Can Shiba Inu (SHIB) Ever Reach $1? The Math Might Shock You.

While Shiba Inu remains a highly popular cryptocurrency, the token’s price has yet to experience meaningful appreciation.

Over the past several years, cryptocurrency has captured the imagination of investors looking for alternative ways to diversify beyond traditional stocks and bonds. Among the vast array of tokens, Bitcoin and Ethereum have emerged as two of the most mainstream options.

Yet, as with any asset class, some investors seek out opportunities that are more disruptive — though often far riskier, too. In the cryptocurrency realm, Shiba Inu (SHIB -0.20%) exemplifies this dynamic: a token surrounded by immense fanfare but still waiting to deliver the kind of multibagger gains its community hopes for.

With its price still trading at less than a penny, some might see now as a rare chance to get in early on a potentially explosive crypto token before it goes to the moon. Even a move to just $1 could generate life-changing returns. But price is not value, and those dreaming of that $1 level should be asking: Is such a milestone realistic, or merely rooted in fantasy?

Let’s break down some numbers.

Image source: Getty Images.

What is Shiba Inu?

Shiba Inu was originally created as an altcoin inspired by Dogecoin.

Built on Ethereum’s blockchain, Shiba Inu integrates with decentralized finance (DeFi) applications and smart contracts. Over time, its dedicated developer community has sought to push the token beyond its meme coin origins by adding real utility. Today, the Shiba Inu ecosystem includes ShibaSwap, a decentralized exchange (DEX) that allows users to trade, stake, and earn rewards, along with engaging in other projects tied to gaming and the metaverse.

Still, despite these efforts, Shiba Inu’s value remains heavily rooted in speculation, with prices often moving in tandem with swings in internet culture or hype-driven narratives.

Shiba Inu is a deflationary coin

In cryptocurrency, tokens can be inflationary or deflationary. An inflationary token sees its supply expand over time, while deflationary tokens have mechanisms in place to reduce the number in circulation. Shiba Inu falls into the latter category. Through its burning process, tokens are intentionally sent to inaccessible wallets — permanently removing them from the circulating supply.

In theory, this shrinking supply creates upward pressure on price since the underlying principles of supply and demand suggest that a scarcer asset should become more valuable.

Can Shiba Inu reach $1?

Let’s break down the math behind Shiba Inu reaching $1. Its price right now is $0.00001213, far from a dollar; far from a penny.

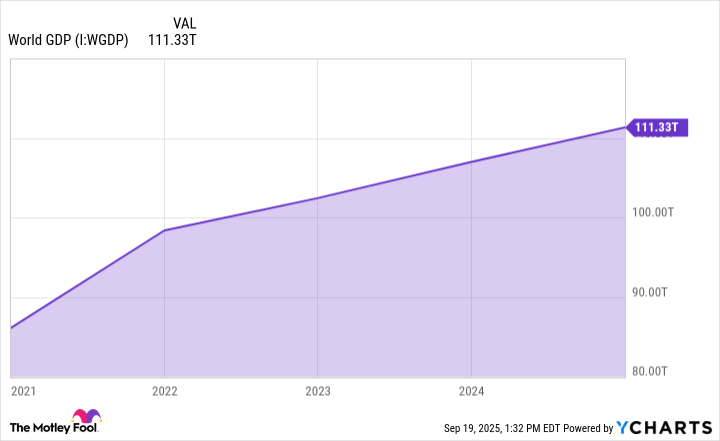

At launch, the token carried a staggering total supply of 1 quadrillion tokens. Today, despite years of burns, its circulating supply remains around 589 trillion tokens. If each token were worth $1, Shiba Inu’s market capitalization would approach $600 trillion — more than five times the value of global gross domestic product.

This makes the idea of a $1 target mathematically out of reach under current conditions. The only remotely conceivable path would involve burning massive amounts of the token’s supply. But here’s the catch: Even after hundreds of trillions of tokens have already been burned, Shiba Inu continues to trade at mere fractions of a cent.

For the token to climb meaningfully higher, it would require either an unprecedented surge of global adoption or a highly coordinated, large-scale burn effort sustained over many years. Both of these scenarios border on implausible.

While it is technically possible for Shiba Inu to reach $1, the economics outlined above make it virtually impossible in practice. The sheer scale of supply, coupled with its dependence on speculation and internet-driven hype rather than durable utility, means Shiba Inu offers little in the way of fundamental value at the moment.

For investors, this positions Shiba Inu less as a prudent and credible long-term holding and more as a speculative gamble akin to a lottery ticket.

Adam Spatacco has no position in any of the stocks mentioned. The Motley Fool has positions in and recommends Bitcoin and Ethereum. The Motley Fool has a disclosure policy.