We discuss what Apple and Meta Platforms see as the future of tech hardware and whether Tesla’s latest delivery boon is a peak for the company.

In this podcast, Motley Fool contributors Travis Hoium and Lou Whiteman and analyst Emily Flippen discuss:

- Apple‘s headset strategy.

- Tesla‘s delivery numbers.

- Earnings trends to watch.

To catch full episodes of all The Motley Fool’s free podcasts, check out our podcast center. When you’re ready to invest, check out this top 10 list of stocks to buy.

A full transcript is below.

This podcast was recorded on Oct. 03, 2025.

Travis Hoium: Are smart glasses the future of technology hardware? Motley Fool Money starts down.

Welcome to Motley Fool Money. I’m Travis Hoium joined by Lou Whiteman and Emily Flippen. We’re going to jump right in today, and the big topic I thought for this week was Apple at least reportedly pulling back on their lighter Vision Pro headset. They’re going to be moving in the same direction, it looks like as Meta has with their Ray Ban glasses, this AR technology. Emily, what are your thoughts on this whole space and where Meta and Apple fits into it?

Emily Flippen: I’m incredibly disappointed by Apple here. Look, Apple invested a lot of time and resources into convincing all of us that the future was in these lightweight, daily wearable glasses that were the visionary of spatial computing. Then a year later, just backtracks and it’s not clear to me if this is, a desperate pull for them to say, no, me, too, when they see the innovation that Meta is doing and literally the metaverse, or if this is just throwing stuff at the wall to see what sticks. But in my opinion, I just am so incredibly bearish. Pivoting toward heavy duty VR glasses when it seems like we have years and years of evidence coming out of Meta that consumers just do not want this.

Travis Hoium: It seems like a space where they’re throwing stuff at the wall, and we don’t know exactly what’s going to stick. But at least we know these lightweight things are going to stick a little bit. That seems like a little bit of the move in the right direction, Lou, but it’s still it seems like this is a money losing proposition for the foreseeable future.

Lou Whiteman: We should say that this is one report, and we don’t know what’s going on, really. Apple has $65 billion in cash. I feel like they can do both. But look, the cynical take here is, I can’t figure out to spin is Meta was right or Apple is really that desperate. Because in a way, this seems like it’s validation of everything Meta is doing. In a way, it’s Apple are they really just they need something? I agree with Emily. I see more potential in the Vision Pro. There’s also more of a chance an outright flop. I don’t get the obsession with glasses right now, and I’m worried to see everyone pushing in that direction.

Travis Hoium: One of the things that was interesting when the Vision Pro came out is look, I’ve been in the VR space for almost a decade now, and what was unique about it is it was almost like an AR pair of glasses while actually being VR. The pass through was better than we’ve ever had in any other device. It seemed like they were, even at that time, moving toward this AI future but the technology wasn’t quite there yet. They hadn’t miniaturized things enough to get to even where Meta and Ray Ban are with their current glasses. Maybe we were headed this direction all along, and like Lou said, they’re walking and chewing gum at the same time. They’re probably doing both of these things, but they’re maybe now saying, hey, look, the Vision Pro has been a flop, and people are at least a little excited about these sunglasses or these glasses from Meta. Emily, is that maybe the right way to think about it? They’re seeing what’s gonna work and what’s not, and they’re seeing Meta’s success. They have always been a follower. They’re never usually the first company to release a device, so maybe that’s the right strategy.

Emily Flippen: Yes, that’s a really generous interpretation, I think, Travis. I think this is an issue. Really, I think it’s an issue of bloat. I say that as somebody who is a fan of Apple. Ultimately, Apple is still a hardware business when push comes to shove. They have to be on the bleeding edge of whatever the new exciting hardware accessory is, even if that ends up getting commoditized, because otherwise, they could lose their position as one of the largest companies in the world. I understand the desperate need to be there. If Meta is onto something, Apple needs to be right there too. But here’s the problem when you have so many extra billions of dollars in cash flow, is that it really does allow you to lack discipline where you choose to invest your CAPEX. I wish there was more focus coming out of the Apple Management team. Again, to your point, we don’t exactly know how many resources are being put behind this larger version of these AR VR glasses. But I really do think that it’s disappointing to see them spread out their attention when the Vision Pro hasn’t lived up to its potential yet, and there is potential there. They might be a little early, but they invested more time and resources into convincing consumers about why this would be an addition to their everyday life. That can actually be onto something great. My concern is that when you do two things poorly, you do nothing well. I wish they would just focus on doing one thing well.

