MLB players won’t accept a salary cap. What does union want instead?

If this World Series is going to turn into a food fight about the economics of baseball, Dave Roberts tossed the first meatball.

The Dodgers had just been presented with the National League Championship trophy. Roberts, the Dodgers’ manager, had something to say to a sellout crowd at Dodger Stadium, and to an audience watching on national television.

“They said the Dodgers are ruining baseball,” Roberts hollered. “Let’s get four more wins and really ruin baseball.”

The Dodgers had just vanquished the Milwaukee Brewers, a team that did everything right, with four starting pitchers whose contracts total $1.35 billion.

The Brewers led the major leagues in victories this year. They have made the playoffs seven times in the past eight years, and yet their previous manager and general manager fled for big cities, in the hope of applying small-market smarts to teams with large-market resources.

The Dodgers will spend half a billion dollars on player payroll and luxury tax payments this year, a figure that the Brewers and other small-market teams might never spend in this lifetime, or the next one.

The Brewers will make about $35 million in local television rights this year. The Dodgers make 10 times that much — and they’ll make more than $500 million per year by the end of their SportsNet LA contract in 2038.

Is revenue disparity a problem for the sport?

The owners say yes. They are expected to push for a salary cap in next year’s collective bargaining negotiations. A cap is anathema to the players’ union. At the All-Star Game, union executive director Tony Clark called a cap “institutionalized collusion.”

The union could say, yes, revenue disparity is the big issue and propose something besides a cap.

But that is not what the union is saying. The union does not agree that revenue disparity is the issue, at least to the extent that the players should participate in solving it. Put another way: Tarik Skubal should not get less than market value in free agency to appease the owner of the Pittsburgh Pirates.

For the most part, the union believes the owners should resolve the issue among themselves.

And the fundamental difference might be this: To most of the owners, the Dodgers’ spending is the big problem, or at least the symptom of a big problem. This was Commissioner Rob Manfred at the owners’ meetings last February: “Do people perceive that the playing field is balanced and fair and/or do people believe that money dictates who wins?”

To the union, the problem is not one of perception. The union believes the problem is that the Dodgers’ spending exposes other owners who would love a salary cap that would give them cover — not to mention cost certainty that could increase profits and franchise values.

“Players across the league show up every day ready to compete and ready to win,” Clark told The Times. “Excuses aren’t tolerated between the lines, and they shouldn’t be accepted outside them either.

“When decision-makers off the field mirror the competitive drive exhibited on it, everybody wins and baseball’s future is limitless. Fans and players alike deserve — and should demand — far more accountability from those to whom much is given.”

