Is the Schwab US Dividend Equity ETF a Buy Now?

This exchange-traded fund’s persistent underperformance may be on the verge of reversing course.

Are all dividend funds the same? They often are, even if each one is structurally and strategically unique. There’s only so much difference possible when a company and its stock’s primary purpose is just generating cash flow.

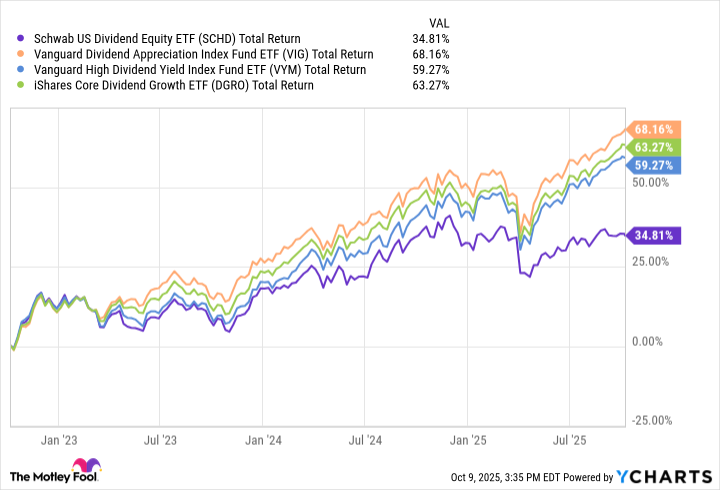

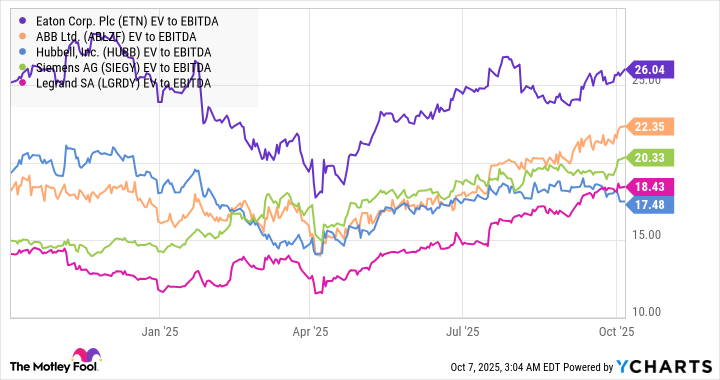

And yet, owners of the Schwab U.S. Dividend Equity ETF (SCHD -1.70%) know all too well that dividend-oriented exchange-traded funds can at times be considerably different than one another. Their fund has measurably underperformed other dividend ETFs like the Vanguard Dividend Appreciation ETF, the iShares Core Dividend Growth ETF, and Vanguard High Dividend Yield ETF over the course of the past three years. Indeed, the disparity’s been wide enough to leave them wondering if they made a mistake that should be corrected as soon as possible.

Well, they didn’t make the wrong choice, so there’s no correction to be made. The very reason this dividend ETF has underperformed of late, in fact, is the very same reason income-seeking investors might want to buy the Schwab U.S. Dividend Equity ETF now.

The same, but different — and more different than the same

What’s Schwab’s U.S. Dividend Equity ETF? It’s meant to mirror the performance of the Dow Jones U.S. Dividend Index, which, just as the name suggests, is dividend-focused. So is the Morningstar US Dividend Growth Index that serves as the basis for iShares’ Core Dividend Growth ETF, though, along with the Vanguard Dividend Appreciation ETF’s underlying S&P U.S. Dividend Growers Index, for that matter.

They’re not all the same, though. And it matters.

Take a comparison of the S&P U.S. Dividend Growers Index behind Vanguard’s Dividend Appreciation fund to the iShares Core Dividend Growth ETF’s Morningstar US Dividend Growth Index as an example. The former consists of U.S.-listed companies that have raised their dividend payments for at least the past 10 years, but it excludes the very highest-yielding tickers (on concerns that the high yields are unsustainable). The latter only requires five years of uninterrupted dividend growth, although it also generally excludes stocks with suspiciously high yields.

End result? The Vanguard fund’s top three holdings right now are Broadcom, Microsoft, and JPMorgan Chase, while the iShares ETF’s biggest three positions at this time are Apple, Microsoft, and Johnson & Johnson. They’re more different than alike, even if there is some overlap.

Image source: Getty Images.

The Vanguard High Dividend Yield ETF’s underlying FTSE High Dividend Yield Index, by the way, currently holds Broadcom, JPMorgan, and Exxon-Mobil as its top three positions — three names that offer the high yield that the index prioritizes. Even so, the fund’s trailing yield is a modest 2.45% at this time, versus the iShares ETF’s yield of 2.2% and the trailing dividend yield of 1.6% currently offered by the Vanguard Dividend Appreciation fund.

