Alphabet shares jumped after the search giant won a big court battle that will allow it to keep Chrome, Android, and search distribution deals.

In this podcast, Motley Fool contributors Travis Hoium, Lou Whiteman, and Rachel Warren discuss:

- Google keeps Chrome.

- Kraft Heinz to split.

- An IPO frenzy.

To catch full episodes of all The Motley Fool’s free podcasts, check out our podcast center. When you’re ready to invest, check out this top 10 list of stocks to buy.

A full transcript is below.

This podcast was recorded on Sept. 03, 2025.

Travis Hoium: Alphabet stock is up 9% today. Did the courts save Google’s cash cow? Motley Fool Money starts now. Welcome to Motley Fool Money. I’m Travis Hoium joined by Lou Whiteman and Rachel Warren. Let’s start with the big news today, and that is Alphabet. The stock is soaring today. After the market closed on Tuesday, we learned that Google, will technically still a monopoly isn’t going to have to change a lot about its business, not going to have to spin off Chrome or Android. They can still pay to be the default on devices like the iPhone. That’s going to be a benefit for Apple as well. There were some changes. They have to share data with competitors. We don’t know exactly what those details are going to look like. The idea is to bring more competition into the market, but ironically, OpenAI and the competition from artificial intelligence may have saved Google’s massive search business. What did you take away from this, Rachel?

Rachel Warren: I think this is definitely a case that shareholders in Alphabet like myself have been watching closely for a while now, and I think the key takeaway here is, Alphabet has avoided the worst case scenario that I think a lot of investors had feared, and shareholders like myself should be happy with that. But I think there’s also been a lot of confusion around this case, trying to understand why is this so important to Alphabet’s future as a business? Well, Chrome plays a really instrumental role. Really in the ecosystem that Alphabet has, it’s a key distribution channel for its profitable Google search business, its advertising services. The Chrome browser itself isn’t directly monetized, but it has this key and dominant market position, and so that allows Alphabet to maintain control over user data, over the flow of Internet traffic. It also reinforces the dominance of Google search, because Chrome has been set historically as the default search engine. It’s also a really crucial mechanism for collecting data on user browsing habits. It serves as a really key entry point to the broader Google ecosystem. It encourages users to adopt other products, like Gmail, Google accounts, their AI product, Gemini. I haven’t wavered on my thesis for this business. We’ve seen the stock really beaten down in the last months in anticipation of this ruling. Shares soaring today. I think that this ruling reinforces the strength of the business as it moves forward in the AI revolution, and I think investors should be happy with these results.

Travis Hoium: Lou, this is one of the companies that has been the cheapest in the Mag 7 for quite a while. Earlier this year, trading for less than 20 times earnings. We’re now up to 22, 23 times earnings, but it seems like this is a sigh of relief for a lot of investors in Alphabet, given that Google, and we’re going to use these names interchangeably, but Alphabet is the parent company, Google is the business that we all probably know and use, but it’s a sigh of relief for investors right now.

Lou Whiteman: Google’s to cash cow. For these purposes, we can go ahead and talk. This is Google. It isn’t status quo. I think, the lawyers would argue with me on that, and both sides are going to appeal because that’s what they do. But as far as we need to look at it, it is the status quo, that the important tenants that have made Alphabet the business they are, that they remain. I think, Travis, the lesson for investors here is, yes, it’s underperformed. I think a lot of that has been just vague fears but antitrust. We probably were too clever for our own good beating the stock down, worrying about this stuff. Yes, we’re getting a bounce back rally here. We were probably overly worried about it before, but the Alphabet we know, this cash cow generate money making machine, there’s still threats out there, but the government isn’t going to break it up. We can just keeping on.

Travis Hoium: One of the reasons they’re not breaking it up that I thought was really interesting in the opinion was because of artificial intelligence and companies like OpenAI. They basically said, you know what? A few years ago, I believe the term was a no fly zone for investors, and then said, you know what? There’s hundreds of billions of dollars flowing into these AI companies that have explicitly said they’re going after Google’s business. Lou is, this one of these cases where disruption or the potential for disruption came out of nowhere? This suit was filed long before ChatGPT was launched. OpenAI existed at that time, but ChatGPT was not the name that it is today. Now you do have this vector of competition that has allowed Google to keep these points of strength and maybe give it a little bit of a leg up, trying to compete with these companies that everybody thinks is going to disrupt the core search business.

