders of bag which is bigger. This is extraordinary amounts of money. On the one hand, yes, but on the other, this is a market that is completely out of sync. The buildout of hardware is so extreme that the infrastructure to support all that hardware just isn’t in place yet. I know you’ve covered energy quite a bit over the years, Travis, and I don’t see how you don’t get to a point where there is a little bit of slowdown in the hardware buildout, and then you do some catch-up around energy infrastructure, around environmental infrastructure, around city planning, urban planning. How do you get all of this done in a way that actually creates sustainable growth? That doesn’t seem to be part of these projections, and I think that’s one of the flaws.

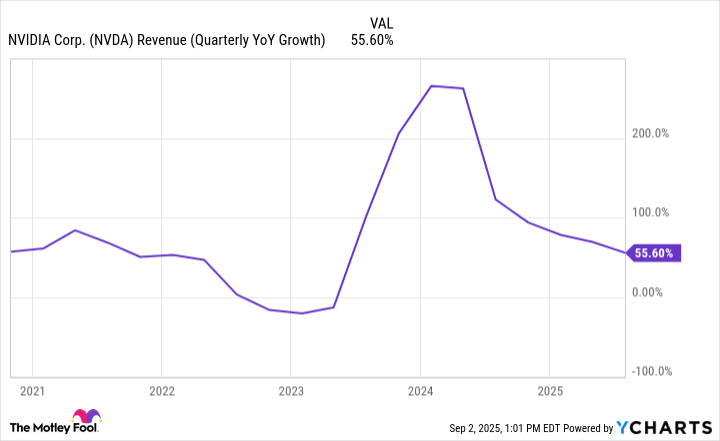

Travis Hoium: It does seem like the numbers are just we’re going to keep increasing this. Going from the ChatGPT moment, that was in late 2022, to where we are today, there has been a massive amount of growth in AI spending in spending on things like NVIDIA’s chips. But we’re still learning what these business models are too. We talk a lot about chips, but there’s more to it than this, than just spending money on these power-hungry chips. What else are they going to be spending money on?

Lou Whiteman: With all respect to Morgan Stanley, I do think that it’s smart research. But humans, we are terrible at recognizing cycles, recognizing pendulums for being pendulums. I feel like some of this is just taking what we’re doing today and assuming it into the future, and not considering a swing back. We’ll see about the actual number, but we’re going to spend a lot of money. I do think that at some point, Tim mentioned energy, we’re going to have to spend money on ways to be smarter about energy consumption or building out energy, so that’s part of it. I do think we’ve seen all of this hiring, this poaching, maybe a shift from building up this hardware to getting the brains that know how to use it. I wouldn’t be surprised if, at some point, just instead of just pure hardware and all this data center spending, that even if we still spend a significant amount of money, the spending gets spread out in ways that we’re just not seeing right now at the initial buildup.

Travis Hoium: Tim, the way that you’re talking about this reminds me a lot of the late 1990s and the telecom buildout. There was a dual bubble. We talk about the dotcom bubble. That was a dotcom stock bubble, but there was also a telecom bubble, which is basically these companies spending incredible amounts of money to build out the fiber that we still use today. Google bought up a bunch of that dark fiber. That’s one of the reasons that they have as good infrastructure as they have. What you’re saying reminds me a little bit about, you know what? The numbers are just going up so fast. Demand is going up so quick, and we hear this from every AI-related company that we’re just going to keep building and keep building at some point, there has to be a business model behind it. There has to be return on investment. If we’re talking about $1 trillion of investment, you’ve got to have some profits coming from that. Most of these companies aren’t profitable. Is that a good analogy for thinking about it, or is there a big difference in this buildout versus that telecom buildout?

Tim Beyers: You would hope there’s a difference. I don’t know that there’s a difference, and I think there is a genuine fight over the right economic model for AI, particularly any commercial AI. I think you have two ways to fight the portal fight. What I mean by the portal fight is, I think we are getting to a point where the next interface for computing is likely to be a chat interface. It’s likely to be some kind of, hey, ChatGPT, do this thing for me, or search for this thing, or whatever it is. Some chat interface. Now you’re going to have ChatGPT anthropic, companies like that that are native to the business of building up a chat portal. That’s their primary economic engine, and they want to build things that make that chat engine economically viable. Then you have a competing idea, which is the search model, the traditional web model, and then putting on top of that a chat portal, and that is Alphabet. That is Microsoft. That’s even Apple with Siri. Those two ideas are going to compete. There’s going to be a real fight to figure out who wins in that model. There’s going to be lots of trial and error here, Travis, between is it all going to be driven by advertising? Is it going to be driven by data access? Is it going to be driven by new tools to make different kinds of software that run from a chat interface? But those different types of companies converging to fight a battle to win the portal War, I think, is something we’re still in the infant stages of seeing that. It’s barely started. But that’s a big piece of this story that we aren’t talking about yet, but I promise you in the next 18 months, we’re going to be talking about it.