Where does Schwab’s U.S. Dividend Equity ETF stand? The Dow Jones U.S. Dividend Index’s biggest three positions right now are AbbVie, Lockheed Martin, and Cisco Systems, followed closely by Merck and ConocoPhillips. In fact, you won’t start seeing any serious overlap between this fund and the other three dividend ETFs in focus here until those positions are so small that they don’t really matter.

That’s why this ETF has underperformed the other three funds in question since early 2023; it’s not holding many of the market’s most popular growth names right now. Indeed, it currently holds a bunch of the market’s least popular value stocks.

SCHD Total Return Level data by YCharts

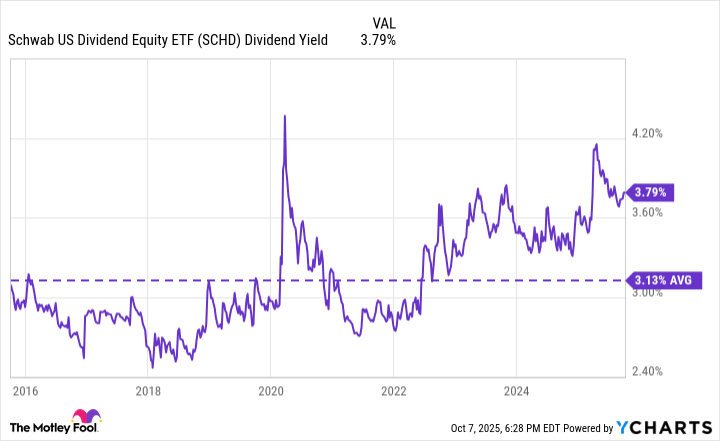

But that’s exactly why income-minded investors might want to dive into the Schwab ETF at this time, particularly in light of its sizable trailing dividend yield of right around 3.7%.

What went wrong for dividend-paying value names?

In retrospect, the fund’s recent underperformance actually makes a lot of sense. The few technology stocks that pay any dividend at all have performed exceedingly well since the launch of OpenAI’s ChatGPT in November 2022, setting off an artificial intelligence arms race that sent a bunch of these stocks sharply higher. The dynamic was also bullish for financial stocks like JPMorgan, which helps companies raise funds or make the acquisitions they need to take full advantage of the AI revolution.

At the other end of the spectrum, most of the Schwab U.S. Dividend Equity ETF’s holdings have been on the wrong side of one force or another. Regulatory headwinds and the impending expiration of key patents have proven problematic for pharmaceutical outfits AbbVie and Merck, for instance.

Inflation and the subsequent rise in interest rates are another one of these forces, and arguably the biggest. Although both have historically been more of a challenge for growth stocks than value names, in this instance, the opposite has been (mostly) true.

Just bear in mind how incredibly unusual the past three years have been. The bulk of growth stocks’ leadership has been fueled by the aforementioned advent of artificial intelligence, creating a secular growth opportunity that wouldn’t be stymied by any economic backdrop.

Also know that the so-called “Magnificent Seven” stocks have done the vast majority of the market’s recent heavy lifting, so to speak, fueled by AI. Data from Yardeni Research suggests that without the help of these seven tech-centric tickers, the S&P 500‘s would be about one-third less than what it’s actually been since early 2023.

It would also be naïve to pretend that value stocks like Merck, Cisco, and ConocoPhillips just haven’t offered the excitement that most investors have craved in the post-pandemic, AI-centered environment.

Here comes the pendulum

As is always the case, though, the cyclical pendulum will eventually swing back the other way. And that’s likely to happen sooner or later. As number-crunching done by Morningstar analyst David Sekera recently prompted him to note, “By style, value remains undervalued, trading at a 3% discount, whereas core stocks are at a 4% premium and growth stocks are at a 12% premium.” He adds, “Since 2010, the growth category has traded at a higher premium only 5% of the time.”

This dynamic, of course, works against dividend ETFs’ growth names, and works for dividend ETFs like the Schwab U.S. Dividend Equity ETF, which almost exclusively holds value stocks. The market just needs a catalyst to start such a shift.

That may be in the offing, though. JPMorgan CEO Jamie Dimon recently lamented in an interview with the BBC, “I am far more worried about that [a market correction] than others… I would give it a higher probability than I think is probably priced in the market and by others.” And this worry follows Federal Reserve Chairman Jerome Powell’s recent comment that U.S. stocks are “fairly highly valued.” That’s a screaming red flag from someone who makes a point of maintaining composure and not inciting panic.

Sure, such a setback could undermine the Schwab U.S. Dividend Equity ETF as much as it does any other stock or fund. That’s not the chief concern of any correction, though. It’s what happens afterward. That bearish jolt may well inspire investors to rethink everything about the risks they’ve been taking, souring them on tech names and turning them onto value names that also dish out above-average income.

You’ll just want to be positioned before it all starts to happen.