“Valuation: Measuring and Managing the Value of Companies” has long been a definitive guide for corporate finance professionals. Eight editions in, the book’s lead author, Tim Koller—a partner at consulting giant McKinsey & Company—says the biggest surprise is what hasn’t changed. Koller speaks to Global Finance about one of the dealmaking world’s most enduring topics.

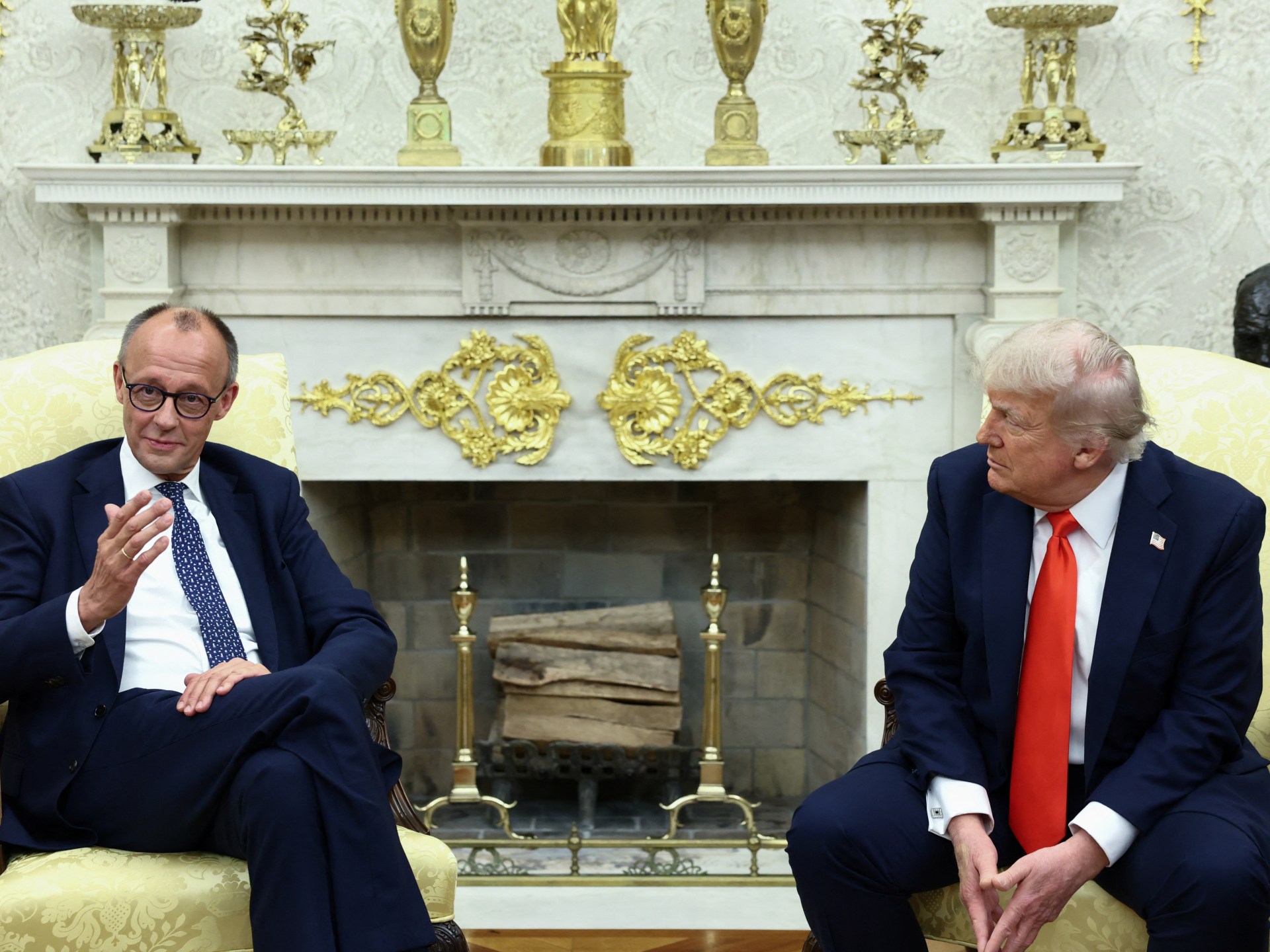

Global Finance: To what extent does geography play a role in affecting a company’s valuation?