Travis Hoium: I saw somebody compare the moment that we’re in in artificial intelligence to the Motorola Razor moments. That really stuck with me. That was my favorite phone, I think 2005. But that was obsolete two years later.

Lou Whiteman: I love that phone. But this is such an important part of the AI conversation for us as investors to have because, Travis, to your point a lot of fortunes were lost on that infrastructure buildup, but it was still value adding over time. All of this money is being spent. I think it is adding value. There is a there there. This isn’t just crazy spending, but if history is a guide, that does not translate to every one of these investments will be a winner. As Tim says, there will be a period of figuring out who’s the winners, who’s the losers. I think there could be a lot of winners that aren’t spending the money, just using AI. Just to use one example, MongoDB was up 30% post earnings today on a huge surge of customers attributed to AI. There are going to be a ton of winners. They’re going to be losers, and we’re just so early. If nothing else, you just don’t put all your eggs in one basket here as an investor.

Tim Beyers: Can I add something there, Travis? Just quickly. One of the things that’s common about that. Now, we can’t be sure that MongoDB is going to be a durable winner here. But one of the things that’s true at least today about that MongoDB result is that they sit in one of the categories that historically, over time, you were likening it back to the dotcom bubble, the telecom bubble, the things that did endure from those periods, at least over time, it took some time to wash away all of the excess. But the companies that didn’t go away had real picks and shovels that they could rely on and build upon for the revolution to come. MongoDB is in that space. They’re not the only ones. If we’re an investor that’s looking to profit from the time that we’re in and the excess that we’re in, please, for the love of God, don’t just look at NVIDIA. Look for the picks and shovels. MongoDB might be one. We can’t say for sure that they will be, but they might be one. Any company that is in successful data management is one to at least consider.

Travis Hoium: One of the problems with the telecom buildout was the debt that those companies ended up taking on that increased their risk of their business. Right now, we have Amazon, Microsoft, Alphabet, and Meta generating almost $500 billion in operating cash flow. They’re spending about 365 on CapEx. That’s a projection for this year. They’re using almost all of their operating cash flow on CapEx, in other words. Are we going to get to a point where they’re going to be going into debt to build out more AI solutions?

Tim Beyers: They might, but they certainly have the cash flow to service that debt. You could see it. I’ll make a reckless prediction on this, Travis, you won’t see that. You will see a relentless focus on efficiency first because there is a software side of the AI equation that we haven’t figured out yet. Right now, most of these models are very dumb. They use a lot of tokens. They just burn through all kinds of energy. Almost indiscriminately, that can’t last. There is real engineering work that is happening and will continue to happen to make models, tools far more efficient. I expect, Travis, that you’re going to see a lot of focus on that at the labs at AWS and Google Cloud Platform, and at Microsoft. I just don’t see how they get around that because ultimately, those companies want to see more software built. If you want to build more software, you need better tools, and there just is no way to get around the need for clever, efficient software engineering. That’s just common.

Travis Hoium: Lou, what’s the big picture here?

Lou Whiteman: The big picture I’m watching, we’re talking about all this spending, and, arguably, AI spending is keeping the whole economy afloat right now. I think that’s a little bit of hyperbole, but not too much. The economist, venture capitalist, nature hiker, Paul Hodorowski, great guy. He put out something last month that was really interesting. AI spending is about 1.2% of GDP. That’s higher than it was back in the telecom boom, higher than the Internet. You have to go back to the 1880s, Travis, with railroads to find a time when one sector had that large of a role. At a time when we’re talking about Tara, so the consumer looks pressured, is AI spending just the only thing keeping us afloat? If so, and some of these pressures do build or what could that mean? I can’t answer those questions, but it’s just a broader investor. Those are the things that I don’t know that keep me up at night, but those are the things I’m really watching.