Lou Whiteman: Here’s a question, and I don’t know if this will end up being bullish or bearish, but, the Apple value proposition from the start was always, it just works. In a way that was tech for the normies. I’m a normie, so I appreciate that. I am yet to be convinced that the normies want these glasses, that there really is the market that they think there is. To me, I don’t see it doing anything right now that you can’t do on your phone, so it’s an accessory to the phone, not a replacement. The watch is, too. The watch has done pretty well, but the watch is half the price of these. Do we want.

Travis Hoium: The watch is also nowhere near the market share that the iPhone.

Lou Whiteman: It is a niche product. Do we want an accessory that costs as much as the phone? I doubt it. The Glass Half Full is, Apple really sees a chance to do what they did with the iPhone relative to the Palm Pre and all those. They really have come up with something that is that next step. Glass Half Empty is that this is going to just be like the watch and be just another product out there that can’t move the needle. When in theory, if they get the Vision Pro right over time, that could be a whole new product category. This is, again, what are we swinging for hits or swinging for home runs? Because this feels like going for a base hit and giving up on the home run swing.

Travis Hoium: I’ll start with you, Lou, do you think the combination of artificial intelligence and these different form factors. Usually the technology revolutions, the disruption that happens, it comes with a new form factor. The mainframe, the PC, the smartphone, brought about all new winners, new business models. We’ve been talking about new form factors in AI for quite a while. The pendant didn’t seem to stick. It seems like glasses has a chance. But then you run into this strange, I don’t know if it’s an uncanny valley where I can see some real value in, look, I can see in our recording, I can see your names. Sometimes I look down there when I’m reading the outro. I don’t know why. I just do it. I’m meeting new parents as my kids go to school. I know I’ve met you before. I know you said your name, but I can’t remember. If it just popped up on my glasses, that’d be great. On the flip side of that, if we’re constantly recording everything all the time, that seems like a pretty dystopian vision of the future. It seems like we do need that killer app and we’re just not there yet, and nobody’s quite figured that out. Is that a fair critique of this next gen issue? It’s almost like we’re in the Apple Newton phase of the industry. We’re 10 years too early.

Lou Whiteman: Let me give you a more subtle critique. Because I’m not going to go dystopian, although I see that, I see the fear. But look, we talk about what a distraction the phone is when you’re driving, when you’re walking down the street, whatever. Maybe, yes. If it just popped up Emily’s name, if I couldn’t think of it, that would be a help. But 90% of the things, be it directions, watching Netflix for gosh sakes while you’re driving or something. All of these things that seem to be obvious use cases, that just doesn’t seem like a good idea for me. Again, it does feel like that, yes, it’s a neat accessory onto the phone, but largely, the reason this is the next big thing is, I think, because no one has any better ideas, not because it is a great idea.

Emily Flippen: That’s an interesting way to put it. I’ll just quickly tap off by saying, I wish Apple was OK with being second, in some cases. I think when you look at the success of the smartphone, Apple wasn’t the first company to come out with a smartphone, but they waited for the proof and the pudding there with Blackberry before they entered the market and destroyed it. The same is true for smart watches. They waited for Garmin and others to come out, fit bit to show the demand for watches, and then said, let’s take this market that already exists, and let’s crush it. The market doesn’t exist right now for these glasses. I think that’s part of the problem that Apple’s running up against.

Travis Hoium: When we come back, we are going to get to Tesla’s phenomenal delivery numbers for the third quarter of 2025 and see what the future looks like because this may be a peak for a while. You’re listening to Motley Fool Money.

