In this podcast, Motley Fool analyst Jason Moser and contributors Travis Hoium and Jon Quast discuss:

- How 2025 compares to 1999 and 2007.

- What they wish they had known in the past.

- Energy’s role in AI.

To catch full episodes of all The Motley Fool’s free podcasts, check out our podcast center. When you’re ready to invest, check out this top 10 list of stocks to buy.

A full transcript is below.

This podcast was recorded on Oct. 10, 2025.

Travis Hoium: How does the market in 2025 fit into the history of the stock market? Motley Fool Money starts now.

Welcome to Motley Fool Money. I’m Travis Hoium joined today by Jon Quast and Jason Moser, and I think this is an important time in the market. Take a step back and look at a little bit of context in history. There are these decade long trends that we typically go through, and it seems like we’re either at the beginning or end of one of those with artificial intelligence and all of the companies that are going crazy right now. I want to get your guys’ thoughts on where we are. We all see the potential of artificial intelligence, but the Internet was a massive opportunity in 1999. Mobile was a huge opportunity in 2007. That didn’t stop the crashes that ensued. What historic parallels, Jason do you see in the market today that investors can learn from?

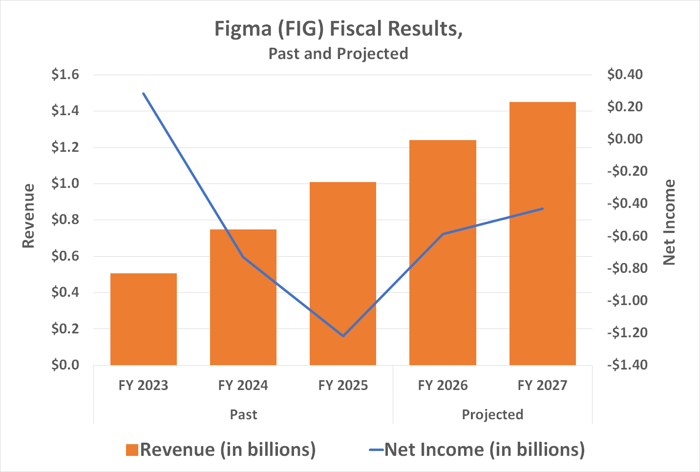

Jason Moser: Yeah well, I love this idea. I think there are a lot of parallels we can draw here. There are some similarities and I think there are some differences as well. You go back to for example, the buildout of the Internet back in 1999, the .com crash that ensued. I mean, there’s a lot of similarities from then to what’s going on today. There’s massive infrastructure buildout. It’s the foundation for what looks to be a new era of technology. It’s also accompanied by a lot of speculation in the markets. We’re seeing that in the form of a lot of nosebleed valuations. I mean, I’m not saying they’re all nosebleed valuations, but there is some data that shows that AI first companies today that are coming to market, are getting 20-40% premium valuations over their non AI driven types of companies. Then you’re also seeing some of the most speculative names are garnering valuations in the neighborhood of 200 times sales.

Travis Hoium: Some of them have gone parabolic just in the past few.

Jason Moser: Yeah, absolutely. I understand the enthusiasm, but there was an interesting interview with Orlando Bravo the other day on TV. He heads up the firm Toma Bravo which they specialize in SAS software and stuff like that. The question that was posed as it’s been posed to most of us is, are we in a bubble? He answered simply yes. I mean, you can’t have companies that are working on $50 million in annualized recurring revenue value to $10 billion, that just doesn’t work. It’s not sustainable. At some point, we will see that shift. But I do think there are some differences too. I mean, primarily, you look at the physical restraints of what was being built out back in 1999, that was laying all that optic cable. Physically difficult to do, but a little bit different than really the restraint today. Now we’re talking about power. We’re trying to figure out how to get the electricity, the power to really make all of this stuff run. I think funding is a little bit more realistic this time around just because so much of it is coming from the hyperscalers. Let’s put OpenAI aside here and look at the other companies, your Amazons, your Alphabets, your NVIDIAs of the world that are helping to fund a lot of this. When you have businesses that are that big with more reliable cash flows, I think the funding side of it seems to be a little bit less speculative than it was back then.