Lou Whiteman: Definitely. It’s a fascinating case. I guess, to the court’s credit, they did adapt at times. Because the court wasn’t stuck in the past here, which they could have been. But now, look, disruption is real. As an investor, you always have to be watching all things. We were so focused on the court case. I don’t think we’ve ignored AI, but I do think, AI is coming, whether or not that’s a threat to Google or an opportunity both, probably. But it’s funny to think about how the world has changed since this suit was first filed. I think the court appropriately reflected that change in their decision. They’re not anchored in the past, which they could have been.

Travis Hoium: Rachel, one of the companies that we probably aren’t talking enough about today is Apple. Apple is the company that is getting that $20 billion or so check from Alphabet, from Google, every single year to be the default on the search engine. That’s one of the things that was kept in place in this. They can pay for this. The logic here was pretty interesting. It wasn’t that this wasn’t going to help Google maintain its previous monopoly status. It was going to harm the ecosystem. That check that they write gets the most attention. But if you think about companies like Mozilla, I think, it’s 80% of Mozilla’s revenue comes from a similar deal with Google to be paid to be the default search engine. If that money goes away, Mozilla has a really hard time building their browser. But this is a big benefit for Apple, who’s going to continue getting this cash cow, for essentially doing nothing but saying, hey, default is Google.

Rachel Warren: Well, even though Alphabet can’t enter into deals that would prevent other search engines or browsers from being pre-installed on different devices, as you noted, it can continue to pay these fees to distributors. Apple being a key entity there to be that go to or default search engine. There is a real positive impact for Apple, which interestingly, hasn’t seemed to really respond in terms of a share price perspective, the same way that we’ve seen Alphabet shares rocket today, but that essentially secures what is something like an annual payment of $20 billion from Google for being the default search engine on iPhone. There are certainly reverberations from this ruling that go far beyond just the Alphabet ecosystem.

Travis Hoium: Final question for both of you, and just to put some numbers on Apple. Apple stocks actually down as we’re recording. We’re about an hour into trading on Wednesday. That’s a shocker to me, because I think that was really financially the biggest risk if they were deemed not able to pay that fee to Apple to be the default search engine, that could have just been money that Google kept rather than paying to Apple. But the market is not seeing it that way. Alphabet stock is up about 8% as we’re recording. We now know that this is at least for now behind us. Lou said that there are going to be appeals. Rachel, I’ll start with you. Do you own shares, and does this make you more bullish or does it change your thesis with Alphabet at all?

Rachel Warren: Interestingly, I own shares of both Alphabet and Apple. Speaking to Alphabet specifically, I think my thesis on the company remains unchanged. I had not been, perhaps, as alarmed by what we had been seeing in this particular element of the antitrust case in recent months as, perhaps, the market’s broader reflection was. I had an inkling that this would be something that would perhaps end in Alphabet’s favor, based on just the trends we’re seeing in the AI space. I think, as Lou mentioned, the judge’s ruling was very much within the context of the changes we are seeing rapidly amid the AI revolution. For Alphabet shareholders like myself, I think this really bolsters the underlying thesis that this is a business that has a really key role to play in the AI space moving forward.

Lou Whiteman: I don’t know, neither. I’m the Mag 7 through all my mutual funds, so I just don’t bother. But I will say, Alphabet still looks intriguing to me. We were caught up in this anti trust thing. We’re still caught up in the AI threat that could be an opportunity. There’s always dramas. There’s always something to worry about. Alphabet is a really well run good company. I think buy good companies for the long haul, focus on that long haul. I think it works here. I think if I was to buy a Mag 7, Alphabet would be on the top of my list.

Travis Hoium: Alphabet is another one that I own, as well. I just have not understood why this was so overlooked by the market, but maybe that sentiment is going to be changing just for a little bit of perspective. They’re still growing their revenue double digits. Apple, three-year growth rate 1.8% on a compound annual basis. Yet, Google even after today’s move is trading for about 22 times earnings. Apple’s trading for 35 times earnings. Maybe we see an inversion of those in the future, but I think Alphabet is probably much better positioned today knowing that they’re going to keep Chrome and Android in house. When we come back, we’re going to talk about the resplit of Kraft Heinz, and Lou is going to explain what dis-synergies are. You’re listening to Motley Fool Money.

Welcome back to Motley Fool Money. Kraft Heinz has plan to split again into companies that they are currently calling Global Taste Elevation and American Grocery Company, inspiring names coming out of Kraft Heinz. The other thing that they talked about was the dis-synergies of this deal. Lou, this has been, I think, probably a failure up and down. It’s hard to look at this merger, what was it a decade ago and see really any positives. But first of all, what are these dis-synergies? What are you taking of this resplit of the company?

