Trump says economic growth ‘shatters expectations’. Data says otherwise | Donald Trump News

The White House has launched an aggressive public relations campaign promoting a narrative of economic strength during the first six months of United States President Donald Trump, with claims of his policies fueling “America’s golden age”.

But an Al Jazeera analysis of economic data shows the reality is more mixed.

Trump’s claims of his policies boosting the US economy suffered a blow on Friday when the latest jobs report revealed that the country had added a mere 73,000 jobs last month, well below the 115,000 forecasters had expected. The only additions were in the healthcare sector, which added 55,000 jobs, and the social services sector added 18,000.

US employers also cut 62,075 jobs in July — up 29 percent from cuts in the month before, and 140 percent higher than this time last year, according to the firm Challenger, Gray and Christmas, which tracks monthly job cuts. Government, tech, and retail sectors are the industries that saw the biggest declines so far this year.

It comes as this month’s jobs and labour turnover report showed an economic slowdown. There were 7.4 million open jobs in the US, down from 7.7 million a month before.

The Department of Labour on Friday released downward revisions to both the May and June jobs reports, significantly changing the picture the White House had previously painted.

“For the FOURTH month in a row, jobs numbers have beat market expectations with nearly 150,000 good jobs created in June,” the White House said in a July 3 release following the initial June report.

The Labor Department had reported an addition of 147,000 jobs in June. On Friday, it sharply revised down that number to just 14,000. May’s report also saw a big downgrade from 144,000 to only 19,000 jobs gained. Trump has since fired the head of the agency that produces the monthly jobs data, alleging that the data had been manipulated to make him look bad.

Even before the revisions, June’s report was the first to reflect early signs of economic strain tied to the administration’s tariff threats, as it revealed that job growth was concentrated in areas such as state and local government and healthcare. Sectors more exposed to trade policy – including construction, wholesale trade, and manufacturing – were flat. Meanwhile, leisure and hospitality showed weak growth, even in peak summer, reflecting falling travel demand both at home and abroad.

The administration also claimed that native-born workers accounted for all job gains since January. That assertion is misleading as it implies that no naturalised citizens or legally present foreign workers gained employment.

However, it is true that employment among foreign-born workers has declined – by over half a million jobs – claims that native-born workers are replacing foreign-born labour, are not supported by the jobs data.

Jobs lost in sectors with high foreign-born employment, including tech, have been abundant, driven by tariffs and automation, particularly AI. In fact, recent layoffs in tech have been explicitly attributed to AI advancements, not labour displacement by other groups.

Companies including Recruit Holdings — the parent company of Indeed and Glassdoor, Axel Springer, IBM, Duolingo and others have already made headcount reductions directly attributed to AI advancements.

Wage growth

The pace of rise of wage growth, an indicator of economic success, has slowed in recent months. That is partly due to the Federal Reserve keeping interest rates steady in hopes of keeping inflation stable.

According to the Bureau of Labor Statistics, wages have been outpacing inflation since 2023, after a period of declining real wages following the COVID pandemic.

Wage growth ticked up by 0.3 percent in July from a month prior. Compared with this time last year, wage growth is 3.9 percent, according to Friday’s Labor Department jobs report.

Earlier this year, the White House painted a picture that wage growth differed between the era of former President Joe Biden and now under Trump because of policy.

“Blue-collar workers have seen real wages grow almost two percent in the first five months of President Trump’s second term — a stark contrast from the negative wage growth seen during the first five months of the Biden Administration,” the White House said in a release.

However, Biden and Trump inherited two very different economies when they took office. Biden has to deal with a massive global economic downturn driven by the onset of the COVID-19 pandemic.

Trump, on the other hand, during his second term, inherited “unquestionably the strongest economy” in more than two decades, per the Economic Policy Institute, particularly because of the US economy’s rebound compared with peer nations.

Inflation

Inflation peaked in mid-2022 during Biden’s term at 9 percent, before falling steadily because of the Federal Reserve’s efforts to manage a soft landing.

A July 21 White House statement claimed, “Since President Trump took office, core inflation has tracked at just 2.1 percent.” On Wednesday, Treasury Secretary Scott Bessett said “inflation is cooling” in a post on X.

However, the Consumer Price Index report, which tracks core inflation – a measure that excludes the price of volatile items such as food and energy – was 2.9 percent in the most recent report and overall inflation was at 2.7 percent in June.