Travis Hoium: We could talk about this all day, and I’m sure this will be a continuing topic, but we do need to take a quick break. When we come back, we’re going to talk about housing prices and the trends that we’re seeing there. You’re listening to Motley Fool Money.

Welcome back to Motley Fool Money. We got a reading from the Case-Shiller Index this week for July. This measures the value of home prices throughout the country, and there’s regions all over the country. Housing is always a regional dynamic. But we are seeing declines in home prices, especially in some of the hotter areas like Florida. Housing is the biggest asset for most Americans. Tim, what should we take away from the potential that home values are going down, not a lot, but at least a little bit throughout the country?

Tim Beyers: It’s healthy. I look at this, Travis, and to me, it feels like a very healthy reset because we badly need more supply in this country. We just don’t have enough, and we haven’t had enough homes for quite a long period of time. When you inject supply into the market, you may see a little bit of pressure on pricing. Pricing comes down a little bit if demand just keeps going, unrelenting, then prices go way up. As supply comes into the market, prices go down a little bit. This feels like exactly what we need right now. I’m very happy to see it. Now, what I’d be looking for is what homes are we talking about here? Are we getting more planned communities? Are we getting more urban housing? I, in particular, think a bit of urban investment is probably the right thing.

Tim Beyers: Because that has economic knock on effects, not that I don’t, like, hey, I live in a suburb. Suburban investment is great, but urban investment where there’s a lot of businesses, there’s a lot of concentrated economic activity. If you get some of this housing influx, new supply, Travis, then I think you may have some knock on effects that are very good for the US economy and very good for consumer facing businesses. I’m hopeful here, but I might be a little bit naive.

Travis Hoium: What do you think, Lou?

Lou Whiteman: I think healthy is a good word. I don’t want to read too much into this. I think this is a sign of just things are getting back to normal. We had a huge price shock. Housing slowed dramatically as we saw rates go up and just we weren’t ready for it. I think what we’re seeing in this data is buyers and sellers returning to the market. A lot of that added supply are just people who have been sitting on their home and are just now saying, we just have to suck it up and sell.

Tim Beyers: That’s because housing is a very sticky thing. If you buy a house and the interest rate goes up, you go, I could double my mortgage payment by moving to a similar home, but that doesn’t make any sense. It is a strange business.

Lou Whiteman: Well, here’s the thing, too, that is interesting, I think, because there’s a lot of macro headwinds that are new supply. Homebuilders are under a lot of pressure in a lot of different ways now between labor, raw materials, all that. I said if we’re just finally adjusting to the rate hikes, there’s a lot of talk now of rates coming back down. I don’t know. The conventional wisdom is that with juice sales, but does that set unrealistic expectations? Does that actually slow sales temporarily? Because we’re just getting used to the status quo, we’re changing again. Look, whatever the Fed does, I think everything going on in the world, all signs are the longer term rates and the mortgages are tied to the 10 year. I don’t know if a Fed rate cut really moves the 10 year and moves the mortgage rate the way, in Econ 101, we were told. If those headlines are there and people aren’t seeing the mortgage adjustment, I have no confidence that this continues. I think there could be another different shock right around the corner, and then we’ll have to adjust to that.

Travis Hoium: For perspective on the 10 year, the 10-year yield has not changed basically since election day. It’s basically flat. I think there has been two rate cuts and another one rumored for September. The other thing I want to bring in here, and this comes down to some of the unemployment numbers that we’ve seen recently, and the Fed talked about this in their Jackson Hole speeches that part of the issue with the headline number, the number of jobs added or not added in the recent revisions, was that there’s just fewer people in the labor market. That could help housing prices, but that’s the other side of the supply and demand. Tim, is that a piece of it that there’s just fewer buyers in the market than there used to be, partly because of less immigration?

Tim Beyers: That could be. I don’t know, but I think Lou made an important point, so I want to double underline it here. This is very complicated. There are a lot of moving parts. The unemployment numbers are going to be important here. We have continued to see layoffs, Travis. I think the thing that I don’t want and I hope I’m not just taking out of context what you were saying here, Lou. But the way I think about it is that if there’s artificial stimulus that comes in at the wrong time, just when we’re seeing a healthy sign come into the market, if you muck with that with more artificial stimulus, let’s say, a poorly timed rate cut, you start to lose some of the benefits you would get by seeing the market return to health. I want the market to just be healthy.

