IBM Is Making the Quantum Leap, But Does That Make the Stock a Buy Now?

IBM’s quantum catalyst may be starting to come back in vogue.

IBM‘s (IBM -1.34%) efforts to capitalize on the rise of generative AI aren’t its only big bet on future technology. Alongside this, the company has also been investing heavily in quantum computing.

Quantum computing utilizes quantum mechanics to solve complex problems more quickly than classical computers. The potential use cases of this technology are extensive, including applications in areas like artificial intelligence (AI), cybersecurity, drug development, and even areas like sustainable energy and traffic optimization.

However, with the perception that this catalyst, at best, will only start to positively impact performance many years from now, investors don’t seem all that interested in “Big Blue’s quantum leap” right now.

Instead, what’s top of mind among them right now is whether increased spending on AI infrastructure is coming at the expense of IBM’s other product and service offerings, which may result in lower-than-expected overall growth for the company.

Still, does this mean it’s better to “watch and wait” with this stock right now? Not necessarily. Instead, this dynamic may start to shift.

Image source: Getty Images.

IBM makes more quantum progress, but investors are unimpressed

Up until recently, news related to IBM’s quantum computing catalyst would elicit a positive reaction from the market. For example, back in June, the stock surged when the company announced plans to have the world’s first “large-scale, fault-tolerant supercomputer” on the market by the end of this decade.

A “fault-tolerant” quantum supercomputer monitors and self-corrects errors at the component level, to prevent the system from producing faulty calculations. This is important, since a high error incidence rate has been a key reason why quantum computing, despite being many decades in the making, has yet to go mainstream.

Now, however, further news regarding IBM’s quantum catalyst hasn’t seemed to excite investors all that much. On Aug. 26, IBM and Advanced Micro Devices (AMD 1.91%) announced that they would collaborate on quantum computing, with AMD providing the chips needed to power IBM’s quantum supercomputer.

However, while the stock has moved higher since this announcement, the gains have been modest at best. Admittedly, this makes some sense, given other events that have transpired over the past few months.

Software uncertainty limited a post-earnings recovery

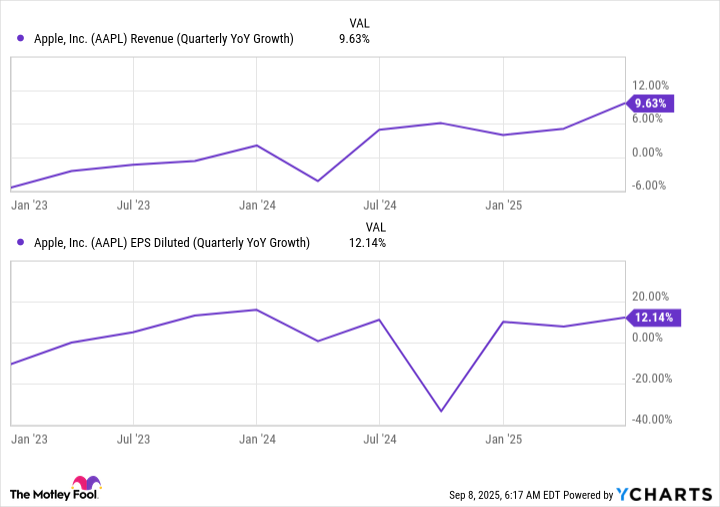

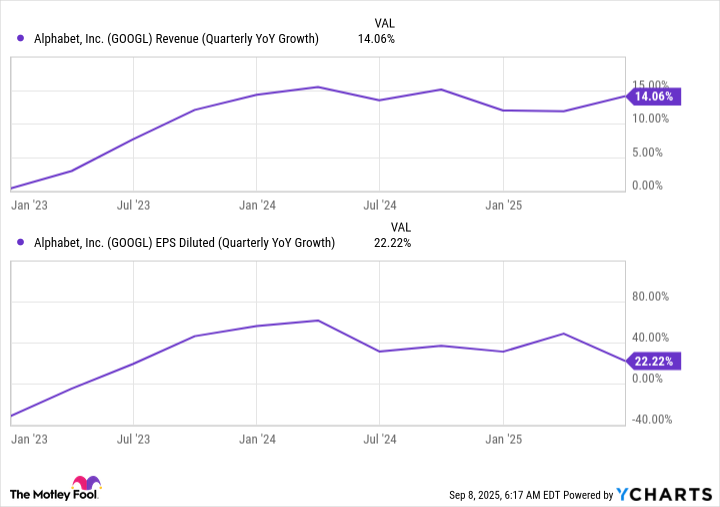

A month prior to this latest major quantum computing announcement, the market reacted negatively to IBM’s latest quarterly earnings release. Overall, the company beat on both revenue and earnings for the quarter ended June 30. Strong demand for AI-specialized mainframes resulted in better-than-expected revenue for IBM’s infrastructure segment, with revenue of $4.14 billion beating forecasts calling for $3.81 billion in revenue.