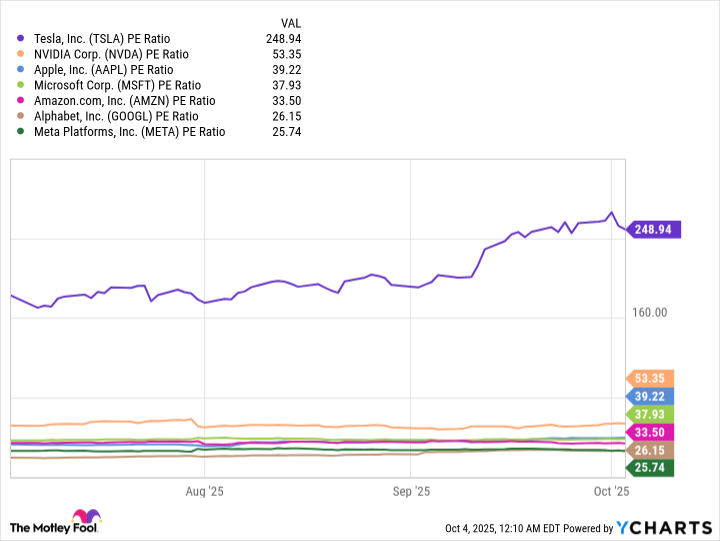

One of the other big pieces of news for the week was Tesla had a phenomenal quarter. Deliveries were 497,099 vehicles. That was a 7.4% increase from a year ago. The problem is, the $7,500 tax credit ended at the end of the third quarter. Emily, is this going to be as good as it gets for Tesla, at least for the foreseeable future?

Emily Flippen: I think it’s a fair statement. I do think two things can be true at once, which is, that this was a great delivery month they put up, but it was also this deadline sprint that you mentioned for people to place orders before the tax credit expired. If I had to estimate, I would imagine that we’re probably looking at a softer fourth quarter here, despite how strong the third quarter was in terms of deliveries, but at the same time, I’m still really bullish on the entire EV sector, especially in the United States, but across the world. I think the rumors of its death, so to speak, have been greatly exaggerated. There’s a lot of people out there, a lot of investors who think that without government incentives, demand for electric vehicles just won’t be there. It’s an interesting argument, and it’s one that I think we’re going to get some more evidence toward or against as we see these tax credits expire, but big picture, we’ve seen higher interest rates, and that softens demand for more expensive cars. EVs are still on average, more expensive than more traditional vehicles, and you still need to have the installation and charging options. A lot of people choose to finance those if they have them installed on their house. Of course, with higher interest rates, less people being willing to finance at higher rates. There’s a lot of factors that are going against EV adoption right now that are unlikely to persist over the long term. That’s the thing where I’m like, it’s great to see a Sean Carter from Tesla. I’m not expecting that to persist for Tesla or any other EV maker. I think Ford‘s CEO, which is commenting earlier this week that he expects EV market share to drop by half for this foreseeable future. Crazy numbers. But when I zoom out 10 years, I’m very not worried about electric vehicles here.

Lou Whiteman: Here’s the interesting thing to me. These are the times autos are very cyclical. These are the times when historically, the big giants of the industry, based at Detroit, through most of the industry, they’ve used their balance sheet to muscle out competitors. When pricing becomes a problem, when affordability becomes a problem, and Ford today still has that great captive Auto Finance unit. GM is rebuilding theirs, where they really can offer you a deal you can’t refuse. Someone else who’s smaller, in this case, a Rivian, back in the day with others just can’t afford to. On paper, Tesla is better positioned to do that than even the Detroit companies. They have a great balance sheet. However, Tesla, unlike all of these companies, also has a huge long list of things other than consumer finance they want to put their money to. I feel like to some extent, Tesla’s near term destiny is in their own hands. If they want to minimize the blow of the tax credit, I think they have the wherewithal to do that. I don’t know if for long term investors, that would be the best use of their capital, though, but I mean, I do think it’s an interesting moment. In terms of the big picture for EVs, for me, right now, it makes sense that hybrids are where it’s at because I think hybrids offer you a better deal, and I’m biased because I have a hybrid. Maybe I’m saying that. To me, the future of EVs is not tied to tax credits. It’s not tied to what Elon Musk thinks when he wakes up in the morning. You tell me how and when that Model 2 hits the streets. You tell me if that Model 2 really is a $25,000 car. I will tell you what I think the near term future for Tesla EVs are. Similarly, all of these companies, Ford has a pickup truck. That’s a very similar value proposition. Tell me whether or not those actually can be made at profit anytime soon. That, I think, is going to be the answer to the question of how quickly and how strongly we see EVs take off from here, not a $7,000 tax credit.

Emily Flippen: Why are we so focused on Tesla and Ford when we actually already have evidence that is the case. BYD out of China has been making profitable, low cost electric vehicles that are getting worldwide adoption. We don’t see them a lot here in the United States because of our own tariff regime and lack of importing there. But I do think that we have evidence that this battery company, originally a battery company now a big car company can do it. There’s no reason to believe that others can’t eventually get there, as well. But that evidence exists. It’s just a matter of, to your point, Lou, how quickly?