Lou Whiteman: Bottom line is, as an investor, housing looks like even a bigger long term trend to me than AI, but it scares me right now. I don’t know how soon that comes.

Travis Hoium: Well, next up, we’re going to get to a few stocks that we like or maybe don’t like in our game called Cut Down Day, you’re listening to Motley Fool Money.

Welcome back to Motley Fool Money. The NFL has just completed. It’s cutdown day. Roster has gotten down to 53 players. Today’s game that we’re going to play is a little bit similar. I’m going to give Lou and Tim three stock portfolios, just three stocks in the portfolio. We’re going to hopefully get through all four of these. They’re going to have to cut one of their favorite stocks or Foolish favorite stocks. Put on your best Dick for Mal hat and shed some tears for some of the stocks that you probably love. The first portfolio is Foolish favorites. Tim, I want to start with you because I know that you have a long history with a lot of these companies. Netflix, Amazon, and NVIDIA, if you own all three and you’d have to cut one from your portfolio, which one gets the boot?

Tim Beyers: It’s going to be very unpopular.

Travis Hoium: Oh, no.

Tim Beyers: It’s going to be NVIDIA. NVIDIA has got to go. I’m sorry, NVIDIA. I’m sorry, Jensens. The reason NVIDIA’s got to go is because this is a business that is highly cyclical. It has been an absolute stone cold winner, and it could continue to be a stone cold winner. But for me, one of the ways that I practice portfolio management, Travis, is I don’t want to sell everything off of a stock. But let’s say, in this particular case, I’m selling, 75% of my NVIDIA, and I’m redeploying some of that capital. If I have to sell all of it, I will, because what I want to do is always keep moving forward. In a portfolio, sometimes you let go of those darlings in order to keep building and moving forward. In this case, you know what? You’ve been great NVIDIA, but your time has come. Got to give a rookie a shot.

Travis Hoium: All right, Lou. Which one Netflix, Amazon or NVIDIA?

Lou Whiteman: I think Tim has the right answer here. But just to have fun, I do want to give a shout to cutting Amazon. Again, I’m glad we don’t actually have to do these. But look, Amazon, their AI performance to date, hasn’t matched the Cloud. We’re not seeing the same, oh, my gosh, growth we’ve seen elsewhere. I think Microsoft and even Google has a better portal to the customer in a lot of ways, which I don’t know. Also, you do have a fantastic retail business, but it’s a retail business. The divorce with UPS means they weren’t giving their easy deliveries to UPS guys. They were giving the ones that were hard for the internal, so I think there’s going to be some cost pressure on the internal logistics. Look, great company, but I do think they could come under pressure in a bunch of different ways up ahead.

Travis Hoium: But Netflix is the stock that you both want to keep. I think that’s interesting, given Netflix is actually losing time spent to YouTube. Why is that one, Tim, the one that is the winner out of these three?

Tim Beyers: Because I think it’s a two horse race between Netflix and YouTube.

Travis Hoium: You don’t think Disney stands a chance? I say that because sports is really the only uncaptured territory in streaming.

Tim Beyers: You know what? Guess what Netflix just did. They wrote a new deal, and this time, they picked off two things from Major League Baseball that are events that are going to capture a global audience. They’re going to have the world baseball classic between the US and Japan, and they’re going to have the home run derby. For the all star weekend. They’re going to under commit on capital and get in, the likely outcome is you’re going to get some rabid fans who are going to show up for just these things, and they don’t have to overcommit on a giant contract to be the exclusive home of Major League Baseball. They’re very smart about this, Travis. They are really good users of capital. I’ll just remind everybody, this is still the only global TV network that across the world has a direct relationship with every single one of its subscribers. It’s the only one.

Lou Whiteman: I just add, of these three, and again, this is a best of show. These are all, top companies. Netflix, to me, feels the most stable in their most important market in terms of volatility.

Tim Beyers: The cash flows would support that, by the way.

Travis Hoium: I guess there’s no real argument for me I guess Netflix would probably be Number 1 for me, as well. Let’s do Portfolio Number 2. That is the Hidden Gems. These have all been phenomenal performers in Hidden Gems. Tesla, Shopify, and Meta Platforms, formerly Facebook. I still think they should change their name back to Facebook or maybe just call themselves Instagram. Lou, which one of these three would you cut from your portfolio?