Prices

The most recent Consumer Price Index report, published July 15, shows that on a monthly basis, prices on all goods went up in June by 0.3 ,percent which is 2.7 percent higher from this time last year.

Grocery prices in particular are up 2.4 percent from this time last year and 0.3 percent from the prior month. The cost of fruits and vegetables went up 0.9 percent, the price of coffee increased by 2.2 percent and the cost of beef went up 2 percent.

New pending tariffs on Brazil, as Al Jazeera previously reported, could further drive up the cost of beef in the months to come.

Trump has pointed to falling egg prices in particular as evidence of economic success, after Democrats attacked his administration over their price in March. He has even gone so far as to claim that prices are down by 400 percent. That figure is mathematically impossible – a 100 percent decrease would mean eggs are free.

During the first few months of Trump’s term egg prices surged, and then dropped due to an outbreak of, and then recovery from, a severe avian flue outbreak, which had been hindering supply – not because of any specific policy intervention.

In January, when Trump took office egg prices were $4.95 per dozen as supply was constrained by the virus. By March, the average egg price was $6.23. But outbreak and high prices drove away consumers, allowing farmers with healthier flocks to catch up on the supply side. As a result, prices fell to an average of $3.38. That would be a 32 percent drop since the beginning of his term and a 46 percent drop from their peak price – far from the 400 percent Trump claimed.

Trump also recently said petrol prices are at $1.98 per gallon ($0.52 per litre) in some states. He doubled down on that again on Wednesday. That is untrue. There is not a single state that has those petrol prices.

According to Gasbuddy, a platform that helps consumers find the lowest prices on petrol, Mississippi at $2.70 a gallon ($0.71 per litre) has the cheapest gas, and the cheapest petrol station in that state is currently selling gas at $2.37 ($0.62 per litre).

AAA, which tracks the average petrol price, has it at $3.15 per gallon ($0.83 per litre) nationwide, this is up from the end of January when it was $3.11 ($0.82 per litre).

While petrol prices have gone down since Trump took office, they are nowhere close to the rate he has continually suggested. In July 2024, for instance, the average price for a gallon of petrol nationwide was $3.50 ($0.93 per litre).

GDP

On Wednesday, the White House said that “President Trump has reduced America’s reliance on foreign products, boosted investment in the US”, citing the positive GDP data that had come out that morning.

That is misleading. While the US economy grew at a 3 percent annualised rate in the second quarter, surpassing expectations, that was a combination of a rebound after a weak first quarter, a drop in imports – which boosted GDP, and a modest rise in consumer spending.

The data beneath the headline showed that private sector investment fell sharply by 15.6 percent and inventories of goods and services declined by 3.2 percent, indicating a slowdown.