Travis Hoium: Absolutely. Speaking of companies that are growing in EVs, I think this one’s fascinating is General Motors, do you know how much their EV growth was year over year? Gulf the third quarter, 105% to 144,668 vehicles. The Equinox EV, which is their entry level, $35,100. I believe that’s less than you can get a Tesla for today. It does seem the dynamics have shifted quite a bit. What will be fascinating, they’re still focusing on big trucks and SUVs. That’s where the money is made, even though Tesla used to be high margin. Their margins are now lower than the traditional automakers today. It’s partly because they’re not making these expensive trucks and SUVs, which are selling like crazy today. This is going to be fascinating because it does seem like one thing that’s going to be consistent is the market will probably not be growing as much as it would have had that $7,500 tax credit remained, and therefore, it’s going to be more competitive because there is more supply coming into the mat.

Lou Whiteman: The one caveat there, I would say on just looking at GM numbers is, I think the dealer model provides more incentive to try and get move metal before the tax credit disappears because as soon as it’s on location, that’s the dealers problem, not the automakers problem. The dealers don’t have that balance sheet to put to work. They wanted to move that metal. But we’ll see if it holds up, that’s great for GM.

Travis Hoium: I want to get your thoughts on we have the end of the third quarter just happened this week on Tuesday. That means the earning season is going to be coming very soon. Emily, what are you looking at for this earning season as it starts next week and the week after?

Emily Flippen: I’m actually looking for companies that are very obviously sandbagging with guidance. I say that, I think we all expect for guidance this quarter to come in weaker. It was that case last quarter. We are living in a really uncertain environment now, so it makes sense that not only are companies expecting their profit margins to be squeezed, especially with weak consumer spending, they don’t know what’s going to happen with inflation or tariffs, whatever the overhang may be. I always love it when a company’s management team is always a bit more pessimistic than I’m, and sometimes I can be a red flag, but sometimes I can also be a buying opportunity. For instance, I think about Dutch Bros, who when you look back at their business at this point last year, kept guiding for low to mid single digit same store sales growth, so much weaker than what they were putting up because management was just that uncertain about the cannibalization that’d be happening with their business or consumer spending. Quarter after quarter, they just kept hitting it out of the park they only recently raised guidance. But that mismatch, in my opinion, between a really conservative management team and a really strong business, where I can see their path to out performance, even more than maybe management can, can be appealing because if you see shares fall really dramatically based on weak guidance that you think is a hurdle that can be easily passed, it can be a buying opportunity.

Lou Whiteman: It’s so funny you say that because I was thinking the other day. I was like, I’m more excited about the opportunity to go shopping this earning season than normal. I do think that that’s yeah, we’re ripe for it, I think. All the containers are there. As far as what I’m looking for, I’ll go big picture. I’m focused on margins just across the board. I’m really curious how much the macro is eating into margins. We know there’s tariffs out there. We know that the consumer is struggling to get a feel for how much that companies are eating it. I think I’m more interested in looking at margin change over time than I’m even, revenue growth or earnings growth. I want to know not what happened in the last three months. I want to know what to expect the next three, six months to come, and I think that is at least a little bit of a window into what’s going on out there.

Travis Hoium: Lou, do you think tariffs is going to be a bigger topic of discussion or less than it was over the last two quarters? I’ll say maybe the second quarter, first quarter was a lot of, we have no idea what’s going on. Second quarter, companies have gotten their heads around it. Third quarter, now we’re really in it. Are we going to hear a lot about it, or is it going to just be in the background?

Lou Whiteman: I think we’re going to hear a ton about it, but I think it’s going to be in the guidance side because we’re in the holiday quarter now, and I think that that’s going to be front of mind. Travis, I’ve used this with you before the boiling frog analogy that you, tariffs are not a light switch. It’s just over time, suddenly what happened? The holiday season seems like if I was a CEO, that would be front of mind for me at the holiday season. I think you’ll be hearing about it a lot in the guidance.

Travis Hoium: It is going to be fascinating to see what companies can who has pricing power. Who doesn’t? Who has to, like you said, eat those tariffs and who’s able to pass them on to customers and where they’re impacting a lot to learn over the next few weeks. When we come back, I’m going to have Emily and Lou take an over or under position on a bunch of predictions for the rest of the year you’re listening to Motley Fool Money.