Lou Whiteman: Again, this is hard. I have to go with Tesla just on the core business here, because, sometimes I feel like I like Tesla’s automotive business more than Elon Musk.

Travis Hoium: It still don’t have a roadster.

Lou Whiteman: No. Honestly, they just need someone from Detroit to come in and just Detroitify it just a tiny bit. But there are questions about that business. There is still a great long term future story to be had with automotives and out so I don’t want to be too hard on it, but I look at Shopify. I look at them just beginning to conquer all worlds, and I see a lot of potential from there. Meta, Zuck, I love you. I can’t quite always figure out what Zuckerberg’s doing, but it works, and they have a case printing machine, which I am just going to bend the knee and be in awe of. Tesla, to me, is the one that I think I can ask the most questions about. Again, in a best to show, were really fascinating companies, they’re the one that I lean to.

Travis Hoium: What about you, Tim?

Tim Beyers: I’ll give you one number, and this will describe why I’m saying what I’m about to say. Nine, Mark Zuckerberg is giving out nine figure packages to AI engineers. No thank you. You’re out. As soon as you start going to $100 million packages to try to get to AI super intelligence, when there’s still so much we don’t know, no thanks. None of this makes very much sense to me. Now, to be fair, they generate a ton of cash. It’s not like they can’t do it. They can do it. But they are going to dilute investors on the way to this. I think this smacks of more desperation than strategy. See you.

Travis Hoium: Do you have the same criticism for Alphabet? Because Alphabet bought Character.AI basically to reacquire one person, the person who invented the [inaudible] this is not unique in Silicon Valley. Especially today.

Tim Beyers: A hundred percent, Travis. You could level this criticism at lots of different companies at lots of different times. Especially the Silicon Valley companies. Alphabet absolutely deserves criticism for that. There’s no question. Now, would I rather have Alphabet than I would Meta? Yes, I would. Because I feel like the data advantage that Alphabet has is extraordinary. It is also global. It is significant, and you can build a lot once you have, so much search data, so much geographic data. They just have a massive data mote that I think they can build off of. But, no, they do not escape criticism. I think it’s a fair point, Travis.

Travis Hoium: The spending spree will probably continue at least as long as the market is giving these multiples for anybody that has some AI story. Let’s go to our Rule Breaker stocks. This is three popular and very high performing Rule Breakers.

Travis Hoium: MercadoLibre, Intuitive Surgical, and Chipotle. Tim, out of those three, which one gets cut?

Tim Beyers: Really hurts me to say this. This is very painful. I have to say Chipotle, which just kills me because I love a Chipotle burrito. But at this moment in time, I think that Chipotle is still figuring out the next phase of its growth, and I’ll be back when you figure out the next phase of your growth. I’ll be back. But robot surgery is only going to grow more important over time. Mercado Libre they’ve barely tapped the opportunity they have across Latin America. Chipotle burritos are amazing. I will continue to eat them, and I will be back when Chipotle figures out their next phase.

Travis Hoium: If you want to hear a painful story about Chipotle, I sold my shares in 2008. That is painful. That was a mistake selling, which anybody who’s invested for a long time, your worst mistakes are usually your sales, not the stocks that you necessarily miss. Lou, Mercado Libre, Intuitive Surgical or Chipotle, who gets got from your portfolio?

Lou Whiteman: I really wanted to find something else, but Tim’s right on this one. Just to underline a couple more things. Mercado Libre, in some ways, is a consumer business, but not in the same way. They’re just, by the nature of the industry, there’s so much more choice. It’s so much hard to fuel growth in a restaurant business versus the other two. The other two, it’s not as simple as just keep doing what you’re doing, and the business will come, but especially on Intuitive, it feels that way. Like Tim said, Wall Street pays for growth. Wall Street does not pay for just, hey, you’re a good performer. Just continue what you’re doing. I think they may be able to answer the question. It’s almost a running joke. It’s like the Apple car and breakfast at Chipotle. Maybe they’ll get there. Maybe it’ll happen, but I do think that their path forward from here is harder than the other two.

Tim Beyers: Having said that, Travis, like super quickly, if the Chipotlanes take off across that network, look out. If volumes across each unit, like if Chipotle materially increases the volume, they can do per store by virtue of those drive-through Chipotlanes, look out, man. There could be some real winds there, but we’re not seeing that yet.

