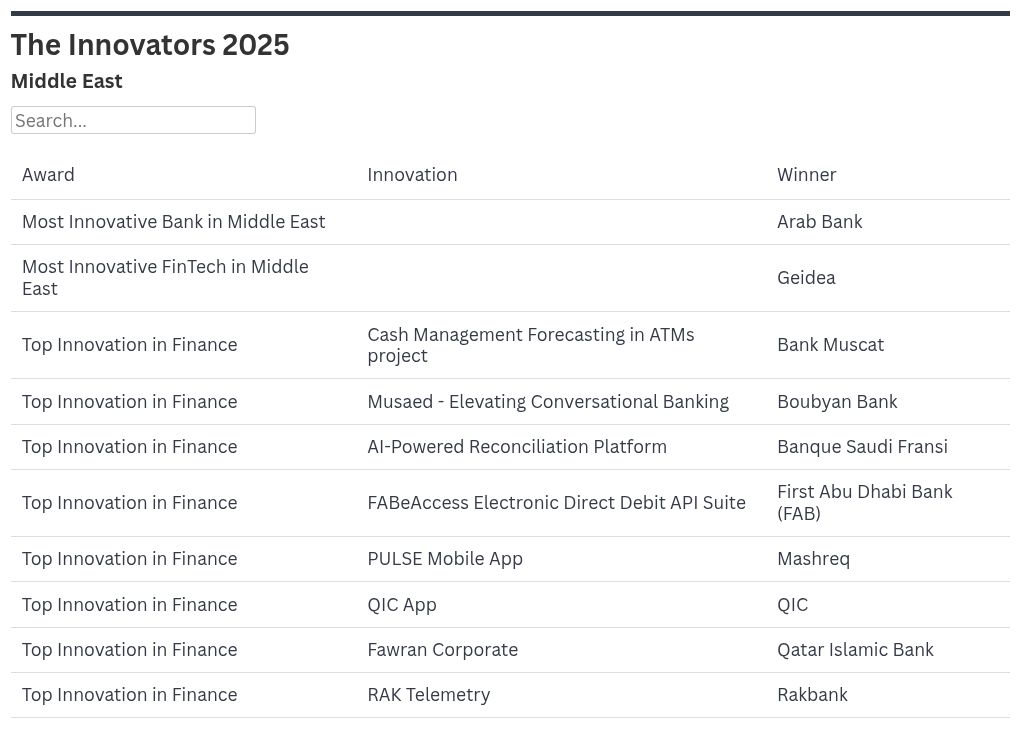

Over the past year, banks embraced innovative technologies like APIs, AI tools, and mobile solutions to enhance efficiency, customer service, and risk management. Global Finance announces the 2025 Innovators from Middle East.

Regional Winners

Most Innovative Bank in Middle East| ARAB BANK

Acabes, Arab Bank’s in-house development factory, enabled the bank to launch an updated version of its Reflect banking app in 2024. Reflect benefits from a host of new digital features, including multicurrency subaccounts for deposits, savings, and payments. Customers can also use Salary Transfer and instant transfer features with these currencies. Arabi Shopix, another Acabes product, is an e-commerce website creation service.

Acabes empowered Omnify, Arab Bank’s embedded finance and open-banking platform, toward its official launch, leading to Omnify signing and/or going live with third-party providers. Omnify has solidified its position as the region’s leading one-stop shop for embedded finance and open banking, preparing for the next era of banking as a service. Partnerships with key innovators like MoXey and Menaitech have improved the platform and let partners quickly develop custom financial solutions.

Most Innovative Financial Technology Company in Middle East | GEIDEA

The first payment provider in the Middle East and North Africa region to offer instant merchant onboarding, Geidea enables businesses to start accepting payments within minutes, thanks to substantial investments in automation, AI, and digital verification.

Geidea’s instant onboarding solution is particularly significant due to the rapid growth of digital-payment adoption across the region and the increasing number of microenterprises entering the formal economy. By facilitating quick onboarding for businesses of all sizes, Geidea supports scalable growth.

Furthermore, Geidea has set a new benchmark for innovation by becoming the first fintech in the region to develop and launch its own proprietary point-of-sale terminal. This establishes a new standard for flexibility, security, and technological integration in payments. By eliminating reliance on thirdparty hardware manufacturers, Geidea has disrupted traditional payment solutions and introduced a model that empowers businesses with unprecedented control and customization.