Welcome back to Motley Fool Money. Today, we’re going to play a little game called over-under. I’m going to give a prediction about something that’s going to happen in the economy or the market, and Emily and Lou are going to guess whether they think there’s going to be an over or under. Let’s start with the topic that we discussed earlier, Metas Glasses. They sold about 1 million pairs of these smart glasses in 2024. That’s a pretty big number. My question is, are they going to sell over or under 5 million units in 2028? Emily, I’m going to have you go first over or under 5 million.

Emily Flippen: I feel this will come as no surprise for anybody who listen to the first half of the show, but I have to go under here. I just don’t see the use cases for it on Meta side. When you look at Metas financials, this business spent more on CapEx in the last 12 months than the business generated in operating income or an operating cash flow in all of 2022. They are just throwing money at the wall, and it’s amazing to me how much money they’re investing into various things, but nothing is sticking with consumers. Ultimately, you can’t force a consumer to come out and buy a new product if they don’t see a use case for it. It’s amazing to me that they even sold 1 million units in 2024. That is peak hype, in my opinion. Unless something really sticks here for Meta, I expect that number to actually fall over the course of the next.

Lou Whiteman: Wow. I’m going to use Emily’s words and come to the conclusion that over. Because, yes, Zuck needs this, and Zuck is more than willing to spend money, and Zuck is still hurting about.

Travis Hoium: You may just give them away.

Lou Whiteman: I wasn’t going to go quite that far, but since you got there, I don’t think that profitability, I’m glad we’re talking volume. We’re talking units, not profitability or success here.

Travis Hoium: But, I don’t think we’re under the delusion that these are going to be profitable in the next three years.

Lou Whiteman: My guess is, he’s going to move these darn things. Come high or high water.

Travis Hoium: This will be interesting because I do think the adoption of the VR space really hit a wall. But glasses are different. Glasses are a little bit more passive. They’re not quite lower cost, which is, I think, interesting $800 for these new display glasses. But there’s definitely a market for it. The other thing to think about, too, is if you bought one in 2024, when are you going to want to update that? If there’s not a lot of new features, that could be a headwind, too. We’ll be fascinated to see how successful or unsuccessful Meta is moving into more of the glasses space. Let’s go to the overall economy, and I want to get your thoughts on mortgage rates. The reason that I think this is important is housing is a huge driver of the economy. It’s huge portion of our money is spent on rents, on mortgages. It provides tons of jobs. Higher mortgage rates, at least than we’ve had over the past decade, has been a real headwind. Fed funds rate is coming down. The rate that the Fed controls is coming down. The problem is, the longer term rates that drive mortgage rates and the borrowing rates for companies is not coming down at the same rate. Right now, we have a mortgage rate average of about 6.3% a year from now, do you think those mortgage rates are going to be over or under 6%? Down just slightly from where we are today, Lou how you go?

Lou Whiteman: Getting a real time lesson in the limits to the Fed’s power. Wait, there’s just so much going on other than the Fed that’s driving these long term rates. I’m going under, and I’m not sure it’s a good thing. I’m all over the place. What’s going to happen in the economy in the next year? But I’m increasingly worried, I think, and I think that there’s going to need to be more and more aggressiveness. I think housing is a natural place for both politics and policy to get involved here. I don’t want to go too much under there, but I have a feeling we’ll be eventually pushed downward one way or the other.

Emily Flippen: Might be a hot take here, but we’re sitting at about 6% right now, and I think the general expectation is that the market can handle the housing market can handle these high rates for very much longer, and that the Fed is going to continue to cut rates, which eventually, hopefully, even though there is obviously a disconnect here between the Fed is doing and what lenders are doing, that will eventually come down, but I have to say over. I think mortgage rates are going to be over 6% one year from now. The reason is is because I don’t actually think we’re going to get as many rate cuts as the market is expecting. I think that tepidness is going to pull over into the market for mortgages. The reason I say that is because a lot of the inflation data, despite the fact that it has cooled off, and it’s down, although obviously not to Fed’s target rates, I expect that we probably heat up as a lot more of these price increases from tariffs are passed along to consumers in the back half of this year, a lot of that evidence has shown that companies so far have eaten the price of these tariffs, and that is eventually that dam is eventually going to break. In my opinion, that’s unfortunately going to impact interest rates.