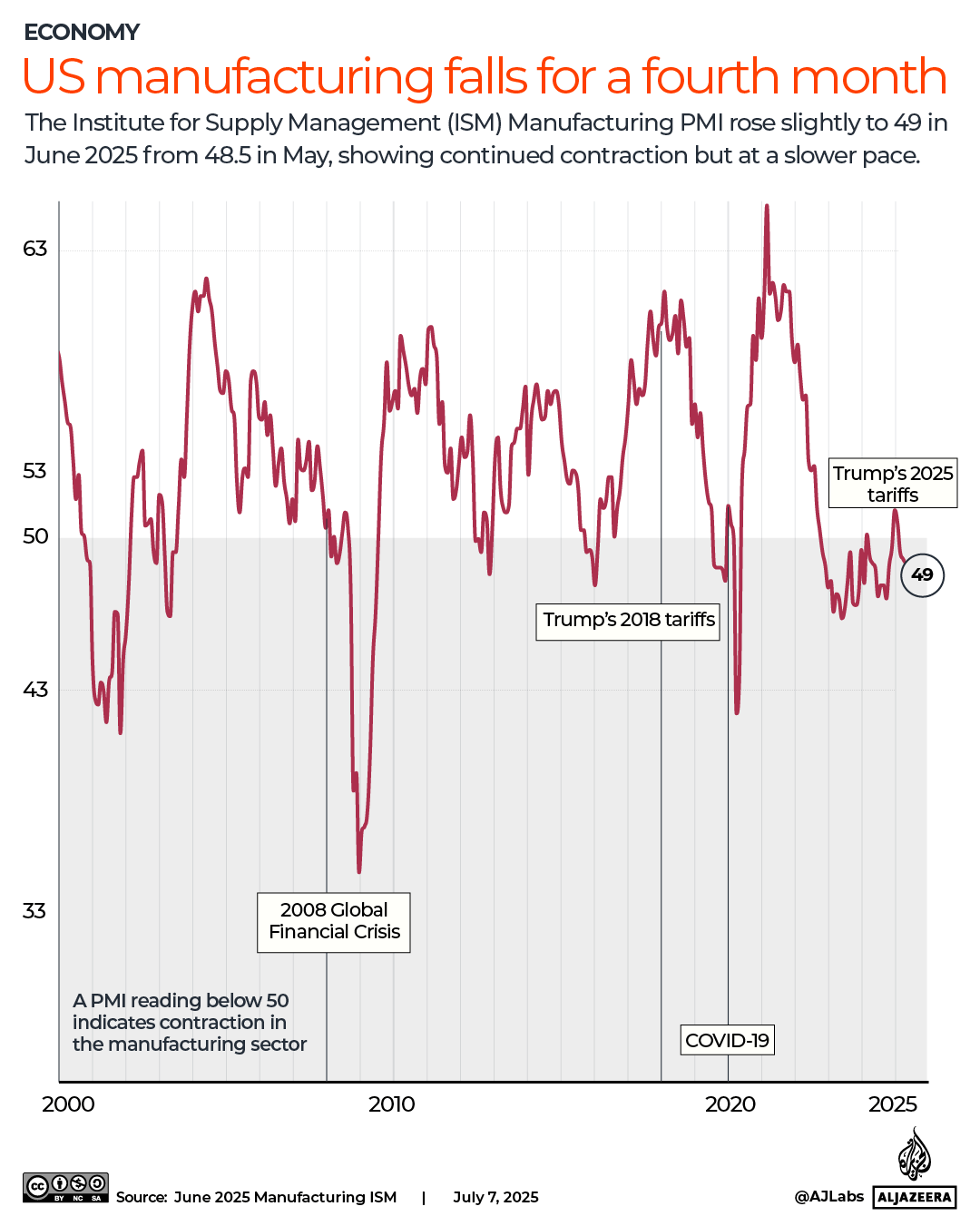

Manufacturing

The administration recently highlighted gains in industrial production, pointing to a boost in domestic manufacturing. Overall, there was a 0.3 percent increase in US industrial production in June. That was after stagnating for two months.

There have been isolated gains, such as increases in aerospace and petroleum-related sectors—1.6 percent and 2.9 percent, respectively.

But production of durable goods — items that are not necessarily for immediate consumption— remained flat, and auto manufacturing fell by 2.6 percent last month as tariffs dampened demand. Mining output also decreased by 0.3 percent.

According to the Department of Commerce’s gross domestic product report, manufacturing growth among non-durable goods has slowed. While there was a 1.3 percent increase, that’s a decline from 2.3 percent in the previous quarter.

This could change in the future, as several companies across a range of sectors have pledged to increase US production, including carmaker Hyundai and pharmaceutical giant AstraZeneca, which just pledged a $50bn investment over the next five years.

Trade deals and tariffs

In April, the White House replaced country-specific tariffs with a 10-percent blanket tariff while maintaining additional levies on steel, cars, and some other items. It then promised to deliver “90 trade deals in 90 days.” That benchmark was not met. By the deadline, only one loosely fleshed out deal — with the United Kingdom — had been announced. As of 113 days later, the US has announced comparable deals with just a handful more countries and the European Union. The EU deal still needs parliamentary approval.

Contrary to the administration’s claims, tariffs do not pressure foreign exporters — they are paid by US importers and ultimately are likely to be passed on to US consumers. Companies, including big box retailer Walmart and toymaker Mattel, have announced price hikes as a direct result. Ford, for example, raised prices on three Mexico-assembled models due to tariff pressures.

To protect their own economies, many countries have pivoted their trade policies away from the US. Brazil and Mexico recently announced a new trade pact.

The White House and its allies continue to defend tariffs by highlighting the increased revenue they bring to the federal government, which is true. Since Trump took office, the US has brought in more than $100bn in revenue, compared with $77bn in the entire fiscal year 2024. The price of imports for consumers has only risen about 3 percent, but many expect that will change as the import taxes are passed on to consumers.

The White House did not respond to Al Jazeera’s request for comment.