Travis Hoium: Yeah, that’s basically the only way that I use Chipotle today. I don’t want to get the kids out of the car. We’re going through that Chipotle lane, and everybody’s going to have their food finished by the time we get home. Final group of stocks, I love them all, but they all make me a little nervous for one reason or another. Exxon, Palantir and Arrow Virment Lou, which one of those three is cut today?

Lou Whiteman: I’m going to invert the game here and say the one that I’m not going to cut is Exxon.

Tim Beyers: The price doesn’t make you nervous.

Lou Whiteman: Valuation all over the place here, but just Exxon’s ability. I’m an owner of this one, and I keep saying, oh, they can’t do it again, and yet they do. I’m going to give the benefit of the doubt, given their ability, not just to add new customers, but they have done such a great job of continuously just layering on new products from tasers to body cams to software to now drones and cameras. You got to pick someone. I believe in them to continue. Arrow Virment, I think, could have a really tough time over the next few years, but I love the long-term potential, so I’m not going to cut them. Palantir, I love the technology. But I’m an old school government guy, and all of these companies have government ties. Palantir is still over 50% government. I know the way government allocation works. There is no way you can justify that valuation of the government, so they have to really just grow that commercial like nobody’s business. I think they have it in them, but I am guessing. Just like Netflix, just like Amazon, this really looks like a company where both things can be true. It’s a big long-term winner, and there’s massive drops along the way. I’m going to say goodbye to Palantir here.

Travis Hoium: Tim.

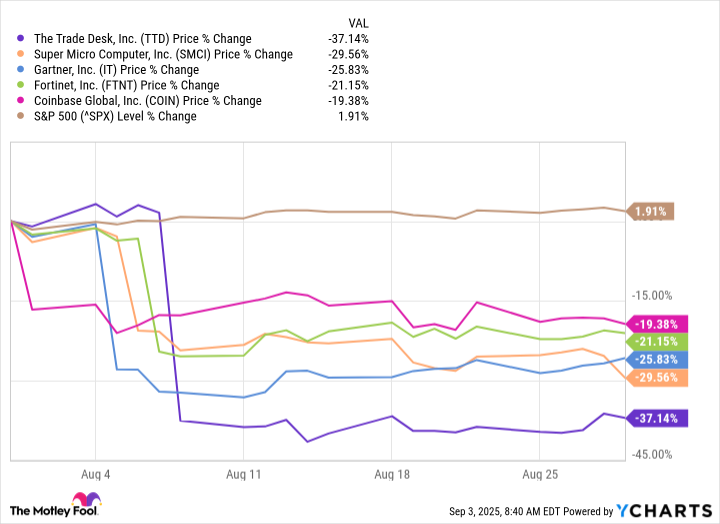

Tim Beyers: Same. I’m not sure. I can’t say it better than that. I will only add that we should consider, in my opinion, Palantir a deeply cyclical business, and it trades like it’s not a cyclical business. And that, I think, should make investors nervous.

Travis Hoium: Well, some very interesting picks from all of you and some great insights on at least why we should be thinking about valuation and growth for some of these companies. Next up, we are going to get to stocks on our radar. You’re listening to Motley Fool Money.

Ava: Hi. This is Ava from Vanta. In today’s digital world, compliance regulations are changing constantly, and earning customer trust has never mattered more. Vanta helps companies get compliant, fast, and stay secure with the most advanced AI automation and continuous monitoring out there. Whether you’re a start-up going for your first SOC2 or ISO 27001, or are a growing enterprise managing vendor risk, Vanta makes it quick, easy, and scalable. I’m not just saying that because I work here. Get started today at vanta.com.

Travis Hoium: Welcome back to Motley Fool Money. As always, people on the program may have interests in the stocks they talk about, and the Motley Fool may have formal recommendations for or against, so don’t buy or sell stocks based solely on what you hear. All personal finance content follows Motley Fool editorial standards, and it’s not approved by advertisers. Advertisements are sponsored content and provided for informational purposes only. To see our full advertising disclosure, please check out our show notes. We do need to touch on the hottest movie of the week. That is KPOp Demon Hunters, Lou, and Tim. Did either of you see this, Lou?

