US Senate passes Trump’s ‘One Big Beautiful Bill’, sending it to the House | Donald Trump News

The United States Senate has passed a sweeping tax bill championed by President Donald Trump, sending the controversial legislation to the House of Representatives for what could be a final vote.

Lawmakers passed the bill by a 51-to-50 vote in the Republican controlled-chamber on Tuesday, after Vice President JD Vance broke the tie.

The successful vote ended what was a marathon 27 hours of debate in the upper chamber. Three Republicans joined with Democrats to vote against the bill, which would enshrine many of Trump’s signature policies, including his 2017 tax cuts, reductions for social safety net programmes, and increased spending on border enforcement and deportations.

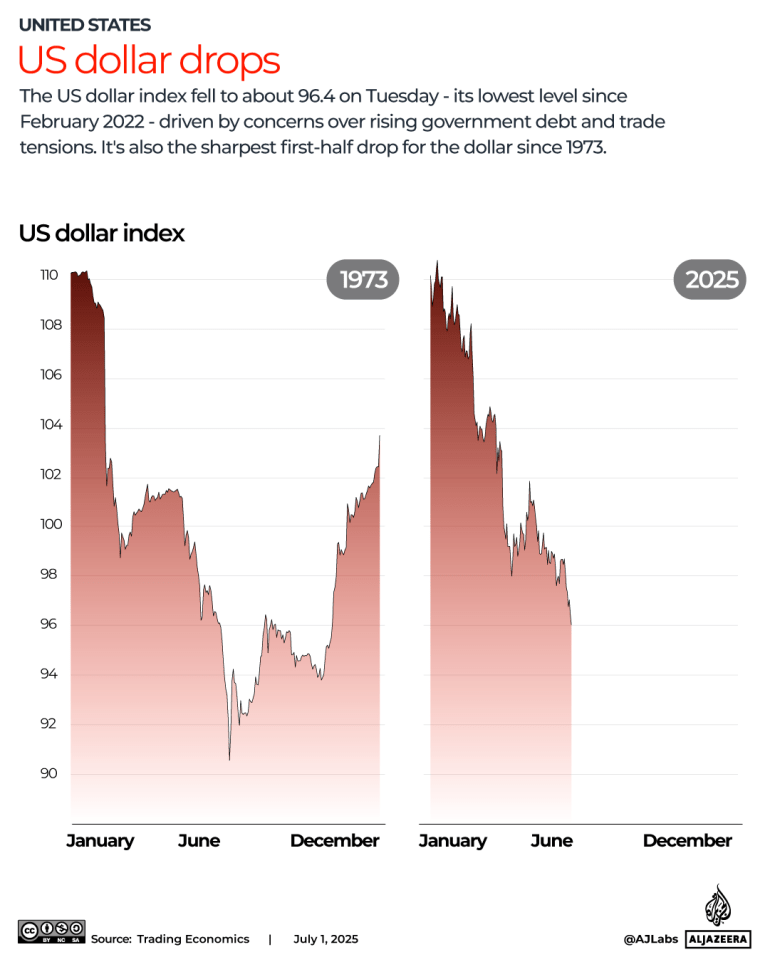

Critics on both sides of the aisle have taken aim at the estimated $3.3 trillion the bill would add to the national debt.

Others have blasted reductions to programmes like Medicaid and the Supplemental Nutrition Assistance Program (SNAP). They argue that the bill takes support away from low-income families to finance tax cuts that will primarily help the wealthy.

Trump, however, has pressed for the bill to be passed by July 4, the country’s Independence Day. The legislation — informally known as the One Big Beautiful Bill — now heads back to the House of Representatives for a Wednesday vote on the updated version.

The president found out about the Senate’s passage in the midst of a news conference in south Florida, where he was touting his crackdown on immigration.

Despite tight odds in the House of Representatives, Trump struck an optimistic tone about the upcoming vote.

“ I think it’s going to go very nicely in the House,” Trump said. “Actually, I think it will be easier in the House than it was in the Senate.”

The president also downplayed one of the most controversial provisions in the bill: cuts to Medicaid, a government health insurance programme for low-income families. About 11.8 million people are anticipated to lose their health coverage in the coming years if the bill becomes law.

“I’m saying it’s going to be a very much smaller number than that, and that number will be all waste, fraud and abuse,” Trump said.

Criticisms in the Senate

Trump was not the only Republican to be celebrating the passage of the omnibus bill. In the Senate, leading Republican John Thune touted the bill as a victory for American workers.

“It’s been a long road to get to today,” Thune said from the Senate floor. “Now we’re here, permanently extending tax relief for hard-working Americans.”