Travis Hoium: I do think it is interesting that we have not really seen we’ve been talking about this on these shows for months. We have not really seen the impact of tariffs yet. The inventory cycle for a lot of these companies is not a month or two. If tariffs went in place, April 2, it’s not like you’re going to see that in stores, even in June. They were planning in April now for the holidays. This is when we’re going to see those price increases. I have kids. We’re buying stuff for them all the time, and you’re seeing those prices go up. I’m interested to see if that impacts consumers. Emily, is your point just that the market is going to say, you know what? Sure, these rates are going to come down short term, but long term, they’re going to have to go back up to fight inflation.

Emily Flippen: I think it’s going to be a combination between a weaker labor market and inflation here that’s going to put the Fed in a bit of an odd position. Ultimately, I think, whenever you see broader economic concerns in combination with the dynamics that we’re seeing in terms of the housing market today, I would just be surprised if rates fall that dramatically within one year. I hope I am wrong. I do tend to be a pessimist, and I like to be pleasantly surprised. I hope a year from now we’re sitting here in October 2026, talking about our nice four per to 5% mortgages. But that feels like a pipe dream to me these days.

Lou Whiteman: You know what’s fascinating, Emily, I’m pessimistic, too, but I think in the near term, it’s easier to play games with it, and in the long term, it eventually comes back to bite you. I’m focused on the one year, too, but who knows? That’s what makes market.

Travis Hoium: Let’s quickly do an over under on the number of fed rate cuts in the next 12 months. Emily, it sounds you’re going under three. That’s where I’m going to set the bar. But is that officially your call?

Emily Flippen: It is. In fact, I’ll tell you what. In the next 12 months, I will even go further. I think we have maybe one rate cut.

Travis Hoium: The market is pricing into this year.

Emily Flippen: Yes.

Travis Hoium: You don’t think that’s going to happen in 12 months?

Emily Flippen: I don’t talked about this on Motley Fool Money in the past, I believe. I think I expected one rate cut in September, which we got. Despite the fact that all of the blind polling here from the Federal Reserve does indicate that even the people on the panel themselves expect a number of rate cuts over the remainder of the year.

Emily Flippen: We don’t have, obviously, with the government shutdown, our most recent jobs data, and inflation has not moderated. I can’t emphasize this enough. It has not moderated to the extent that the Fed wants it to moderate. It’s still well above their target rate. We’ve actually seen it accelerates on a month over month basis, and there’s a fair bit of evidence that despite the fact that tariffs have not had the impact that I think a lot of economists and investors fear to this point, which is wonderful, that that shoe is, in my opinion, likely to drop toward the back half of the year. Again, I really hope I’m wrong here. I really hope mortgage rates come down. I really hope we have three rate cuts. But I’m betting on one rate cut in the next.

Lou Whiteman: I really hope I’m wrong, Ron Gur, because for the record, I agree. If you want me, I play pundit. I agree with everything Emily said. I was reluctant to even cut the first time. I was scared about that, and I don’t want rate cuts. I’m worried about inflation. But again, I think politics plays into this, and especially as the year goes on with the Fed. I think market dynamics is providing pressure. Officially, I would push to three. I think we are at three. But, if anything, if you force me not to push, I’m going to take the over. That scares me a bit, but I do think that just the pressure on the Fed to cut rates is only going to accelerate as Pal steps away and as other changes, and as just assist the situation, I’m afraid we are going to deteriorate some from here.