Lou Whiteman: I didn’t know about it till you asked. [LAUGHTER]

Travis Hoium: Apparently not the target demographic for this movie. But what’s unique about this and what I think is interesting for our investment discussion is, this is a movie made by Sony that ended up on Netflix and became just an absolute hit. I can’t avoid it with my kids. We have not watched it, but it pops up every single time we open up Netflix, and now it ended up in theaters, and it’s been a smash hit in theaters. I had no idea it was coming, except for multiple parents brought it up over the weekend. Are you seeing KPOp Demon Hunters? Tim, is this one is this a new model for the industry? And two, I think it’s interesting that no one saw this coming, including Netflix. It seems like they’re throwing content at the wall, and they don’t know what’s gonna hit. But every once in a while, they hit KPOp Demon Hunters or Squid Game. Is that the strategy for them?

Tim Beyers: Well, it is. The strategy for Netflix is to build a long tail. The longer the tail is, the more opportunity you have to get unexpected hits. And the thing that really makes Netflix sing and what drives that cash flow is you have a hit that goes across multiple territories. Netflix is not. They are the opposite of the max strategy, where you’re going to invest in a very big franchise name, and you’re going to have to put a lot of money behind that franchise name, and then you hope that it delivers just huge returns. Netflix does the exact opposite of that. Lots of seeds, and then something grows into just this giant, beautiful flower that you just can’t help but admire it. We’ve seen this over and over and over again. The Queen’s Gambit did this, Squid Game did this. Wednesday did this. There are some others that are multi-territory hits that are on a smaller scale. Well, I’ll recommend it to you, Travis, Department Q. Great. There’s little things like that. It is a deliberate strategy. It’s going to keep happening. It’s one of the reasons why we should believe in.

Travis Hoium: Lou, do theaters matter and does the order matter theaters first or streaming first?

Lou Whiteman: I don’t think the order matters anymore. I think we’ve evolved to a point where it’s a very different experience. One is more of a communal, and one is more just kind of at home. I think that the same property can work depending on what you’re trying to accomplish. It depends on the group, but more and more, I don’t think it matters. It’s just you put your assets in the ways where it generates money, and it all works out in the end.

Travis Hoium: We’re going to end with stocks on our radar, and I’m going to play the role of Dan Boyd today. Tim, what are you bringing to us for our radar stocks?

Tim Beyers: I’m bringing you Warby Parker. The glasses maker that originally made for selling glasses online, you could get a big package in the mail. You could try on several sets. You use your computer camera to check the fit and check your prescription. They have since moved dramatically from that, Travis. Now they have just under 300 stores across the country. Those stores are highly profitable. Over the trailing 12 months, even when you strip out the stock-based compensation, they’re still generating free cash flow. This is a business that’s getting more and more efficient over time. I’ll give you one stat on this to highlight that. In the most recent quarter, revenue up 13.9%, operating expenses up 3.3%. This is a business that’s getting better and better and better, and I think it’s one for the future. Look out. We’re seeing clearly with Warby Parker.

Travis Hoium: Lou, what are you bringing to radar stocks today?

Lou Whiteman: I’m watching CSX, the Railroad and only watching. The stocks are about 10% down this week, it seems, because no one wants to buy them. CSX’s primary rival, Norfolk Southern. They are going to be acquired by Union Pacific. That puts CSX in a really tough position. And conventional wisdom is that they would get bought by Burlington Northern. However, Berkshire Hathaway, and this does sound like a soap opera, I know. But Berkshire Hathaway, which owns Burlington Northern, Warren Buffett says, no, thank you. I don’t want to buy another railroad. Canadian Pacific said no, too. This is a mass guy, and the market’s reaction to sell off CSX, makes sense. But this story is far from over. For one, we don’t even know if that deal will get through. It’s possible regulators will carve out rules that make it interesting for everyone. I’m not ready to jump in here, but I feel like there might be an opportunity if the market overreacts to their seemingly getting left at the altar. So one to watch.

Travis Hoium: As much as I like these transportation stocks, Lou, Warby Parker, I think is interesting. The deal with Target, we’ll see if that gives them a little bit more legs, a little bit more growth. I think it’s interesting that these DTC companies making these retail partnerships. I don’t know if they all win, but if they can, they can get a little bit more exposure; it could be a big win for them. For Lou Whiteman and Tim Beyers, thanks for joining me today and our production magician Bart Shannon and the entire Motley Fool team, I am Travis Hoium. Thanks for listening to Motley Fool Money. We’ll see you tomorrow.