A handful of companies are driving the S&P 500’s push to all-time highs, but risks remain.

The S&P 500 closed Sept. 12 up 12% year to date, 62% over the last three years, and 97% over the last five years. Mega-cap growth-focused companies are largely responsible for driving the index to new heights.

The “Ten Titans,” which includes Nvidia, Microsoft, Apple, Amazon, Alphabet, Meta Platforms, Broadcom, Tesla, Oracle, and Netflix, now makes up over 39% of the S&P 500. And the technology sector alone makes up 34% of the index.

Here’s how the S&P 500 being dependent on the performance of a single sector impacts the broader market and your financial portfolio — and is a low-cost and straightforward way to bet on the continued dominance of tech stocks.

Image source: Getty Images.

Tech is even more dominant than it appears

The S&P 500 has a high concentration in the tech sector, namely because of just a handful of stocks. Nvidia, Microsoft, and Apple collectively account for approximately 20% of the S&P 500. Throw in Broadcom and Oracle, and that number jumps to close to 24%. So, nearly a quarter of the index is in just five tech stocks.

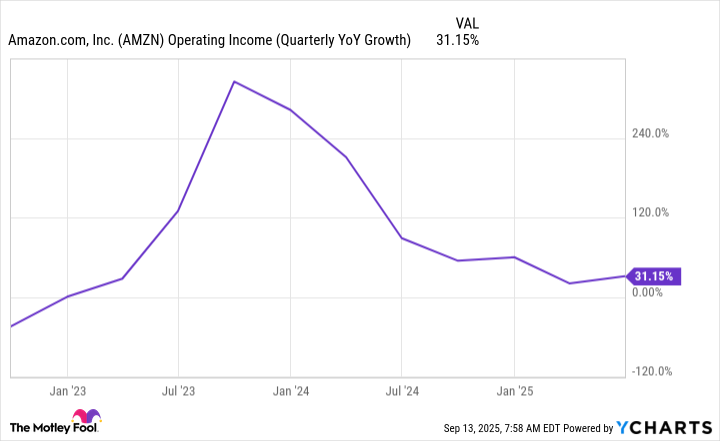

However, there are many leading tech-focused companies that aren’t in the tech sector. Amazon, which owns the largest cloud computing company by market share — Amazon Web Services — is in the consumer discretionary sector, along with Tesla, which is being valued more for its activities outside of electric vehicles, such as robotics, automation, and artificial intelligence (AI).

Alphabet and Meta Platforms are often thought of as big tech companies, but they are in the communications sector, along with Netflix.

The tech sector, plus these five companies, makes up 48.7% of the S&P 500. So, as big as the tech sector is, purely based on the companies that are classified as tech stocks, the real reach of tech-focused companies is far larger.

Let the S&P 500 work for you

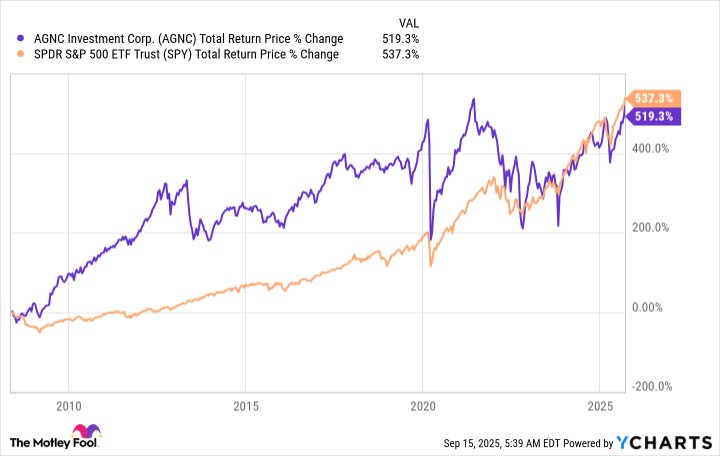

The S&P 500’s concentration in the tech sector has expanded its valuation and made it more of a growth-focused index. This can pay off with outsized gains if tech keeps outperforming, but it can also lead to more volatility.

During the worst of the tariff-induced stock market sell-off in April, the Nasdaq Composite fell 24.3% and the S&P 500 also got crushed, falling as much as 18.9%. So while the S&P 500 used to be led by consumer staples, industrial, and energy companies, it has now become like a lighter version of the Nasdaq.

Any investor with exposure to index funds or market-cap-based exchange-traded funds (ETFs) will be impacted by this change. An S&P 500 index fund may seem diversified at first glance, with over 500 industry-leading companies. But the reality is that the S&P 500 is really betting big on just a handful of companies. This presents a dilemma for risk-averse investors, but an opportunity for risk-tolerant investors.

Risk-averse investors can reduce their dependence on mega-cap tech companies by mixing in value and dividend stocks or value-focused ETFs. Many low-cost ETFs have virtually the same expense ratio as an S&P 500 index fund, meaning there’s next to no added cost for picking an ETF that better suits your investment objectives.

However, some investors may feel that it’s best not to fight the market’s momentum, and if anything, lean into it. The Ten Titans are massive, but they are also extremely well-run companies with high-margin businesses and multi-decade runways for future growth. So some folks may cheer the fact that these companies have gotten so large and are dominating the S&P 500.

In that case, buying an S&P 500 index fund may be more interesting. Or even a sector-based fund like the Vanguard Information Technology ETF, which has a staggering 53.2% invested in Nvidia, Microsoft, Apple, Broadcom, and Oracle.

Navigating a tech-driven market

As an individual investor, you don’t have to measure your own performance against an index like the S&P 500. Rather, it’s best to invest in a way that suits your risk tolerance and puts you on a path to achieving your investment goals.

Regardless of your investment time horizon, I think it’s important for all investors to be aware of the current state of the S&P 500 and what’s moving the index. Knowing that so much of the index is invested in tech-focused companies explains why the S&P 500 has such a low dividend yield and a higher-than-historical valuation.

Put another way, the U.S. stock market is being increasingly valued for where its top companies could be years from now rather than where they are today. And that puts a lot of pressure on leading growth stocks to deliver on earnings and capitalize on trends like artificial intelligence and cloud computing.