Travis Hoium: Do you think that has changed over the past, even the past few weeks with things like guaranteeing revenue? I think, you know, India did that with CR weave. You’re seeing more variable interest entities or they’re going by different names now, but it’s basically doing some of these financings off balance sheet. That’s what ultimately got Enron in trouble. That isn’t necessarily a parallel that we want to go down, but it’s one of those things where there are these small red flags that you can look throughout history and go, Okay, when you start to see this happen, you should perk up a little bit.

Jason Moser: I think you need to be asking the questions. I think it’s no accident that this week we really saw a lot of those maps circulating around that were showing the intertwinenss of all of these. It’s just a handful of companies that are really dictating the space and you want to put some numbers around it. I mean, this is what really makes me nervous. I think you look at Morgan Stanley research. They say that OpenAI itself, they make up more than $300 billion of this something like $880 billion total future contract value that’s tied to the spending with Microsoft, Oracle, and CR weave, among others. You think about that in the context of the fact that OpenAI, I mean, they just generated basically $13 billion annualized at the midpoint of 2025, and they’re losing money still hand over fist. Where that capital ultimately comes from I think, is a question that investors really need to be focused in on. It’s not to say that OpenAI won’t continue to grow, but that is a big Delta that they’re going to have to figure out a way to shore up.

Travis Hoium: Jon, how do you think about this in a more historical context? What things are you trying to learn from history that could maybe apply today?

Jon Quast: Well, I think historically, whenever you see something new and exciting, investors are wanting in on that and they’re not wanting to miss out. I’d say that applies to both retail investors and private equity investors. You can see that in a couple of fronts here that there are some companies, I think, that are preying on that, taking advantage of that, knowing that investors are willing to pay up for the excitement, the admission to the theme park. You look at the public markets, for example, look at special purpose acquisition companies.

Travis Hoium: These are SPACs. This is what was really popular in 2020 and 2021.

Jon Quast: Yeah, right before we had major, major pullback in so many of the companies out there. These are companies that don’t even have a business. They’re saying, give us money so we can go buy a business. Many of them came forward in 2020, 2021. There’s been a couple of years of a lull but now this year, we have 161 that have gone and filed so far this year, and the years not even over yet. That’s as much as basically the last three years combined. I’m not saying that they’re all bad opportunities. I’m not even saying that most, but I’m saying somewhere in there, the data is saying, yeah, somebody is taking advantage of a situation where investors are very excited and they’re willing to pay for a lottery ticket, essentially. The same thing in the private equity space, you look at the AI private companies out there starting to do perhaps some questionable things, maybe counting some one time deals as part of the calculation in their annual recurring revenue and doing that so that they can boost their valuations, and that increases the amount of funding that they’re able to get from these private investors. We would think that private investors are a little bit smarter than that. But again, I mean, we all have human psychology, and we don’t want to miss out on something that is truly transformative in artificial intelligence.

Travis Hoium: Jason, you brought up those images that are going around. There’s one from the FT, there’s one from Bloomberg, just show this web around OpenAI. One of the things that I think I learned in the 2008, 2009, downfall of the market and the recession that ensued was things just got really, really complicated when a lot of things didn’t need to be complicated. We started with mortgages, mortgage is a fairly straightforward financial instrument, but then you start turning it into 48 different products that you’re cutting into different pieces, and nobody knows where the risk is or who’s holding the risk. That’s what I get concerned about right now is, if AI is such a no brainer and it’s such a high return on investment, then why do we need all this complicated these complicated financial structures? Again, it’s just raising red flags to me. Let me put it this way because I think what we’re trying to do today is take a little bit of our knowledge and pass it on to everybody who’s listening. If you are going to go back, Jason, I’ll start with you, if you were going to go back and talk to yourself in 1999 or 2007, what would you tell yourself that you could maybe implement as an investor?