Lou Whiteman: Those terrible names are probably the icing on the cake. They’re the perfect final chapter of this. Dis-synergy seems like the perfect term because there is no way this drives efficiency, getting smaller, doubling up back off, because everything we talk about when we talk about the advantage of M&A, they are getting rid of. They are using terms like simplicity, but for logistics, for negotiating just share in grocery stores, scale matters. Bottom line here, Travis, like you said, this has been a disaster. This has been a failure of management. The deal made sense. The compelling, if you get it right, made sense, but the execution was wrong. Now it’s back to the drawing board. They’ve already divested some assets. Honest to God, I wonder if that isn’t just a better way to go here, see what they can sell off to others, because scale does make sense, but it has to be scale in the hands of a management team that knows what to do with it.

Travis Hoium: This seemed to be, at least when the deal was initially announced, a management team that should have known what they were doing. 3G ran the deal. Buffett was involved. Rachel, how does this go so wrong for investors, because this seemed like one of those slam dunk businesses. Kraft and Heinz aren’t going anywhere. Turns out they are.

Rachel Warren: Look, I mean, the namesake brands aren’t going anywhere, even if they’re under different entities moving forward. But it’s very fair to say that this merger, which was engineered by Buffett along with 3G Capital back in 2015, it has not performed as expected. There’s been a lot of challenges for the Kraft Heinz business in particular. I mean, that’s very much been reflected in the share price of the company in recent years. There’s been a shifting consumer preference toward healthier options and away from a lot of the process products that Kraft Heinz sells. They have, as a business, had to enact significant asset write downs. All of this has created a picture of difficulty for the business, and it’s also been a difficult dynamic for Berkshire Hathaway. This is a company that is the largest shareholder of Kraft Heinz. They hold a 27.5% stake in the business. Buffett has been doing the interview rounds the last few days. He said he believes this is code a repudiation of the original vision of the 2015 merger. There’s a lot that’s gone wrong with the business the last few years. It’s really unclear, though, whether trying to turn the ship around, so to speak, from that decision made a decade ago is actually going to solve the problems that Kraft Heinz is facing.

Travis Hoium: Lou, I’m going to put you on the spot. We have two companies. I’m going to know which one you like better. Global Taste Elevation, $15.4 billion in 2024 sales, $4 billion in adjusted EBITDA. They will have Heinz, Philadelphia cream cheese, Craft Mac & Cheese or you get North American Grocery, $10.4 billion in sales, 2.3 billion in adjusted EBITDA. You get craft singles and lunchables. Which one are you taking?

Lou Whiteman: Probably want to take the first one, but gosh, you can’t get enough craft singles. The world revolves on craft signals.

Travis Hoium: Which one do you want, Rachel?

Rachel Warren: I got to say, Global Taste Elevation just sounds more exciting as a business.

Travis Hoium: It just rolls off the tongue.

Rachel Warren: It really does. It’s just so easy to say. Say it 10 times fast.

Travis Hoium: When we come back, we are going to talk about the hot IPO market. You’re listening to Motley Fool Money.

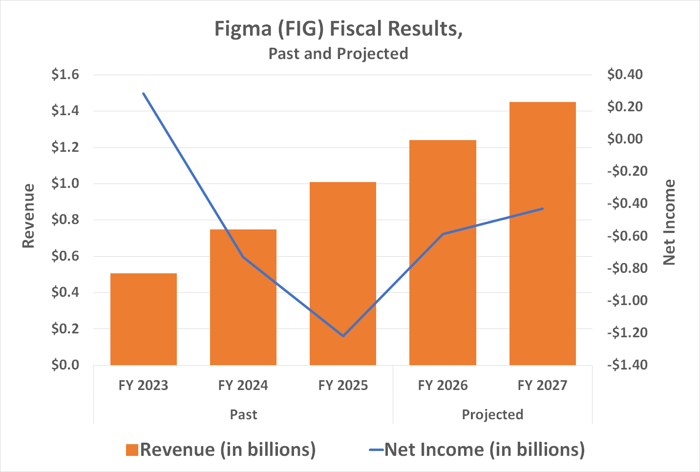

Welcome back to Motley Fool Money. The IPO market has suddenly opened up again with some huge IPOs from Circle Figma and Chime already this year, and we learned that Klarna, Figure Technology Solutions and Gemini Space Solutions are pricing their offerings. Stripe and Databricks seem to be waiting in the wings. Is this a healthy IPO market? Are we entering some 2021 style frenzy, given some of these stocks? I think Circle was up almost 10X from its IPO price. What do you think is going on here, Rachel?