Koller: It applies to most parts of the world. If you are a purely local business, in Europe or Asia, for example, then it’s less of an issue. But, if the US were to experience a severe recession, it would probably affect everybody. And then, of course, there are those businesses that are directly impacted—companies that export, import or compete with US companies. A lot of companies, even if they appear to be local, they’re competing with US-based companies, or they’re trading with US-based companies. So, the impact is felt far beyond the US.

GF: Are more companies growing frustrated with US volatility and seeking opportunities in Europe and the APAC region?

Koller: For most companies, it takes years to build or to change strategies from a geographic perspective. Some of the companies I talked to are thinking about these things, but, at this stage, you don’t just break into a market in a couple of months. If you want to build a business in a new country, or if you want to change your supply chain, these things take time. So it depends. If your supply chain is highly specialized, that could take years to restructure. If your supply chain is simple or there are lots of other producers, and you can switch from one country to another, that’s a little bit easier.

Bringing things back to the US is also very time consuming—no matter what industry it is. People are thinking about it and making plans, but for the most part, the timeframe of any kind of major structural change is fairly long, and you don’t want to commit to it until you probably know more about what’s going on.

GF: In this latest edition of your book, did you touch upon digital assets or how companies are building their own reserves?

Koller: We don’t address it, and I’ll tell you why. For the most part, a lot of what people are talking about is not a currency. We call it a cryptocurrency, but it’s not a currency. It is a speculative investment. And the nature of these speculative investments is unlike a stock or a bond. There’s no inherent valuation. We won’t know what the answer is eventually. It’s purely a function of supply and demand of investors and sentiment for many of these cryptocurrencies. It’s like investing in vintage automobiles or fine art. It’s nothing more than that. As far as I’m concerned, that’s why we don’t touch on it, because you can’t do anything with it, and then I wouldn’t understand why a company would put money into that. Because you’re really betting on market sentiment. You’re betting on other investors wanting to get into that market and pushing up the price.

GF: What about stablecoins?

Koller: Stablecoins are cryptocurrencies tied to real-world assets, usually the US dollar or another fiat currency. The more reputable ones are backed 1:1 by actual reserves. From a corporate valuation perspective, they’re not particularly interesting. If a cryptocurrency is simply pegged to the dollar but involves additional transaction costs, it doesn’t offer much advantage over using dollars directly.

There’s been talk for decades about something replacing the US dollar as the world’s reserve currency—whether the euro, the yuan, or others—but those alternatives face their own challenges. For a currency to be viable for transactions, especially everyday purchases, it needs to have a stable value. That’s why something backed by the dollar or another relatively stable fiat currency is necessary.

However, stablecoins don’t really factor into the strategic decision-making of most companies or investors unless they’re directly involved in currency or cryptocurrency markets. And that’s a niche area I’m hesitant to speculate on.

GF: Are there certain basic mistakes that happen at a company that hurts valuation or leads to their failure?

Koller: It’s rarely that a company is fundamentally unsound. The real issue is often the gap between how companies value themselves and how the market values them. Many CEOs and CFOs believe their companies are undervalued, but when we analyze hundreds of companies each year—using discounted cash flow models and peer comparisons—we usually find valuations are within 10% of fair value. That margin is small and can fluctuate day to day.

Companies, on the other hand, often have financial projections that are inconsistent with their market values, because the market doesn’t give them credit for things that they hope to achieve, unless they have a strong track record. For example, if an industry grows at 4% annually and a company projects 6% growth, the market may only price in 4%. If the company hits just that, it’s not a failure—investors never expected more. It’s not a disaster from a valuation perspective, because investors didn’t expect that anyway.