Jason Moser: Wow, yeah. I like that question a lot. I think if I look back to 1999, while I was investing at the time, I wasn’t a member of the Motley Fools. I think, first and foremost, and I’m being dead serious here, I would have told myself to get a subscription to the Motley Fool because from an educational perspective alone, I think that style of thinking, that style of investing and taking that longer term view is just invaluable. I’d also say, wow, it’s tempting. Steer clear of speculation. I think you’re right. One of the big problems back in 2007/8 was just how ununderstandable that web of financial instruments ultimately became. I think that was a result of greed primarily. But I also look at today and you’re talking about these special interest entities and whatnot. Money isn’t limitless and so I think they start to make it a little bit more complicated when they need to figure out ways to raise more money. That becomes a little bit more concerning as well. I’d say, for me, I’d steer clear speculation. These were stretches of time when some of the great businesses of our time went on sale. Stay focused on owning those high quality businesses, leave the speculating to those who think they probably know what they’re doing and maybe don’t necessarily actually know.

Travis Hoium: Jon, what do you think?

Jon Quast: So 1999, I wasn’t an investor yet, and so it didn’t really start for me until around the great recession.

Travis Hoium: You weren’t investing, but do you remember feeling the.com bubble and crash? Because I think that is an interesting until you actually have money in the market, it is kind of ah, this thing happens, but it doesn’t really affect me.

Jon Quast: Well, I would say absolutely not. I mean, just where we were in our little corner of North Carolina back in those days, I mean, man, we had dial up Internet. I mean, we weren’t even all that aware of what was going on. For me, the great recession was where I really began to take investing seriously. What I tell myself, besides what Jason already said was, I wish that I had just held on to my original vintage of stocks that I invested in. I know it’s 20 years later now, but I look at some of the ones that I had at the time. Buffalo Wild Wings, which is no longer publicly traded, but if I’d just held onto Buffalo Wild Wings from the time I invested until the time that it went private, it was a 10 bagger or more, and I sold after it doubled. I owned Marvel back before Disney acquired it and sold around the time of the announcement. I wish I had just held onto Disney all that time. McDonald’s was one of the first stocks I ever bought. Yeah, maybe that’s not the flashiest thing, but it’s up over 1,000% with dividends. I know some of the listeners are saying, hey, well, that’s 20 years ago, but let me tell you something. For me, it’s 20 minutes. I just started investing. Time goes by so fast. At the time you say, invest for three years, invest for five years. How could you ever? Twenty years is a heartbeat. Man, I wish I could just go back and say, hang on. Don’t try to get cute. Don’t try to buy and sell, trade, all this. Just buy and hold.

Travis Hoium: Yeah, Jon, the lessons that I have learned more than anything is not selling to give you an idea of what I owned in those days that I sold Chipotle, Apple, these are Las Vegas Sands. I remember buying for $2 a share. I think that was a 20 bagger over the next couple of years that I sold too early. Yeah, owning those companies that aren’t going anywhere that can survive any downturn, I would also say start paying attention to balance sheets. Because if companies are going to not survive, it’s not going to be the revenue drops a little bit. It’s going to be because there’s more risk on the balance sheet than they can handle. Something to keep in mind. When we come back, we are going to talk more about this buildout and where there could be opportunities you’re listening to Motley Fool money.

Come back to Motley Fool Money. One of the big topics of the AI buildout has been energy, and this has gotten a lot more attention over the past couple of months. Every hyperscalar, every Neo Cloud is looking for basically as much energy as they can get. Some of them have made deals with Bitcoin miners. I think that’s an interesting play here. Bitcoin Miners spent a lot of time building out the energy they need to run their mining equipment. Now we’re moving that to AI. Jon, where are the opportunities for investors in energy or at least what should we be keeping an eye at?