Innovations In Finance Globally From Middle East

Cash Management Forecasting in ATMs Project | BANK MUSCAT

Oman’s Bank Muscat became the first Middle East bank to leverage AI and machine learning for predictive analytics in cash management, creating an efficient, non-manual ATM cash forecasting and replenishment process. By analyzing historical data for cash withdrawals and deposits along with external factors like seasonality and local events, the new forecasting system ensures optimal cash levels at ATMs, solving the problem of cash outs, which can be an annoyance for customers, and minimizing idle cash in the ATM, which is not ideal for the bank.

Musaed – Elevating Conversational Banking | BOUBYAN BANK

Boubyan Bank’s chatbot, Musaed—”helper” in Arabic—has undergone a series of recent enhancements. One such, Boubyan Playback, provides customers with a personalized “Year in Review” of their interactions with the bank, encouraging high customer engagement. Additionally, Boubyan has become the first bank in Kuwait to offer AI-powered recruitment assistance through Musaed’s Job Interview Service. During Boubyan’s internal job fair, Musaed streamlined the interviewing and hiring process by facilitating over 1,000 CV submissions and aiding HR in efficiently identifying potential candidates.

AI-powered Reconciliation Platform | BANQUE SAUDI FRANSI

In February, BSF partnered with Deben, a Saudi SaaS platform that automates cash flow management and generates instant reports for financial managers, to launch an innovative AI-powered reconciliation platform. As the first of its kind in both the kingdom and the region, the platform uses AI to deliver intelligent reconciliation, forecasting, anomaly detection, and real-time financial insights. Businesses can customize transaction categorization to meet their specific needs and automation streamlines processes for increased efficiency, cost savings, and an enhanced user experience.

FABeAccess Electronic Direct Debit (eDDS) API Suite| FIRST ABU DHABI BANK (FAB)

FAB’s eDDS API Suite is transforming the way businesses manage their receivables. The solution offers real-time, secure, automated collection processes while ensuring regulatory compliance. eDDS API Suite streamlines collections for billers and enhances convenience for payers through features including mandate registration, cancellation, collection requests, realtime status updates, and pre-collection reports. By eliminating manual processes and reducing administrative costs, businesses gain end-to-end visibility over their receivables. As the first API-driven electronic direct debit solution in the United Arab Emirates, eDDS API provides scalability, seamless integration with ERP systems, and a customer-centric approach.

PULSE Mobile App| MASHREQ

PULSE Mobile, a pioneering corporate banking app in the Middle East, provides relationship managers with a comprehensive, 360-degree view of client information. The innovative tool enables instant access to critical client data, transaction approvals, and call report submissions, directly from mobile devices. Additionally, the app’s news alerts feature ensures that relationship managers stay informed of key industry events, enabling them to proactively manage their portfolios and respond to market changes in real time.

QIC App| QATAR INSURANCE CO.

he QIC App is Qatar’s premier comprehensive mobile platform, delivering an array of services tailored for motorists and vehicle proprietors over a platform set up to streamline their daily routines and enhance road safety. By integrating both insurance and auxiliary non-insurance offerings, the QIC App addresses a critical issue: the disjointed and protracted procedures associated with overseeing diverse automotive requirements. Concurrently, QIC Reads operates as Qatar’s exclusive digital repository dedicated to insurance education, aiming to foster a robust culture of insurance awareness and simplify the understanding of everyday insurance needs in Qatar.

Fawran Corporate| QATAR ISLAMIC BANK

Qatar’s first Sharia-compliant, real-time corporate payment service, Fawran Corporate launched last November. The service allows instant transactions, including payroll, supplier payments, and intercompany transfers, improving liquidity and streamlining operations. Adherence to Sharia principles fosters trust and expands the service’s reach within the Islamic finance sector. Fawran Corporate marks a major milestone in Qatar’s financial development, promoting innovation, efficiency, and inclusivity.

RAK Telemetry (Real Time Dashboard)| RAKBANK

RAK Telemetry, a groundbreaking suite of 32 real-time and near real-time dashboards, offers a centralized platform to track and monitor essential business processes, integrating key data points and metrics to provide a comprehensive overview of onboarding journeys, service requests, transactions, and IT tickets status. By eliminating the need for multiple, disjointed tracking systems and manual data correlation, RAK Telemetry streamlines operations, enhances decision-making, and boosts overall efficiency. Businesses can leverage the tool to gain valuable insights into customer behavior, market trends, and operational performance, enabling them to respond swiftly to changing conditions and optimize their strategies.