The bigger issue is the disconnect we saw in the dotcom bubble. There’s sometimes a disconnect, you might argue, with some of the big mega [magnificent seven] stocks. One of the characteristics I look for, in terms of potential overvaluation, is who are the investors in a company. And, in particular, what share of retail investors? And if you see a very high share of retail investors inside in a stock, that is often a sign of overvaluation. Retail investors don’t crunch the numbers. They typically buy based on emotion and hype. It may be a great company, but that doesn’t mean you should pay 100 times earnings for it.

GF: Could that also complicate M&A strategies?

Koller: Yes, although that does create an opportunity. Very few companies have the guts to take advantage of it. If my shares are overvalued, that’s the time when you can use those shares to buy something, and that’s great. We’ve seen a couple of those, but not that often.

GF: Over the eight editions on valuation, what’s the most surprising change that you’ve seen in how companies wrestle with value?

Koller: The most surprising thing isn’t how much companies have changed, but how little they have. And it’s not just because we’ve written a book, but other academics have done research. Many companies remain too short-term oriented. Large firms still try to cost-cut their way to success, which only works for a limited time. And while innovation continues, it often comes from smaller companies rather than the big players.

One positive shift has been the steady decline of conglomerates. More companies are breaking themselves up into simpler, more focused entities. This trend, certainly evident in the US and to some extent in Europe as well, has improved management effectiveness and is favored by investors who value focus and clarity. That’s probably the most meaningful change—the breaking up of complex companies into smaller ones.

GF: Do the recent headlines of Google and Meta being under scrutiny and possibly broken up exemplify that trend?

Koller: I can’t speak specifically to Google or Meta, because their business units are more interconnected than, say, a company making both valves and toothpaste—where there’s clearly no synergy. What matters isn’t size but complexity, especially when businesses don’t share customers, technologies, suppliers, or distribution channels. That’s when it makes sense to consider breaking them up.

More broadly, while the trend toward focused companies has been positive, many firms remain too short-term oriented. They often blame the stock market, but that’s not entirely fair. Our research shows that about 75% of investors—whether retail, index funds, or institutions—are long-term holders. The problem is that companies tend to pay too much attention to the loudest voices, which are often short-term traders. There’s still a lot of room for companies to take a more long-term approach, and that’s work that continues.

GF: In past editions or in this new edition on valuations, has there been any sort of trend or surprising development you noticed?

Koller: One major trend we’ve seen is the globalization of equity markets over the last 35 years. Today, the shareholder-base of large companies in Europe, Japan, and Taiwan often looks very similar to their US peers. As an individual investor, you can easily buy hundreds of international funds or even individual foreign stocks—and the same goes for investors abroad buying US equities. So, from a capital markets perspective, things have truly globalized.

However, corporate behavior still varies by region. On average, European companies continue to earn lower returns on capital than their US counterparts—though the gap has narrowed, and some of the best-performing companies in various industries are European. In Asia, there’s still a noticeable emphasis on size and prestige over value creation. I’m surprised that focus persists. While it’s slowly shifting, many companies still prioritize growth and scale rather than returns, which often results in lower valuations compared to US firms—unless they’re high-growth global competitors.

GF: What will modern finance look like in the future?

Koller: I’m hopeful that AI will help us value companies more effectively. Right now, it’s good at tasks like summarizing and researching quickly, and over time it may become more capable. But while tech—and AI in particular—makes up a large share of the stock market, it still represents a relatively small part of the broader economy. Most people still need housing, food, clothing, travel—those businesses aren’t going away.

AI will be used across many industries to improve customer experience, reduce costs, or enhance products, but it’s not fundamentally going to change things. Valuations are going to be disproportionate towards those companies. But the real question is: Will companies use AI to actually boost profits, or will those gains be passed on to consumers, like with many past innovations? For investors and executives, the key is understanding whether AI is a true source of competitive advantage. That distinction will vary by industry, but it’s central to how we think about value in the future.