Jon Quast: Well, I think that nuclear power is big trend and I know that people have been hearing about it. I just think it’s going to be a lot of emphasis put there and even the emphasis that we put there isn’t going to be enough. You look at what OpenAI is reportedly wanting. They’re reportedly wanting 250 gigawatts of electricity by 2033, just for running their AI data centers. That’s just one company. President Trump earlier this year, signed an executive order to quadruple the country’s nuclear power. It will add basically 300 gigawatts of nuclear power. You look at that,250 is what OpenAI wants. We’re saying, we’ll add 300 gigawatts of nuclear power. Basically, they’ll take all of that.

Jason Moser: Doesn’t seem like a lot of wiggle room there, Jon.

Jon Quast: Exactly. Here’s the thing. The order is by 2050 to have that much extra power. President Trump is saying, we’re going to add 300 gigawatts. Give us 25 years. OpenAI is like, we need it now and so does every other company that’s doing what OpenAI is doing. I just think we’re going to have a heyday for nuclear, but even if we do, it’s still not going to be enough.

Travis Hoium: I want to put some numbers to this. The EIA, Energy Information Administration, which is a phenomenal source for energy information because they pull all the prices, all the capacity production, all that stuff. Between 2024 and 2028 in the US, there is a planned about 200 gigawatts of additions. About half of that, over half of that is solar, so an intermittent energy source. You have to consider that the capacity factor of solar, meaning the amount of time that it produces energy on an average day is about 20, 25% of the time. We’re not anywhere near hitting those numbers in what is planned, and power plants don’t go up. Even a solar plant, which can be built relatively quickly, you’re still talking many months, in some cases, years. All that said, Jason, where are you looking for opportunities today?

Jason Moser: It definitely feels like we’re going to need all we can get. It’s all hands on deck. I think the key is going to be focusing on every resource available. I think in regard to AI specifically and the capabilities that it’s driving, I think the overwhelming demand is going to be on those reliable or firm energy sources. The stuff that’s on 24/7 that’s easily distributable. Renewables are one thing. But I think for AI specific stuff, we’re going to be looking at nuclear, natural gas and hydro electric primarily. We saw Google earlier in the year made a deal to provide some early stage capital for elemental power to prepare some nuclear sites here in the US. I think those were those small modular reactors. The other thing to think about longer term and I’m talking about longer term, Travis, but think a decade out. There was an interview with Jeff Bezos this week that I was pretty, I was fascinated by because I actually could totally see this happening. He was talking about data centers in space. Essentially.

Travis Hoium: It sounds crazy.

Jason Moser: It sounds crazy. It does. It sounds like. But if you think about it, they’re already trying. They’re already in the process of trying to figure out how to make this work. Now, that solves two key problems. You get the limitless resource of solar up in space and you’ve solved your.

Travis Hoium: Suddenly, that becomes a base source of energy as opposed to variable.

Jason Moser: You solve your cooling problems as well. It knocks out you kill two birds with one stone, so to speak. I think that’s pretty interesting to think about just further out. Just keep an eye on that. I don’t think that’s high in the sky stuff. I think that’s actually pretty legit. Beyond that, I looked to other companies in the value chain that enable SMRT usage and monitoring. The company I’ve talked about before called Itron that does that. They help their customers safely and securely monitor that critical infrastructure and power and water. You can look beyond the providers and look to those value chain adders as well.

Travis Hoium: Do you think that the rise in electricity prices which again, is getting more attention this year, I’ve noticed it with my electricity bill Jason, is that a pending problem in the US because if AI is what’s raising the costs for the average person, seems like an issue.

Jason Moser: Consumers will not like it. I can guarantee you that. I mean, I noticed the power bill difference when the winter hits here in Northern Virginia, and it basically doubles. If we see things going beyond just your typical seasonality, I think that’s going to be a real problem.