Rachel Warren: I think, first, it is worth noting. In July of this year, we saw the most IPOs since November of 2021. We have seen a lot of recent IPOs really focus on areas around AI, crypto. There’s been a lot of strong first day or first week’s gains. There’s been a lot of focus as well in the IPO space this year on Fintech and other service oriented business. I don’t think it’s a one-to-one with what we saw in 2021. We obviously haven’t reached those levels yet in terms of companies entering the public markets, but it’s also a very different environment for the market for investors. A lot of these companies that are going public are tech, blockchain, crypto companies. With the passage of the Genius Act, there’s been a heightened appetite for those types of businesses. I think that that is very much being reflected in the types of companies that are now entertaining public offerings. Klarna, we’ve been waiting for a long time for them to actually formally announce their IPO after they had halted those plans earlier in the year. They’re targeting a valuation of up to $14 billion in their US IPO. Figure is another blockchain lender that said they’re going to go public. They’re looking at a valuation of about four billion. Then notably, you have Gemini. That’s the crypto exchange that was co-founded by the Winklevoss Twins, and they’re looking for a valuation around 2.2 billion. I think a lot of this is hype around AI and crypto, not all of it, certainly, but as always, it’s so important to take each company on its merits. The opportunities are there, but there’s a lot of hype and excitement right now, and sometimes differentiating that from a viable business, I think, can be really tough in this market.

Travis Hoium: Lou, IPOs are good. We need to have exits for some of these companies that have been staying private for longer than we have seen historically. Amazon and NVIDIA came public in the 1990s. When they were really small businesses, we don’t really see that today, even a company like Figure, Circle very well established, if Stripe does come public, that’s been rumored for what seems like a decade at this point. But how are you thinking about the IPO market that we have today, and potentially, considering these investments?

Lou Whiteman: For some context, yes. We’ve had a couple of hundred IPOs already this year. That’s up from 154 in ’23, so we are up. But there are over 1,000 in 2021. We are not anywhere near that level. Travis, I think a lot of a frenzy, and I do think there is some frenzy. But like you say, these are names that they’re quite mature. We know the names. There is just this demand because there’s built in familiarity. We want these companies. But look, the best advice is that, two things can be true at the same time. These can be great companies, and there can be a frenzy that makes the IPO dangerous. I think both of those things are true. If you look at Figma, Figma has lost half of its value since August 1st. I welcome these companies to the public. This is much different than the SPAC boom when it was all pre-revenue. I think this is healthy. But if I’m an investor, I’m not diving in on Day 1. I’m going to let these things play out. I don’t know if all of them will do what Figma did, but I think patience is the best bet now. If these companies are as good as we think they are, you can get in after a couple of months and still do fine over time.

Travis Hoium: One example with that is CoreWeave, and this is something we need to consider as well, there’s typically some lockup period for insiders who are not selling during the IPO. Their lockup period just ended. I believe insiders sold seven million shares of CoreWeave. Lou, that may just be another reason to wait it out. It’s OK to be six months late not get in on Day 1. Even some of the best companies in the world, Facebook [Meta‘s] traded below its IPO price. That was, I think, the first few weeks, but eventually the hype cycle typically wears off, whether it’s 2022 or 2023 that you jump into those 2021 IPOs or whether it’s just a few months later.

Lou Whiteman: Exactly. Look, everybody loves the excitement on Day 1. You love the pop. You love all that, but real wealth is created over the next five, 10 years by investing in good company, so you don’t have to be in Day 1.

Travis Hoium: Even getting in late on a IPO, like Google, a few years late would have been very good for investors, so something to keep in mind with that long-term. As always, people on the program may have interest in the stocks they talk about and the Motley Fool may have formal recommendations for or against, so don’t buy or sell stocks based solely on what you hear. All personal finance content follows Motley Fool editorial standards, and is not approved by advertisers. Advertisements are sponsored content and provided for informational purposes only. To see our Fool advertising disclosure, please check out our show notes. For Lou Whiteman, Rachel Warren, Dan Boyd, behind the glass, and the entire Motley Fool team, I’m Travis Hoium. Thanks for listening to Motley Fool Money. We’ll see you here tomorrow.