3 Big Dividends That Could Be at Risk and 1 That Isn’t

These 3 companies offer huge dividend payouts, but even bigger worries. Luckily, there’s a better stock you can buy.

Stocks that pay big dividends can give your portfolio a big boost, but beware! Some high dividends could be … traps!

A yield trap is a type of dividend stock offering a very high yield. But the only reason its yield is so high is that the share price dropped significantly over a relatively short time (and is likely to stay down for a while), increasing the odds that the dividend will need to be cut (or even suspended altogether). Investors who buy in chasing the high yield can get hit with the double whammy of a dividend cut and a sharp share price drop as investors dump the stock.

Here are three stocks paying high dividends that look very risky right now, and one high-yielding stock that’s a much safer pick.

Image source: Getty Images.

At-Risk Dividend No. 1: LyondellBasell (current yield: 10.4%)

Industrial chemical and materials companies like LyondellBasell (LYB -1.76%) have had a rough few years. Prior to the COVID-19 pandemic, these companies could count on steady, if slow-growing, demand for their products, which include construction materials, lubricants for industrial machinery, automobile coatings, consumer packaging, and other industrial products.

Usually, this diversified customer base would prevent a slowdown in one sector from affecting a company like LyondellBasell’s bottom line too much. However, the sectors that rely on these products the most — automotive, construction, and manufacturing — are in a multi-year slump.

This has hurt LyondellBasell’s bottom line. Trailing 12-month net income has collapsed by 96.7% over the past three years and free cash flow has dropped by 91.6% to $453 million. Considering that dividends are paid out of free cash flow, and the company’s current dividend payouts add up to $1.72 billion per year, investors should be concerned about dividend sustainability.

The company is clearly hoping it can power through. It has launched a “Cash Improvement Plan” and sold some assets in an effort to “support shareholder returns.” But with just $1.7 billion in cash left on its balance sheet, it won’t be long before the company has to either turn to borrowing to support its dividend — which isn’t sustainable over the long term — or cut it, like…

At-Risk Dividend No. 2: Dow (current yield: 5.8%)

LyondellBasell’s fellow chemical company Dow (DOW -1.36%) is facing the same headwinds, but has fared even worse, with earnings and free cash flow that both turned sharply negative in the most recent quarter.

Like LyondellBasell, Dow’s dividend yield crept above 10% as its share price dropped by more than 60% from its highs. However, with negative cash flow eating into the company’s balance sheet, Dow ripped off the bandage and cut its quarterly dividend in half, from $0.70/share to $0.35/share.

It’s ironic that even after that major cut, Dow still has a higher yield than most other companies. But if the industry doesn’t pull out of the slump it’s currently in, further cuts could be coming.

At-Risk Dividend No. 3: UPS (current yield: 7.8%)

In a case of “same song, different beat,” shipping and logistics giant UPS (UPS 0.43%) has seen a post-pandemic collapse in net income (down 50% in the last three years) and free cash flow (down 65%), as the pandemic-era delivery boom — for which UPS made major capacity upgrades — fizzled. Investors responded by sending shares down 57% from their highs.

With dividend payouts of $5.4 billion outstripping the company’s trailing cash flow of $3.5 billion, and tariffs expected to reduce shipping and delivery volume even further in the near term, the company’s $6.3 billion cash hoard may not last long enough to avoid a cut, although CEO Carol Tome is trying to. “You have our commitment to a stable and growing dividend,” she said on the most recent earnings call, but investors should remember that dividend policy can change without warning.

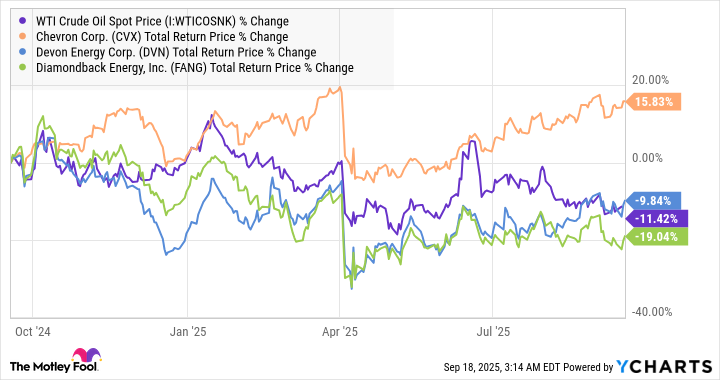

Safe Dividend: MPLX (current yield: 7.6%)

If high dividends are what you’re after, why pick UPS’ risky 7.8% yield when you could get a nearly identical 7.6% yield that’s much more secure? Midstream energy company MPLX (MPLX -0.48%) offers just such a payout.

MPLX operates pipelines, storage units, and shipping terminals for the oil and gas industry. As a master limited partnership (MLP), it gets favorable tax treatment in exchange for paying out almost all of its cash flow as dividends to investors. The only drawback to MLP ownership is some increased reporting at tax time if you hold your MLP shares in certain types of accounts.

Unlike the other three companies listed here, MPLX’s net income and free cash flow have only been growing over the past three years. Better yet, so has its dividend payout. But it still has plenty of dividend coverage, with its distributable cash flow currently 1.5x higher than its payouts, meaning MPLX has ample room to address a potential business slump without cutting its dividend.

That’s the kind of peace of mind you won’t get from LyondellBasell, Dow, or UPS right now, and why MPLX is a better choice for most dividend investors.