Travis Hoium: Yeah, that’s something to keep an eye on because regulators do play a pretty big role in this, who’s gonna get the electricity? What are people paying? That’s not just an economics process, although the economics could help with justifying some of these investments too, something else to keep in mind is that, you know, energy costs are important, and if prices are going up, people are gonna put more money into the ground. When we come back, we’re going to see how well Jason and Jon know their history of investing you’re listening to Motley Fool money.

Welcome back to Motley Fool Money. I want to know how well Jason and Jon know their market history. I’m going to ask you guys a few questions and see who knows the answer. Jon, I’ll have you go first here. What was the date of the 1987 crash? As a bonus, how much did the Dow Jones Industrial average drop on that day?

Jon Quast: Oh, and I assume that you’re wanting more than the year 1987, yeah?

Travis Hoium: Yeah, I would like you can give me the day of the week. Any information is.

Jon Quast: Well, it was on a Monday.

Travis Hoium: What color was this Monday, Jon.

Jon Quast: Well, there we go. A very black Monday. I would think it’s in October, but I don’t remember.

Travis Hoium: Jason, do you know the date?

Jason Moser: I actually do know this one. It’s October 19th.

Travis Hoium: 1987 and how much did the Dow drop?

Jason Moser: Do we have a little wiggle room here? I know it was 20%. It was a little bit more than 20%, but I don’t think it was 25%. It was somewhere in the middle between 20 and 25%.

Travis Hoium: Oh, that’s good. Jon. Do you have an answer.

Jon Quast: I was going to say 12.

Travis Hoium: Okay, 22.6% drop for the Dow Jones Industrial average. But the other thing that’s interesting with that historically is the Dow was what really got all the attention back then. It was not the S&P 500. We don’t talk much about the Dow anymore, but it was those 30 stocks. That’s what was reported on the nightly news. That’s the numbers that everybody knew is, what was the Dow doing?

Jason Moser: Yeah, and it’s interesting to think about the difference between the Dow and the S&P. We talk about, they definitely tried to modernize the Dow to a degree. It’s a little bit more up to speed now. But there’s also that difference between the stock price weighted index, the Dow Jones.

Travis Hoium: Do you want to explain that? Because that is a really weird thing about the Dow.

Jason Moser: Yeah, essentially, I mean, you’re just looking at one index and the Dow where it’s basically measured by the value of the stock price itself.

Travis Hoium: The number, so if you have $100 stock, it has a 10X weighting of a stock that has a $10 stock.

Jason Moser: Whereas the S&P, it’s market capitalization weighted. You’re actually talking about how heavy the whole company is. Stock price can be a function of anything. I mean, stock splits and whatnot can change it. It is just interesting to see that difference there and how that ultimately plays out in the way those indices perform.

Travis Hoium: Yeah, and back then that was a big reason that a lot of stocks typically were kept with stock splits and things like that, between somewhere around $30 and $100 per share. We get 100, you would expect a stock split to come. We don’t really think about that anymore because we have fractional shares and all that kind. That stuff didn’t exist.

Jason Moser: Yeah, I think didn’t memory serves, I think when Apple joined the Dow and didn’t it actually split its stock in order to be able to facilitate that membership? I feel like that might have happened.

Travis Hoium: That is a historical question I do not have the answer to. Speaking of big tech though, and maybe I’m giving things away here, what was the most valuable company in the world on January 1st, 2000? Jason, I’ll have you go first here. This is .com bubo. Lots of options.

Jason Moser: There are a lot of options. Was it global crossing? I don’t know. Honestly, just I feel like that’s a Jon.

Jon Quast: I would guess Cisco.

Travis Hoium: That would have been my guess. Cisco was the most valuable company in the world for a short period of time, but that was in March of 2000 at the turn of the century to the millennium, it was Microsoft. That was really most valuable company in the world. Interesting, parallel to where we are today, Microsoft was the most valuable company in the world. That is still one of the most valuable companies in the world. But if you would have invested in Microsoft at the beginning of 2000 and held it for the next 15 years, you would have basically the same amount of money.

Jason Moser: I was going to say the Balmer years didn’t treat shareholders very well.