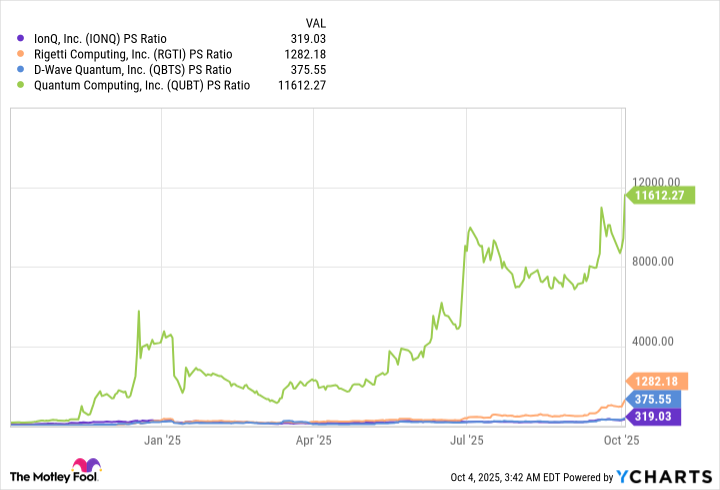

Travis Hoium: Lou, I did allow you to push on that one, but this one, we’re going to make things a little bit more difficult. NVIDIA is the most valuable company in the world, $4.6 trillion market cap; Microsoft, 3.9, Apple, 3.8 trillion. My question for you, is NVIDIA going to be over or under the 1.5? Basically, are they going to be first or are they going to be lower than first? Most valuable company on January 1st, 2030. You have a little over four years between now and then. Are they going to maintain this ranking?

Lou Whiteman: Any good gambler has to take the field on that. I’m going to take the field and say under. However, NVIDIA is a pretty good choice to be there. It’s a great company. They have staying power. But no, if you’re going to give me every company or NVIDIA and have it play out four years, I’ll take everybody else.

Emily Flippen: Unfortunately, if you look historically speaking, companies that are the largest in the world when you zoom out in a 5-10 year period don’t tend to maintain that positioning. I have to agree with Lou here, I to take the under. That being said, if anybody can do it, it’s NVIDIA. This would be, and you hate as an investor to say this time is different, but this could be the exception to the rule.

Travis Hoium: We’ll end on this one. I want to get your S&P 500 picks over the next 12 months. Over or under 7,000. As we’re recording, we’re at about 6,750. I’m giving a little bit of a gain, 5% gain or so. Do you think a year from now we are under 7,000 on the S&P 500, Emily?

Emily Flippen: This is an interesting question because I think everyone in their dough will tell you right now that the S&P 500 is overvalued. The market is overvalued. We have all of these headwinds, consumers are feeling hurt. The government, as we are talking, is literally shut down, and the stock market is up. Make that make sense, exactly. There is this real disconnect that’s happening between the American consumer, the American economy, and, I guess, general vibes of the American people here versus what we’re seeing in the market. I fear that the irrationality, to some extent, can maintain over the course of the next year because it hasn’t made a lot of sense to this point. That being said, I can’t get behind why that would be. I have to take the under. I think it’s less than five. In fact, I think the stock markets probably down from where we are today a year from now. Again, I hope I’m wrong, and pessimists sound smart, optimists tend to make more money, so I’m staying fully invested, regardless of what my short-term prediction is for the markets. But it’s hard for me to rationalize how the market could go up from here, given the factors and the headwinds that we’re seeing in the broader economy.

Lou Whiteman: It’s hard to disagree with that. I’ve been all doom and gloom when we were talking about the Fed and stuff, but here’s the deal. I do think that it’s “priced in.” I think one of the weird things is Liberation Day was such a shock that we just normalized that or became immune to that real quick. I am more confident that we aren’t going massively in one direction or the other. I think it’s going to just be a grind, but I’m going to take the over. I think that we can just grind along almost regardless of what’s going on on Main Street for a while.

Travis Hoium: When we come back, we will get to stocks on our radar. You are listening to Motley Fool Monday.

As always, people on the program may have interest in the stocks they talk about, and the Motley Fool may have formal recommendations for or against, so don’t buy or sell stocks based solely on what you hear. All personal finance content follows Motley Fool editorial standards and is not approved by advertisers. Advertisements are sponsored content and provided for informational purposes only. To see our full advertising disclosure, please check out our show notes. One of the interesting news items for the week is Spotify founder and CEO, Daniel Ek, is stepping down. He is going to be replaced by co-CEOs Gustav Soderstrom and Alex Norstrom. Emily, this has been a phenomenal run for Spotify and for Ek over the past three years. I think they’ve solidified their business model, but going with the co CEO strategy seems to be a trend, too. What did you take away from this announcement?

Emily Flippen: I was really disappointed by this announcement because, as you mentioned, Travis, wow, it looks good for Spotify over the last couple of years; it wasn’t always the case. When Spotify first went public, part of my conviction behind the business was the way that Dan Ek talked about the company being very focused on the long term, and investors can forget that there is a period for Spotify there, a very long period where investors were very pessimistic, believing that Spotify would never be able to get its gross margin above 30% because of the limits and the caps on the way that the licensing agreements for music operated. Dan Ek had a really impressive long-term vision for what the Spotify platform could be, and he really did execute well on that, raised prices when it was appropriate, while expanding into things like audiobooks and podcasting, of which so many people, even internally in Spotify, were very skeptical about his investments there. Ek led that initiative. It’s disappointing to see him leave, even though he will stay on his executive chair. I don’t love co-CEOs in general, but I will say if anybody can pull it off, it’s possibly this pair. Norstrom and Soderstrom have already acted together as co-presidents of Spotify. They seem to have different expertise, one more product, one more operational. Hopefully they’ll find a way to marry in that sense, but the devil’s always in the details, and it’s scary when you have a founder, CEO leaving the helm of a great company.

