Prediction: Nvidia stock will increase by about seven to 17 times in five years, depending upon the level of competition and assuming the U.S. economy remains at least relatively healthy for most of this period.

Nvidia (NVDA -0.31%) stock has been a fantastic performer over the short and long terms. Shares of the artificial intelligence (AI) chip and infrastructure leader have returned 1,440% and 26,960% over the last three years and decade, respectively, as of Friday, Oct. 17. These performances have transformed a $1,000 investment into $15,400 and $270,600, respectively. By comparison, one grand invested in the S&P 500 index has turned into $1,894 in three years and $3,910 in 10 years.

With Nvidia stock’s eye-popping gains, it’s easy to wonder if you missed your chance at buying shares. The answer is no, in my view, as Nvidia stock has many years of great performance left.

There are two reasons for my optimism. First, the AI revolution is still in its early stages. Second, Nvidia’s graphics processing units (GPUs) are the gold standard for processing AI workloads, and there is no indication that they’re in danger of losing that status, at least not for some time.

Below are my prediction ranges (a best case and a base case) for Nvidia stock’s price in about five years, or by the end of 2030. My estimates are built upon data provided by Nvidia’s CEO and CFO on the company’s most recent quarterly earnings call. (Nvidia’s earnings calls are chock-full of valuable data — and listening to them is worth the time.)

Image source: Getty Images.

Nvidia CFO: “We see $3 [trillion] to $4 trillion in AI infrastructure spend by the end of the decade.”

From CFO Colette Kress’ remarks on Nvidia’s fiscal second-quarter earnings call in late August:

We are at the beginning of an industrial revolution that will transform every industry. We see $3 [trillion] to $4 trillion in AI infrastructure spend by the end of the decade. The scale and scope of these [AI infrastructure] buildouts present significant long-term growth opportunities for Nvidia Corporation. [Emphasis mine.]

Numbers from CEO: 58% to 70% of an AI faciility’s cost goes to Nvidia

From CEO Jensen Huang’s remarks on the fiscal Q2 earnings call:

And so our contribution … is a large part of the AI infrastructure. Out of a gigawatt AI factory, which can go [cost] anywhere from … $50 to $60 billion, we represent about $35 [billion] plus or minus of that.

Huang is saying that a typical 1-gigawatt AI data center or other AI facility costs about $50 billion to $60 billion to build, and that about $35 billion of that cost is for Nvidia’s AI technology.

So, about 58% ($35 billion divided by $60 billion) to 70% ($35 billion divided by $50 billion) of the total cost of an AI facility is the cost of buying Nvidia’s tech.

Putting together the data provided by Nvidia’s CFO and CEO

Kress said the company expects total global AI infrastructure spending to be $3 trillion to $4 trillion annually by the end of the decade. (It’s not clear whether she meant by 2029 or 2030, but I’m using 2030 to be conservative. Moreover, Nvidia just published a presentation that uses the $3 trillion to $4 trillion projection by 2030.)

Of that $3 trillion to $4 trillion, Nvidia stands to take in 58% to 70% of it, according to Huang. This assumes that percentage range remains about the same. This will be part of my “best-case estimate,” but I am also going to calculate a “base-case estimate” that assumes Nvidia’s percentage of total AI infrastructure spend declines moderately, by 20%. This will account for the potential for increased competition by chipmaker Advanced Micro Devices (AMD) and others.

Revenue from AI infrastructure spend that Nvidia should generate in about five years:

- Best-case estimate: 58% to 70% of $3 trillion to $4 trillion = $1.74 trillion to $2.8 trillion.

- Base-case estimate: 46% to 56% (I chopped 20% off the percentages in the best-case range) of $3 trillion to $4 trillion = $1.38 trillion to $2.24 trillion.

Calculating my Nvidia stock price target ranges for 2030

Now, I’ll use the numbers calculated above to come up with price target ranges for Nvidia stock in about five years. Two additional data points needed:

- Nvidia stock’s closing price on Oct. 17: $183.22.

- Nvidia’s AI-driven data center revenue was $41.1 billion (of its total revenue of $46.7 billion) in its most recently reported quarter (fiscal Q2, ended July 27). This equates to an annual run rate of $164.4 billion ($41.4 billion X 4).

Nvidia stock best-case price target in five years: $1,942 to $3,115.

- Nvidia’s projected AI infrastructure revenue in five years: $1.74 trillion to $2.8 trillion.

- Nvidia’s AI infrastructure revenue currently: annual revenue run rate of $164.4 billion.

- Step 1 numbers divided by Step 2 number: 10.6 to 17.0. This means Nvidia’s annual data center revenue should increase by 10.6 to 17.0 times in 5 years.

- Nvidia stock price at market close on Oct. 17: $183.22.