Travis Hoium: Yeah, and so there’s a couple of things. I mean, their business actually did fine during the 2000, but the end of the ’90s, early 2000s, the price that you were paying was extremely high, and so multiple compression, meaning the price to earnings multiple or the price to sales multiple was going down over that period of time. Instead of multiples being a tailwind, like they’ve been for a lot of stocks over the past couple of years, it was a headwind for Microsoft. Again, just something to think about as we think about the market today. Pets.com gets a lot of attention in the .com bubble. Do you know when pets.com IPOed, and what its highest market cap was before falling apart. Jon, I will have you go first. When was the IPO, and what’s the highest market cap?

Jon Quast: Oh, how should I know? I mean, you want more than the year.

Travis Hoium: Actually, you might not get the year.

Jon Quast: I know. I mean, I feel like this is a high bar. I’m gonna go with June 12th, 1995, and I’ll say peak valuation was 50 billion.

Travis Hoium: See, Jason, I’ll give you a guess here, but these numbers surprise me.

Jason Moser: Yeah, the IPO, I don’t know, so I’m just going to guess March 1997, valuation wise, I know given the valuations that we see today, you would want to say something like 50 billion or I get that. But I think actually it was really especially at that time. This was even big at that time. I think it was something like 450 million, $500 million.

Travis Hoium: Wow. You guys are both way off for the timing. Their IPO was February of 2000. Way later than I would have guessed. But, Jason, you’re almost exactly right. $400 million was their top market what I think is interesting about that is, that is the name that we all remember from the .com bubble. But it wasn’t all that big of a company.

Jason Moser: No. Well, I mean, at the time it was. I mean, consider.

Travis Hoium: But you’re looking at I think today’s prices, that would be still less than billion dollar.

Jon Quast: I literally 100 times more than that.

Jason Moser: They had obviously a very short lived campaign as a publicly traded company. But yeah, I mean, that was like the quintessential Internet stock. I mean, just advertising at the Yin Yang, found a clever brand with that little sock puppet puppy, and they were just selling stuff on the Internet, like, this is the way we do it and just making no money in the process. But it’s interesting how we gave Amazon so much leeway to build out that concept, and yet your pets.coms of the world just never really stood a chance.

Travis Hoium: The lesson that I take from that one because you’re right. Amazon has become, obviously a household name everywhere. But if you would have just waited. If you would have just said, I’m not going to invest. The Internet, I think, is a huge thing. But 1999 I’m just going to say, you know what? I’m going to let things play out a little bit and you just waited even till 2002, 2003, 2004, 2008, when you knew who the winners were, that was actually a great time to invest in even a company like Amazon.

Jason Moser: That’s a really good lesson.

Travis Hoium: This one’s fun. OpenAI has 800 million weekly active users. How many users did AOL have at its peak? Then I have a follow up, Jason. Users. How many subscribers? That’s the, basically households. We were sending disks around, in those days.

Jason Moser: That’s the thing, OpenAI, 800 million weekly some odd user, 20 million paying subscribers. They got to figure out a way to short that up. AOL, I have no idea. Households,125 million.

Travis Hoium: John?[laughs]

Jon Quast: Well, I want to change my answer now. I was going to go with eight million. Here’s why. You had other companies. You had Juno, you had NetZero. You had all those. The trend started, but then eventually we switched off of those things. I was going to say eight million.

Jason Moser: John, I could be spectacularly off.

Travis Hoium: John, you’re actually pretty close, 25 million was their peak. But here’s the follow up. When did AOL shut down its dial up service?

Jon Quast: I think I know this one. It was earlier this year.

Travis Hoium: Jason do you want to?

Jason Moser: I was going to say, you would think they did this 15 years ago. It just happened, like John said, very recently. I think sometime within the last year, they actually stopped the whole thing.

Travis Hoium: It was last week.

Jon Quast: I would love to know the guy who was still using it two weeks ago.

Travis Hoium: Who was shocked that their Internet was shut down.