Yet while robust demand for AI infrastructure led to an earnings beat, the market placed greater focus on a negative aspect of the earnings release: weaker-than-expected software sales. Software makes up the majority of the company’s overall sales, with this segment representing around 43.5% overall revenue during Q2 2025.

The software sales miss was relatively minor, $7.39 billion compared to $7.41 billion expected, and was mainly due to flat transaction processing software sales. However, the concern remains that, as macro uncertainty persists, companies continue to invest in AI infrastructure, but are reducing expenditures in areas like enterprise software.

Hence, uncertainty about whether this trend will continue in Q3 and beyond is the likely culprit behind IBM’s modest post-earnings rebound. Still, with shares trending higher, albeit slowly, perhaps the market is starting to appreciate the company’s AI and quantum computing catalysts, as well as other promising areas like IBM’s consulting and hybrid cloud businesses.

Quantum computing, other growth catalysts, could drive a further rebound

As noted by CEO Arvind Krishna in prepared remarks released alongside Q2 2025 earnings, AI is driving growth across multiple IBM segments, including within the software segment, as well as in segments like consulting.

As a result, IBM’s total “AI book of business,” consisting of both sales and bookings, continues to grow at a rapid clip. Last quarter, this “book of business” totaled $7.5 billion, up $1.5 billion, or 25%, versus the previous quarter. Also, don’t forget that AI is not the only near-term growth driver for the company.

Earlier, I briefly mentioned IBM’s hybrid cloud business, made up primarily by the company’s Red Hat software unit. During the second quarter, Red Hat sales grew 16% year over year, up from 12% during Q1 2025. This could be the prelude to further growth acceleration in the coming quarters.

As for the “quantum catalyst”? The big payoff may be years in the making, but another major update could be just around the corner. Later this year, IBM and AMD plan to hold a public demonstration of how IBM supercomputers, powered by AMD chips, could deliver hybrid quantum-classical workflows.

Progress in these areas could lead to higher prices for the stock, as the market once again appreciates how IBM is shedding its past “tech dinosaur” image. IBM’s operating margins increased from 13.7% to 14.5% last quarter, and could be en route to rehit levels above 20%, a level of profitability not seen for more than a decade.

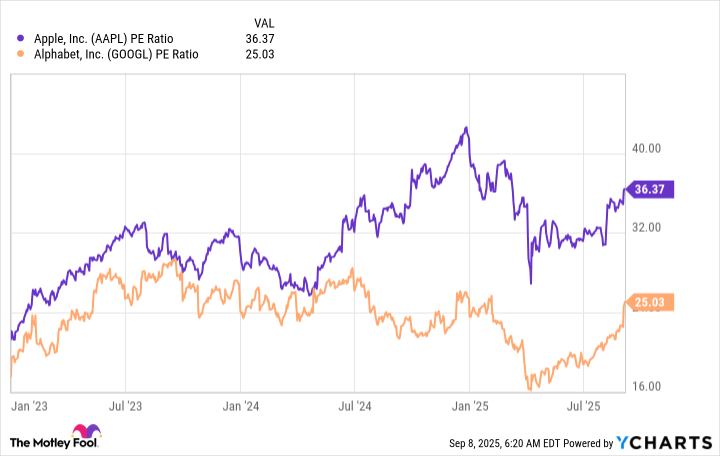

While IBM’s stock has surged in value over the past two years thanks to this long-term transformation, further upside may be on the table. Currently trading for around 21.5 times forward earnings, shares remain undervalued compared to other tech giants investing heavily in AI, like Meta Platforms and Microsoft, which trade for between 25 and 35 times forward earnings, respectively.

With all of this in mind, I would consider IBM worth buying at this stage of the rebound.