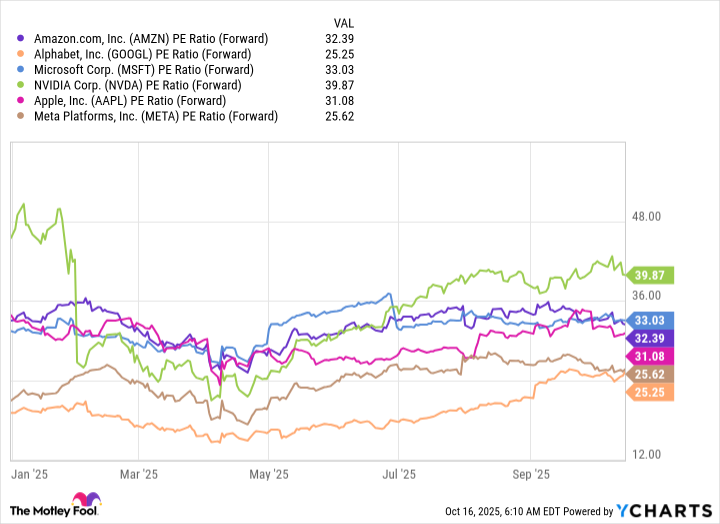

- Valuation assumption: I am assuming that Nvidia stock’s earnings-based valuation will remain the same in five years. That’s because its valuation is reasonable now given its growth and projected growth dynamics, in my view. (Trailing and forward price-to-earnings (P/E) ratios are 51.5 and 28.7, respectively.)

- The above assumption means the conversion from revenue growth (Step 3 numbers) to stock price growth will be straightforward.

- $183.22 X 10.6 to 17.0.

- Stock price target in five years: $1,942 to $3,115.

Nvidia stock base-case price target in five years: $1,300 to $2,125.

- Nvidia’s projected AI infrastructure revenue in five years: $1.38 trillion to $2.24 trillion.

- Nvidia’s AI infrastructure revenue currently: annual run rate of $164.4 billion.

- Step 1 numbers divided by Step 2 number: 8.4 to 13.6. So, Nvidia’s annual data center revenue should increase by 8.4 to 13.6 times in five years.

- Nvidia stock price at market close on Oct. 17: $183.22.

- Valuation assumption: I am assuming that Nvidia stock’s earnings-based valuation remains the same in five years.

- The above assumption means the conversion from revenue growth (Step 3 numbers) to stock price growth would be straightforward.

- BUT, I’m going to assume that the data center platform’s profitability declines modestly due to the possibility of increased competition. I can adjust the factors in Step 3 down by 15% to account for this since I had been assuming a straightforward relationship between revenue, earnings, and price target growth.

- [8.4 to 13.6] x [85%] = 7.1 to 11.6.

- $183.22 X 7.1 to 11.6.

- Stock price target in five years: $1,300 to $2,125.

Why there is upside to both these target ranges

I only considered Nvidia’s data center market platform growth when calculating my price targets. That’s because this AI-driven platform accounts for the vast majority of the company’s revenue and earnings — and stock price gains are usually driven by earnings growth.

In the first half of the current fiscal year, the data center platform accounted for 88% of Nvidia’s total revenue. And it accounted for an even higher percentage of total earnings. That percentage is unknown because management does not break out earnings or other profitability metric by platform. But management has said that its data center platform is more profitable than its overall business. So, the data center platform probably accounts for in the mid-90% of total earnings.

If one or more of the company’s other market platforms (gaming, professional visualization, and auto) grows revenue and earnings tremendously over the next five years, that should be upside for my price targets. The auto platform has the potential to be a big winner over the next five years due to driverless vehicles steadily progressing toward legality. Nvidia’s end-to-end AI-powered driverless tech platform is widely adopted.

Caveat about the economy and overall stock market performance

My estimates assume the U.S. economy remains in at least a minimal growth mode and the stock market remains in a bull market for much of the next five years.

I don’t think a mild and relatively brief recession would derail my Nvidia stock price targets, at least not by much, but a deep or long-lasting recession and long-lasting bear market would almost surely derail them.

My wrap-up

Nvidia stock best-case price target in five years: $1,942 to $3,115. (Of course, the stock would most likely split before it reached these levels, but the underlying growth remains the same.) This equates to Nvidia’s stock price increasing by 10.6 to 17.0 times. It also equates to a compound annual growth rate (CAGR) of 60% to 76%.

Nvidia stock base-case price target in five years: $1,300 to $2,125. This equates to Nvidia’s stock price increasing by 7.1 to 11.6 times. It also equates to a CAGR of 48% to 63%.

Taken together, the Nvidia stock price target range in five years is $1,300 to $3,115.