Jason Moser: Not one person.

Travis Hoium: I got a couple of quick ones here. At its peak, how much was invested annually in the USTelecom buildout? The thing that I wanted to bring in here is we talk about the .com bubble bursting. But in the late ’90s, there was really two bubbles. There was the Internet bubble, so the companies that was a valuation bubble, and there was basically an investment bubble where telecoms were investing a lot of money in building out the fiber that Jason mentioned earlier. But what was the actual number that they were putting in the ground? This is just in the US. What is your guess, Jason? Annual number, annual peak.

Jason Moser: One hundred billion dollars.

Travis Hoium: John.

Jon Quast: Did you say million or billion?

Jason Moser: Billion.

Jon Quast: Man, I was going with 10 billion.

Jason Moser: Again, it could be spectacularly off.

Travis Hoium: Jason, you’re about right, 118 billion in 2000. I believe we’ve only passed that number in two years since then. Interesting that the telecom buildout was basically hockey stick growth rate, and then it just plateaued. The other one that we’re not going to get to that is a similar is Apple in 2007, sold 1.4 million iPhones. 2015, that got up to 231 million, and then essentially plateaued. The question, for all these businesses is, when do you hit that plateau? Because that’s when you could potentially run into problems. Here’s the one I wanted to end on quickly. From January 1st, 2000 to March 2000, how much did the QQQ NASDAQ-100 rise? Then my follow up is, how much did it fall over the next six months, John? How much did it go up in those first three months? How much did it go down in the next six?

Jon Quast: I’m going to guess for going up, I’m going to guess it went up 15% during those three months. Then I believe there was a 50% drawdown from there.

Travis Hoium: Jason?

Jason Moser: I was going to say 20% for the first one. Then for the next six months, from that point, I think it fell.

Travis Hoium: From March to September.

Jason Moser: March to September, I would say it fell probably a good 60%.

Travis Hoium: Up 18% in those first, a little less than three months. Then over the next six months, fell 71%. Up an escalator out of window is the way that we quit this. Well, hopefully that was good context for people because I think we can always learn from history whether things repeat or not, they typically rhyme. I think that’s how the saying goes. When we come back, we will get to the stocks that are on our radar. You’re listening to Motley Fool Money.

As always, people on the program may have interest in the stocks they talk about and the Motley Fool may have formal recommendations for or against, so don’t buy or sell stocks based solely on what you hear. All personal finance content follows Motley Fool editorial standards and is not approved by advertisers. Advertisements are sponsored content and provided for informational purposes only. To see our full advertising disclosure, please check out our show notes. One company I want to bring into the discussion, we’ve high level, talked about history and AI. But Google had some interesting announcements. OpenAI is obviously getting all the attention, but Google Gemini Enterprise was announced this week. Jason, what did you take away from that?

Jason Moser: A few things, I think. I use both Gemini and ChatGPT interchangeably. Probably use Gemini a little bit more. I wasn’t terribly surprised to see the announcement because this is an arms race. I think it speaks to Google’s ability to respond to market forces and competition. I think, also the real advantage that it has, and it’s already massive user base and the powerful business model, not to mention just customer mind share. I think ChatGPT absolutely is doing a great job on customer mind share, but going back to earlier in the show, when we were talking about 800 million some odd weekly users, only 20 million really of those are subscribers. I think that is just a big hurdle for a company like ChatGPT to overcome. The reason why Google doesn’t have to worry about it so much is because they’ve got a business that’s funded by this powerful advertising model, not to mention it’s growing Cloud business, as well. Now, when you look at Google in this space, they’re a total package. What’s that? They call it a full stack player?

Travis Hoium: A few of the things they announced, it pulls Gemini into applications. This goes into GCP, Google Cloud Platform. That is actually a profitable business. I think that’s something, as investors, we should highlight. OpenAI is losing money. They’re not public yet, but this is a huge growth business for Google and for Alphabet, and it is now profitable, as well. I think the idea here is, this is going to be an enterprise play along with, hey, you know what? If Gemini as a consumer app wins great.

