Some investors look for stocks that have good growth potential, while others look for stocks that can provide consistent income. It’s not always an either-or thing as some stocks have proven to do both.

Case in point: energy company MPLX (MPLX 2.05%). Although MPLX may not be a household name like other top energy companies, the stock has been on an impressive run over the past five years. In that span, it’s up close to 186%, while the S&P 500 is up 95% (as of Sept. 9).

No one can predict if the stock will continue growing at its current pace, but one thing’s for sure: Its ultra-high dividend is a dream for investors interested in income stocks.

Image source: Getty Images.

How MPLX’s business works

You can think of the energy industry as three parts: upstream, midstream, and downstream. Upstream companies explore for and produce oil and natural gas; midstream companies focus on storing and processing; and downstream companies refine, market, and sell end products like the gasoline you buy at gas stations.

Some larger companies may operate in two or three of the phases, but MPLX solely operates in the midstream section. Formed by Marathon Petroleum, it owns pipelines, processing plants, storage facilities, and other infrastructure that moves and conditions oil, natural gas, and natural gas liquids (NGLs).

MPLX says it handles over 10% of all natural gas produced in the U.S.

MPLX has a shareholder-friendly business structure

MPLX isn’t structured like your typical corporation. It’s a master limited partnership (MLP), meaning its profits and losses are passed on to partners (investors) to avoid paying taxes on the corporate level, allowing it to pay out more money to its investors.

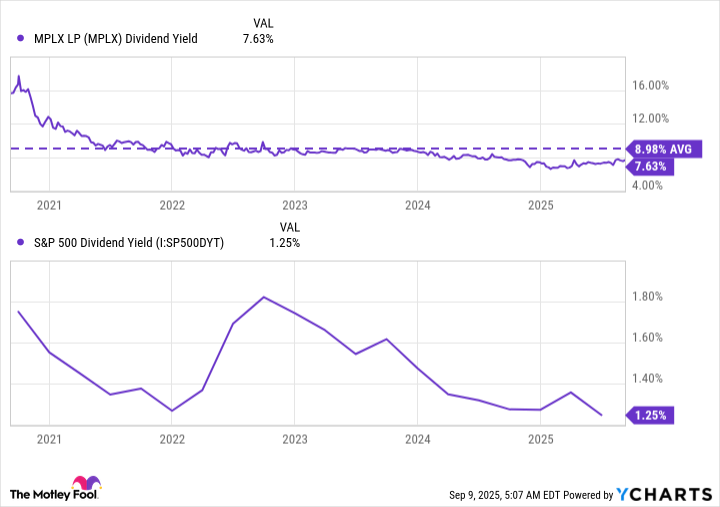

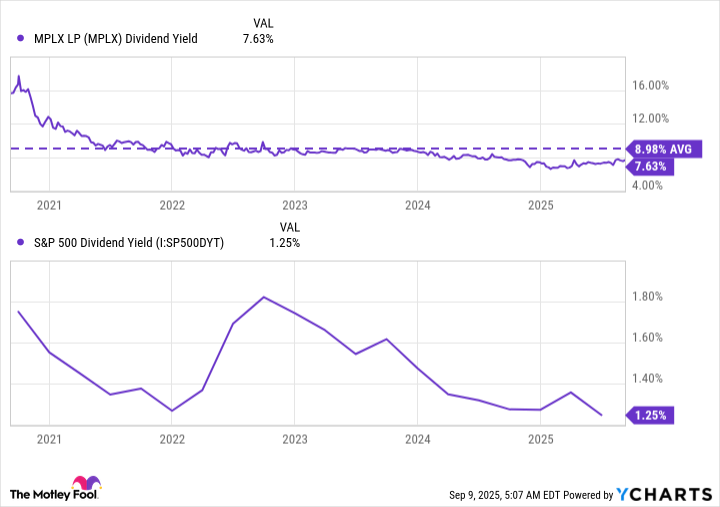

Its current 7.6% dividend yield is below its 9% average over the past five years, but it’s still more than six times the S&P 500’s average.

MPLX Dividend Yield data by YCharts

MPLX’s dividend payout won’t be consistent like typical corporations because it depends on its distributable cash flow (DCF). However, its DCF has had a compound annual growth rate (CAGR) of 6.9% since 2021.

MPLX has shown solid financials in recent years

MPLX makes money by charging fees for transporting, storing, and processing oil, natural gas, and NGLs. These are typically long-term contracts, which help provide the company with stable and predictable cash flow.

In the second quarter, MPLX generated $3 billion in revenue, which was down around 1.6% year over year. Its adjusted EBITDA (earnings before interest, taxes, depreciation, and amortization) — which focuses strictly on its profits from core operations — was $1.7 billion, up 5% year over year.

MPLX isn’t a company that will typically produce double-digit percentage revenue growth consistently, but what matters most to investors is its DCF because that determines its dividend payout (the main reason many investors invest in the stock to begin with).

MPLX’s DCF in the second quarter only increased 1% year over year to $1.42 billion, but it was able to pay out $0.9565 per share compared to $0.8500 per share in the same quarter last year.

Should you own MPLX’s stock?

An ultra-high dividend yield is great for income investors, especially when it’s as high as MPLX’s. However, that alone shouldn’t be the sole reason you invest in a stock, because it could be a yield trap. Thankfully, when it comes to MPLX, that doesn’t seem to be the case.

MPLX likely won’t experience tech-like high growth over the long term, but it has solid growth opportunities. One of the key ways MPLX grows is via acquiring systems and assets that expand its footprint.

A recent example is its acquisition of Northwind Midstream, which it purchased for $2.375 billion. The company expects this to increase its treating capacity by roughly three times by the second half of 2026 and return mid-teen percentages, which is pretty impressive.

If you don’t mind dealing with the additional tax step needed when dealing with MLPs and their distributions (like filing a Schedule K-1 form), then MPLX can be a good income addition to your portfolio.