Lou Whiteman: Everything in my gut makes me want to hate the co CEO structure. You need one person in charge. I think I need to get over that, though. We’ve seen it in a lot of companies. I do think, look, the CEO title has always been vague. It means different things in different companies. It’s too much for one human being to do all the work of a big company. Average tenure of CEOs is falling, so you need to have a lot of talent there. I think if you look at this case, and I think there’s a good chance it works. I think the idea of just we’re almost just recategorizing what we call people. When inevitably, nobody was multitasking everything, and everybody had different roles, anyway. I think what’s evolving more is just how we describe these things, not how companies work. You need the right people. You need well-defined roles. You need, maybe a founder as executive chairman to play referee if needed. I think it can work, and I need to be less scared of it. Hopefully for the best year.

Travis Hoium: It has been interesting to see Netflix has done a similar thing, where they have different expertise. It does seem like a two-headed dragon at the top, and these companies are so big now that maybe that makes sense because it’s a huge job to fill. Let’s get to the stocks that are on our radar. We’re going to bring in Dan Boyd from behind the glass. Lou, I’m going to have you go first. What’s on your radar this week?

Lou Whiteman: Dan, I’m looking at Delta Airlines, ticker DAL. They kick off transport earnings next week, Thursday, I think, should set the tone not just for airlines, but could provide insight into the consumer, into big macro, and all that. Baseline expectations is that corporate travel is holding up better than tourists. International is steady, and premium products are in demand. If that proves true, that is really good news for investors not just in Delta, but United too, which I think Delta and United, probably the best stocks in this sector. Very curious to hear what they have to say and what we can read into the entire sector from them.

Travis Hoium: Dan, what do you think about getting into airline stocks?

Dan Boyd: Now, Lou, you are a Georgia guy. How much of this is blind Homerism?

Lou Whiteman: I haven’t lived in Georgia that long.

Dan Boyd: You’re saying none?

Lou Whiteman: No.

Dan Boyd: I don’t believe it. I don’t believe that for a second.

Lou Whiteman: Dan, as someone who flies Delta regularly, I have all the reason in the world to hate them, trust me.

Dan Boyd: Fair enough.

Lou Whiteman: Emily, what’s on your watch list?

Emily Flippen: Well, hopefully, a stock that generates a little less hate than Delta Airlines. I’m looking at Mercado Libre. The ticker is MELI. Mercado Libre shares are down about 15% this week because this e-commerce behemoth that operates in South America looks like it’s getting a bit of renewed competition from Amazon. Amazon announcing that in their attempt to expand their presence in Brazil, they’d be waiving additional fees for sellers and fulfillment by Amazon throughout the country over the holiday season. In my opinion, this is a great buying opportunity, Dan. You have to listen to me here because Mercado Libre’s been there, done that. Sea Limited, with the Shoppe app, tried to move into Brazil in Latin America, South America, a couple of years ago, and got absolutely trounced by Mercado Libre. Mercado Libre has by far the biggest lead in this space. I couldn’t be less concerned for the lead they have here, and with shares off around 15%. What’s a better time to be buying?

Travis Hoium: Dan, Emily’s going with a long-term winner compared to the troubling industry in the airlines. What do you think about Mercado Libre?

Dan Boyd: She said, you have to listen to me. Travis, so I guess I have to listen to Emily now.

Emily Flippen: Let this be a lesson to ask for what you want in life.

Travis Hoium: What’s going on your watch list? Is it officially Mercado Libre?

Dan Boyd: It’s definitely going to be Mercado Libre. I think the price point might be a little too good to ignore these days.

Lou Whiteman: For Lou Whiteman, Emily Flippen, our production leader, Dan Boyd, and the entire Motley Fool team, I’m Travis Hoium. Thanks for listening to Motley Fool Money. We’ll see you here tomorrow.