Jason Moser: Well, I think this shows a couple of things. This technology at its core is totally replicable. Basically, all they need is the resources and the time to be able to do it. I think the thing that’s not necessarily replicable is the power under the hood, so to speak, with what Google has built through the decades. ChatGPT is just not there yet. It’s not to say they can’t get there. Don’t get me wrong, but I’m just saying that it’s a much younger company that still has a lot to prove. From that perspective, again, I look at something like a Google today, and I think, wow, they’re doing a lot of really neat stuff. I think ChatGPT is doing a lot of really neat stuff, too. I think we’re going to see at some point, OpenAI is going to have to resort to some sort of an ad supported model in order to be able to continue generating that revenue, or they’re just going to have to come up with a way to grow that subscriber number, which is just so small today compared to what Google has just on an ongoing basis.

Travis Hoium: The 800 pound gorilla in the room that we always continue to overlook. Let’s get to this accident on our radar. John, I’m going to have you go first. What is on your radar this week?

Jon Quast: On my radar right now is a company called Rubrik that is ticker symbol RBRK. This is a small cybersecurity company. But what I like about this is that it’s not trying to prevent attacks. Its business model is assuming an attack has already taken place, and it’s going to get your business back up and running in a fraction of the time. You think about that. That’s really an interesting counter positioning, when it comes to maybe what your CrowdStrikes of the world are trying to do. That’s really interesting. It trades at about 15 times its sales. You look at its annual recurring revenue. It’s up 36%. That’s a good growth. Gross margin has jumped to about 80%. Those two things right there signal to me that I don’t think it looks terribly overvalued. It does generate positive free cash flow, despite being a young business. It has a net cash position. It’s adding new customers at a good pace. But with only 2,500 spending 100,000 a year, I think there’s plenty of room to grow that. Net dollar retention is over 120%, so its existing customers are spending more over time. I really like its co-founder and CEO, Bipul Sinha. He really values this mentality of basically innovate or cease to be a business. That could make things a little bit volatile, but I think it’s going to also potentially make it a key innovator here in the cybersecurity space. It’s definitely on my radar and one I’m watching.

Travis Hoium: Dan, what do you think about Rubrik?

Dan Caplinger: I do like the company, John, but I have a question about what they call themselves. They call themselves a zero trust data security and zero trust doesn’t exactly make me feel good.[laughs].

Jon Quast: That’s an unfortunate way to talk about it in the trade.

Travis Hoium: Jason, what is on your radar?

Jason Moser: Something we’ve been doing here on the website recently with the analyst team, it’s something we’re calling the Analyst Stream, and a couple of days a week, we’re taking a topic of the day and all just offering our spin on it. Today, Friday, we’ve got safety stock pitches for folks. A stock that I recently purchased from my own portfolio with safety in mind is Waste Management. Ticker is WM. As the old saying goes, your trash is my treasure, and we certainly produce a lot of trash here, but weights management, they own or operate the largest network of landfills in the US and Canada with 262 sites, making it the top dog. They also benefit from a growing recycling segment, renewable energy segment, and healthcare solutions business, too. Because you remember they just acquired Stericycle last year, I think, given the nature of the market there, trash is pretty reliable. I think holding onto this one for a decade or longer makes a lot of sense for investors.

Travis Hoium: Dan, what do you think about investing in garbage?

Dan Caplinger: Garbage isn’t going anywhere, gang. We’re not going to stop making it. It’s going to be something that we’re going to have to deal with forever.

Jason Moser: As the kids say, Dan, it true.

Travis Hoium: Dan, Rubrik or Waste Management, which one is going on your watches?

Dan Caplinger: Like I said, garbage ain’t going anywhere. We’re going to go Waste Management. I like that dividend, too.

Travis Hoium: We are out of time this week. Thank you for listening to Motley Fool Money. We’ll see you here tomorrow.