But not all Republicans were as enthused about the bill. Three party members — Thom Tillis of North Carolina, Rand Paul of Kentucky and Susan Collins of Maine — all voted against its passage. And even a critical vote in favour, Lisa Murkowski of Alaska, appeared to express regret in the aftermath.

“Do I like this bill? No,” she told a reporter for NBC News. “I know, that in many parts of the country, there are Americans who are not going to be advantaged by this bill. I don’t like that.”

She later took to social media to criticise the haste of its passage. “Let’s not kid ourselves. This has been an awful process – a frantic rush to meet an artificial deadline that has tested every limit of this institution.”

Meanwhile, the top Democrat in the Senate, Chuck Schumer, said that Republicans had “betrayed the American people and covered the Senate in utter shame”.

“In one fell swoop, Republicans passed the biggest tax break for billionaires ever seen, paid for by ripping away healthcare from millions of people,” said Schumer.

Still, Schumer announced one symbolic victory on Tuesday, writing on the social media platform X that Trump’s name for the legislation — “One Big Beautiful Bill” — had been struck from its official title.

Republicans currently hold a trifecta in US government, with control of the Senate, the House of Representatives and the White House, giving Democrats reduced power in legislating.

But the Republicans have narrow majorities in Congress, leading to uncertainty about the bill’s fate. In the Senate, they hold 53 of the chamber’s 100 seats. In the House, where the bill heads now, they have a majority of 220 representatives to the Democrats’ 212.

‘Not fiscal responsibility’

The bill is therefore likely to face a razor-thin margin in the House. An early version that passed on May 22 did so with just one Republican vote to spare.

The House Freedom Caucus, a group of hardline conservatives, has continued to baulk at the bill’s high price tag and could push for deeper spending cuts in the coming days.

“The Senate’s version adds $651 billion to the deficit — and that’s before interest costs, which nearly double the total,” the caucus wrote in a statement on Monday.

“That’s not fiscal responsibility. It’s not what we agreed to.”

Billionaire Elon Musk, whose endorsement and funding helped propel Trump to victory in the 2024 presidential election, has also been a vocal opponent of the bill.

“What’s the point of a debt ceiling if we keep raising it?” Musk asked on social media on Tuesday. “All I’m asking is that we don’t bankrupt America.”

Musk has threatened to fund primary challenges against Republicans who support the bill and even floated on Monday launching a new political party in the US.

Trump, however, has brushed aside Musk’s criticism as a reaction to the elimination of tax credits for electric vehicles: The billionaire owns one of the most prominent manufacturers, Tesla.

The president also threatened to use the Department of Government Efficiency (DOGE) — which Musk helped to found — to strip the billionaire’s companies of their subsidies.

“DOGE is the monster that might have to go back and eat Elon,” Trump said as he travelled to Florida.

Reporting from Washington, DC, Al Jazeera correspondent Alan Fisher said that public support has been slipping as a clearer picture of the bill has emerged.

“The longer this has been talked about and the more details that become public, the fewer Americans support him,” Fisher said.

Several recent polls have shown a majority of Americans oppose the bill. A survey last week from Quinnipiac University, for example, found just 29 percent of respondents were in favour of the legislation, while 55 percent were against it.

Increase to national debt

All told, the legislation in its current form would make permanent Trump’s 2017 cuts to business and personal income taxes, which are set to expire by the end of the year.

It would also give new tax breaks for income earned through tips and overtime, a policy promise Trump made during his 2024 campaign.

At the same time, the bill would provide tens of billions of dollars for Trump’s immigration crackdown, including funding to extend barriers and increase technology along the southern border. The bill would also pay for more immigration agents and build the government’s capacity to quickly detain and deport people.

Beyond cuts to electric vehicle tax breaks, the bill also guts several of former President Joe Biden’s incentives for wind and solar energy.

Faced with criticism about the knock-on effects for low-income families, Republicans have countered that the new restrictions to Medicaid and SNAP — formerly known as food stamps — would help put the programmes on a more sustainable path.

Many Republicans have also rejected the Congressional Budget Office’s assessment that the legislation would add $3.3 trillion to the country’s already $36.2 trillion debt.

Nonpartisan analysts, meanwhile, have said the increase in debt has the potential to slow economic growth, raise borrowing costs and crowd out other government spending in the years ahead.

![[Al Jazeera]](https://www.aljazeera.com/wp-content/uploads/2025/07/INTERACTIVE-US-DOLLAR-DROPS-US-july1-2025-copy-10-1751373067.png?w=770&resize=770%2C962&quality=80)