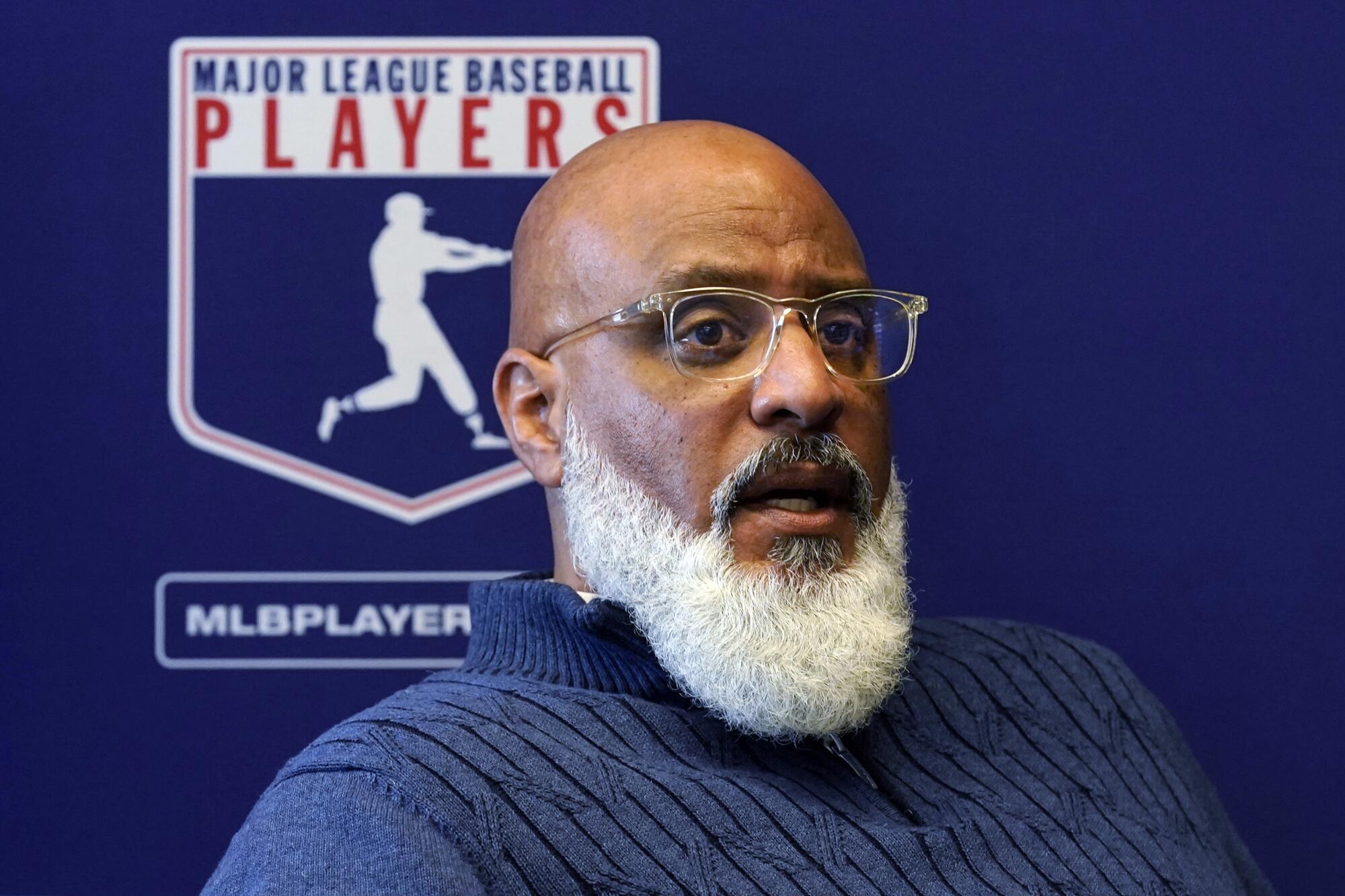

Tony Clark, executive director of the MLB Players’ Assn., speaks during a news conference in New York in March 2022.

(Richard Drew / Associated Press)

In its annual estimates, Forbes had the Dodgers’ revenue last season at a league-leading $752 million and the Pirates’ revenue at $326 million. The Pirates turned a profit of $47 million and the Dodgers turned a profit of $21 million, according to those estimates.

The Pirates — and other small-market teams — make more than $100 million each year in their equal split of league revenue (national and international broadcast rights, for instance, and merchandising and licensing) and revenue shared by the Dodgers and other large-market teams. That means the Pirates can cover their player payroll before selling a single ticket, beer, or Primanti sandwich stuffed with meat, cheese and fries.

“The current system is designed so larger markets share massive amounts of revenue with smaller markets to help level the playing field,” Clark said. “Small-market teams have other built-in advantages, and we’ve proposed more in bargaining — and will again.”

The union would be delighted to get a salary floor — that is, a minimum team payroll. The owners would do that if the union agreed to a maximum team payroll — that is, a salary cap.

Whether the owners believe recent and potential future changes — among them a draft lottery, more favorable draft-pick compensation for small-market teams losing free agents, providing additional draft picks for teams that promote prospects sooner and for small-market teams that win — can begin to mitigate revenue disparity is uncertain. Whether the players can condition revenue sharing on team progress also is uncertain.

And, perhaps most critically to owners, the collapse of the cable ecosystem means many teams have lost local television revenue that might not ever bounce completely back, even if Manfred can deliver on his proposed “all teams, all the time, in one place” service.

Whatever the issues might be, fans are not throwing up their hands and walking away. The league sold more tickets this year than in any year since 2017. Almost every week brought an announcement from ESPN, Fox or TNT about a ratings increase, and the league did not complain about the outstanding ratings the Dodgers and New York Yankees attracted in last year’s World Series.

Dodgers fans celebrate after Shohei Ohtani hits the second of his three home runs in Game 4 of the NLCS against the Brewers at Dodger Stadium on Oct. 17.

(Eric Thayer/Los Angeles Times)

Payroll is under the control of an owner. Market size is not.

Of the top 15 teams in market size, six made the playoffs. Of the bottom 15 teams in market size, six made the playoffs.

Is that a reasonable exhibition of competitive balance? Would the Dodgers winning the World Series in back-to-back years define competitive imbalance, even if they would become the first team in 25 years to repeat? The only other team currently dedicated to spending like the Dodgers — the New York Mets — has not won the World Series in 39 years.

The Kansas City Chiefs have played in the Super Bowl five times in six years, winning three times. That is because they have Patrick Mahomes, not because the NFL has a salary cap.

In the past three years, the Dodgers are the only team to appear in the final four twice — more diversity than in the final four in the NFL, NBA or NHL, each of which has a salary cap.

The league used to happily distribute information like that. After the winter chants about the Dodgers ruining baseball, the league started talking about how no small-market team had won the World Series in 10 years.

Payroll itself should not define competitive balance, but that becomes a self-fulfilling prophecy if an owner decides competing with the Dodgers would be no less futile by spending another $25 million on players.

It is premature to count heads now. However, at this point, you wonder whether any team besides the Dodgers and Mets would lobby against the league pursuing a salary cap in negotiations. If the owners really want a salary cap, they need to be prepared to do what the NHL did to get one: shut down the league for an entire season.

We should be talking about the magic of Shohei Ohtani and Mookie Betts. Instead, on its grandest stage, the talk around baseball will be all about whether its most popular team is ruining the game to the point of depriving us of it come 2027. Well done, everyone.